Economic value of equity

| Economic value of equity |

|---|

| See also |

Economic value of equity is the present value of all overall assets minus present value of all liabilities. It is commonly used by banks as an instrument of interest rate risk management.

Δ(economic value) = Δ(value of assets) – Δ(value of deposits)

EVE supports banks to appraise the influence of interest rate risk on net worth and equity of the bank because the value of assets and liabilities of a bank are throughtly linked with the interest rates. The values of the assets and liabilities are not the accounting or book values. The values of the assets and liabilities are not the accounting or book values. This is an economic concept that evaluate s the influence of interest rate changes on fair market values of asset, liabilities, and equity.

EVE captures the change in economic value of the bank even though that modification may not be imaged in the bank's accounting books and records. Consider the underlying market value of bonds in the investment portfolio. We all know that if interest rates rise, bond prices fall. This is the manifestation of price risk. What is not as clear, however, is the degree to which that modification in the economic value of the investment portfolio value will influence the overall value of the balance sheet. Note that loans also have a theoretical economic value just like bonds. If market interest rates rise sharply, then existing fixed rate loans will be worth less from an economic point of view.

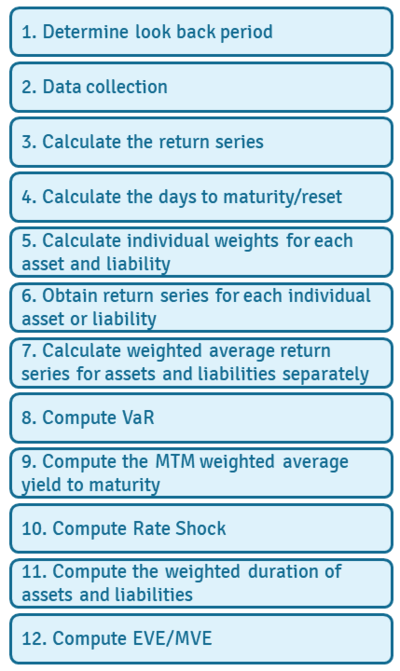

How do we calculate Economic Value of Equity?

If we can count the fair market value of assets and liabilities, then we can readily back into the value of equity capital. Furthermore, if we can project the changed value of assets and liabilities under different rate environments, we can measure projected changes in EVE as well. This is accurately what we do when we measure interest rate risk from the economic perspective.

Surveillance modification in the Economic Value of Equity is worthwhile in that it supplies a comprehensive measurement of interest rate risk. It captures the effects of possibility and other significant influences on value that are not contained in static accounting type reports. The economic valuation tactic also reflects those sensitivities across the full mellowness spectrum of the bank's assets and liabilities.

Advantages of EVE

For all its advantages, Economic Value of Equity also suffers from a number of disadvantages. For instance, the sensitivity of the Economic Value of Equity to changes in interest rates gives no information about the exact timing of rate risk. Managers need to know IRR timing as well as the quantity. Risk exposures may exist in the next 12 months, but may be entirely different over the subsequent two years. EVE simply shocks the balance sheet instantaneously and calculates overall valueKatKrisk. Another downside is the fact that EVE consist inmethodological and calculation presumptionwhich may or may not turn out to be precise.

The most brilliant of these is the discount rate assumptions that are used to calculate the present value of assets and liabilities. It is relatively easy to count the market value of a bond with a fixed rate of interest and a fixed maturity. It is considerably more difficult and far less aim to count the economic value of a saving account with no fixed maturity and an administered rate that is subject to change by bank management.

Measurement interest rate risk involves tracking energetic and composed relations within a bank's balance sheet. To do it accordingly, we must have good contribution, reasonable assumptions, and sound methodology. The estimate and monitoring of changes in the economic value of equity is a significant part of the process. And in the last analysis, we cannot correctly manage the financial risk of our bank without a clear understanding of these measurements.

EVE

Economic value of equity:

- is helpful for calculating actual risk as a going concern.

- makes it possible bankers to visualize what can happen in a season of interest rate volatility causing important deposit withdrawals and loss of earnings.

- has more worth than a shorthold instrument such as NII which falls short in giving bankers insight to proactively respond to detrimental market developments.

This is why the Basel Committee on Banking Supervision recommends a plus and minus 2% stress test on all interest rates and why US bank regulations require regular analysis of EVE.

References

- Berglund,A. (2017). On the risk relation betweenEconomic Value of Equity and NetInterest Income, On the risk relation betweenEconomic Value of Equity and NetInterest Income

- Georgiev G.P, (2016), Interest Rate Risk Management Using Economic Value Sensitivity Model , Interest Rate Risk Management Using Economic Value Sensitivity Model

- Gregory E. Sierra and Timothy J. Yeager,(2004)What Does the Federal Reserve’s Economic Value Model Tell Us About Interest Rate Risk at U.S. Community Banks?. What Does the Federal Reserve’s Economic Value Model Tell Us About Interest Rate Risk at U.S. Community Banks?

Author: Beata Furmanek