Vertical diversification strategy

| Vertical diversification strategy |

|---|

| See also |

Vertical diversification strategy is one of the business development options. Managers choose a new market in which the company wishes to go with the new product. Diversification may be carried out using company's own resources or by acquiring other companies.

Extension and diversification of existing market fields is performed with products not yet manufactured by the company. Results of actions can be measured by relation of a prior business results to planned goals. In addition to vertical diversification we can distinguish also: horizontal and parallel diversification.

Types of vertical diversification

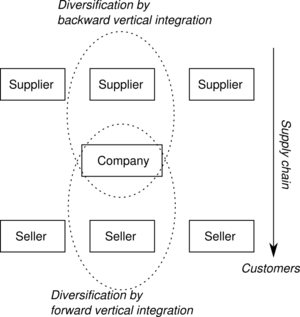

Vertical integration is an extension of business as:

- diversification by backward vertical integration (e.g. the manufacturer of footwear acquires tanneries)

- diversification by forward vertical integration (e.g. the manufacturer of footwear start his own network of shops)

with regard to the already undertaken activities of the organization.

Effects of vertical diversification

Taking these action reduces the risk of activity and reduce dependence from suppliers and customers. However, company may experience the negative effects of such changes, for example. flexibility of action and the effectiveness of adaptation to changing environmental conditions can be reduced. Therefore, this strategy is effective mainly in technologically mature branches of production, with relatively low intensity of technical innovation.

References

- Chong, Y. Q., Wang, B., Tan, G. L. Y., & Cheong, S. A. (2014). Diversified firms on dynamical supply chain cope with financial crisis better. International Journal of Production Economics, 150, 239-245.