Options

| Options |

|---|

| See also |

The option is a contract that conveys to its owner the right * not an obligation * to buy or sell an underlying asset at a specified price (strike/ exercise price) at some point in the future. We should differentiate European Option form American one. European Option can only be exercised at the end of its life while American can be exercised any time during its life.

In the option contract there is writer - person who creates an option, the originator, the seller.

And the buyer/holder - the party that holds option. The buyer pays a writer (or the seller) the premium, which is kept by the writer whether the option is exercised or not. In return the writer commits to deliver underlying asset when an option be exercised.

There are different types of options depending on underlying assets: equity options (index option, option on futures, currency option.

Classification

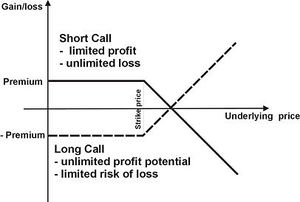

Call option * it an agreement that gives the holder of the option the right to buy (writer has an obligation to sell) an underlying asset at strike price. You can profit as a buyer on a call when the underlying asset increases in price, in other words when the price of an asset is above the strike price. Short position is seller position whereas long position is position of the buyer.

The call option is:

- in-the-money, when stock price > strike price

- at-the-money, when stock price = strike price

- out-of-money, when stock price < strike price

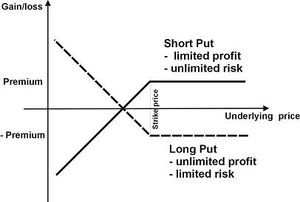

Put Option * the contract in which the holder has the right to sell (writer has an obligation to buy) an underlying asset at specified price on/within specific period of time. You will make a profit as holder when the price of underlying asset will be below strike price.

The put option is:

- in-the-money, when stock price < strike price

- at-the-money, when stock price = strike price

- out-of-money, when stock price > strike price

Investment strategies.

The holder of the option can act in three ways:

- Use option. Exercise call option * buy shares at fixed price or sell shares at a specified price in the case of put option.

- Leave the option to expire, when using would not be profitable

- Close position. Sell the option before its expiration date.

See also:

References

- Kolb, R. W., & Overdahl, J. A. (1997). Futures, options, and swaps. Oxford: Blackwell.

Author: Katarzyna Wierzbinska