Bargaining power of buyers

| Bargaining power of buyers |

|---|

| See also |

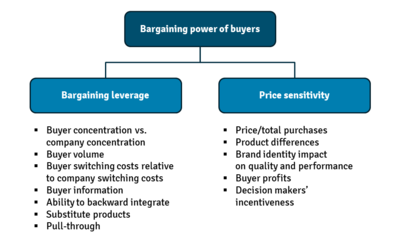

Bargaining power of buyers is a competitive force, which may result in lower prices for the product and improve the quality of services, which reduces costs and increases profits for the industry (S. A. Di Biase 2014).

How does the Bargaining Power of Buyers work?

- The buyer's power increases when large amounts of product are purchased, the product is undifferentiated, there are few switching costs, low profits are obtained, backward integration is possible, and the quality of the buyer's product is not dependent on the supplier's roduct.

- If the buyer represents a large percentage of the supplier's sales, the buyer has more bargaining power over the supplier. For example, the chocolate and cocoa industry has several large volume retailers who have significant bargaining power. Large-scale retailers can bargain for lower prices and lower industry profits (G. R. Ungson, 2014).

Bargaining power factor of buyers

- If the cost of switching is high for buyers moving from brand to brand or substitutes, they will be reluctant to change frequently. Because they are loyal to a particular brand, the buyer bargaining power is low in relation to the industry. At low switching costs, however, buyers are more distracting, which increases their bargaining power. In the case of air travel, buyers with a tight budget can choose the supplier with the lowest cost, even if they prefer the other.

- If the number of buyers is small, and their purchases are not relevant for industry suppliers, they do not affect significantly the profit and loss industry suppliers. There are many substitute products, especially in the sectors producing flashlights, mounting materials, paper clips and so on. If there is only a few buyers, each of whom buys a large amount, the situation is changing.

- If buyers are not well informed about the products seller, prices and costs, this gives retailers the opportunity to manipulate prices, and the bargaining power of buyers is low. On the contrary, if the buyers have abundant information about the sellers can negotiate better results. However, the growing power of buyers, because the Internet reveals prices customers buying books or records.

- If it is not possible for buyers to continue reverse integration and their only choice is to buy from specific sellers, they are not a threat to these sellers. As a result, the bargaining power of buyers is low. But some buyers are a threat of backward integration. Some companies have reduced their dependence on car suppliers by producing a lot from their own suppliers, from internal production, and the rest comes from external suppliers. Backward integration implies total integration, that is, the buyer internally uses what they previously acquired from others.

- If the buyer have discretion as to whether and when the market, have greater bargaining power. Buyers are particularly sensitive to the price: they accept, for example, consumers or buyers, for whom the purchase of a product constitutes a large part of their total costs. Companies which purchase in large quantities or large quantities, they tend to get a higher price, the lower the price, and sometimes the profits from the supply industry (S. A. Di Biase, 2014).

- The buyers' profits are marginal and therefore they want to reduce costs.

- Buyers have impact on sales, which retailers and wholesalers can influence consumers, promoting the company's products.

- The bargaining power of buyers is growth for with:

- the number of large volume

- buyers relatively low profits from products

The bargaining power of buyers, however small, to moderate because of differentiated products in the industry, the presence of switching costs, no risk of backward integration and reliance on the product industry (G. R. Ungson, 2014).

A summary of the importance of the Bargaining Power of Buyers

The strength of these forces will vary in various industries, as will the dominant power and the level of profitability of the industry. The collective strength of these forces determines the ultimate potential of profit in the industry. The forces range from intense in industries like tires, paper and steel - where no company has achieved spectacular gains - the relatively mild in industries such as equipment and services to the oil field, toiletries and cosmetics, where high returns are commonplace (G. R. Ungson, 2014).

Reference

- Carstensen P. C. (2017). Competition Policy and the Control of Buyer Power. A Global Issue

- Choi A., Triantis G. (2014). The Effect of Bargaining Power on Contract Design, " Virginia Law Review ", vol 98, no 8, page 1665-1743

- Di Biase S. A. (2014). Applied Innovation

- Hojeghan S. B., Esfangareh A. N. (2011). Digital economy and tourism impacts, influences and challenges, " Procedia Social and Behavioral Sciences ", vol 19, page 308-316

- Nair A., Narasimhan R., Bendoly E. (2011). Coopetitive Buyer- Supplier Relationship: An Investigation of Bargaining Power, Relational Context, and Investment Strategies, " A Journal of the Decision Science Institute ", vol 42, no 1, page 93-127

- Ungson G. R., Wong Y. (2014). Global Strategic Management

Author: Justyna Galon