Subsidiary account

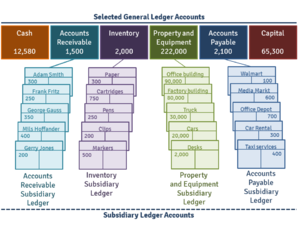

Subsidiary account - is an account that keeps track of any information concerning transactions through accounts receivable and accounts payable. Subsidiary accounts are linked in a subsidiary ledger that in turn is summarized under a general ledger. A subsidiary account is a part of a three-level system that controls all the transactions occurring in the entity[1]:

- lowest level: subsidiary account (constituting the part of a subsidiary ledger);

- next-lowest level: subsidiary ledger (the aggregated total number of them enter the control account);

- highest level: control account (one of the parts of the general ledger).

Examples of subsidiary account[2][3]:

- a vendor record that belongs to accounts payable ledger. This type of subsidiary account provides the detail for the amount that is indebted to specific suppliers.

- a customer record that belongs to accounts receivable ledger, that in its turn includes the transactions on the accounts’ receivable control account in the aforementioned general ledger. This subsidiary account lists amount of money that is indebted to the company by specific customers.

Purpose and uses

Subsidiary account has the following functions[4]:

- The essential function of a subsidiary account (ledger) is controlling customer payments and avoiding overpayment and other accounting instances. Since accounting relies on details, the balance sheet may help to reveal the problems of over-/underpaying.

- Another function of subsidiary accounts (ledgers) is to reveal embezzlements and internal corporate fraud. Subsidiary ledgers can prevent such fraud schemes as: fictitious receivables offset, lapping, borrowing against receivables using accounts as a collateral one, adjoining one client's payment to another client's account to disguise theft.

- Project management functions are also provided by the use of a subsidiary account (ledger) since it helps to manage accounts that finance each separate project. If a company caters for a number of customers, its subsidiary accounts are divided by customers and they show what service the customers choose the company for. Having subsidiary accounts, the companies can stay aware of the amount of money indebted and for which service.

- Aging subsidiary accounts is a tool used by business owners to check their clients’ reliability and detect defaulted accounts. The report on aged accounts demonstrates for how long the clients have owned money, what the total debt sum is and which client past due. This tool and the subsidiary ledgers are of the utmost importance for the business and its proper management of accounts receivable. Without subsidiary accounts a business owner cannot have the complete information about customers that owe money for an extended period of time (the amount receivable can be, for example, 30, 60, 90 days old).

- A better demographic and geography-wise targeting - is another opportunity a subsidiary account provides. The control and analysis of a whole subsidiary ledger provides invaluable information for a business management: it can help to define consistency in payment of each region, reliability remittance of different age groups and the biggest sources of cash flow for a business.

Benefits

The benefits of having an subsidiary account are as follows[5]:

- Subsidiary accounts can demonstrate in one account transaction how a customer or creditor were affected, providing business owners with up-to-date information on specific balances.

- They eliminate unnecessary excessive details from general ledger; thus, the latter is not overloaded with vast numbers of individual accounts.

- Eliminations of errors in individual accounts by the implementation of control accounts or reduction of accounts in a ledger.

- Enables division of labour in introducing new numbers to the ledger. An employee from one department can post to subsidiary ledger, while another can post to the general ledger.

Drawbacks

The disadvantages of having an subsidiary account are as follows[6]:

- All the functions of a subsidiary account require additional legal and accounting operations.

- Tedious procedures increase bureaucracy.

- Since subsidiary accounts require specific documentation - the financial statements become more complex.

- The company is liable for subsidiary's criminal actions and debts.

Examples of Subsidiary account

- Accounts Receivable Subsidiary Account - This type of account is used to track the money that customers have borrowed from the company. It can help track the balance owed, any payments made, and any discounts taken.

- Accounts Payable Subsidiary Account - This account is used to track the money that the company owes to its suppliers. It can help track the balance due, any payments made, and any discounts taken.

- Sales Subsidiary Account - This account is used to track the amount of money that a company has received from its customers for goods and services. It can help track the total sales, any discounts given, and any returns.

- Inventory Subsidiary Account - This account is used to track the amount of goods that a company has in stock. It can help track the quantity of goods, any costs associated with purchasing or producing the goods, and any returns.

- Cost of Goods Sold Subsidiary Account - This account is used to track the cost of the goods that a company has sold. It can help track the cost of any goods purchased, any costs associated with producing the goods, and any returns.

Limitations of Subsidiary account

Subsidiary accounts have several limitations that should be taken into account when using them for financial reporting. These limitations include:

- Potential for human error when entering data into the subsidiary account, which can lead to inaccurate financial reports.

- The fact that subsidiary accounts are often only updated periodically, which means that up-to-date financial data may not be available.

- Subsidiary accounts can become outdated as customers’ payment methods and terms evolve.

- Subsidiary accounts are not easily accessible to anyone outside of the company, making it difficult to compare financial statements between different companies.

- Subsidiary accounts can be difficult to maintain and update, as they involve manual processes.

- Subsidiary accounts can be vulnerable to fraudulent activity, as they are not always secure.

A subsidiary account is a ledger account that is used to record transactions that are related to accounts receivable and accounts payable. Other approaches related to subsidiary accounts include:

- Analyzing the transaction data to gain insight into the company’s financial performance. This can help to identify areas that need improvement and can be used to inform future decisions.

- Reconciling the subsidiary ledger with the general ledger to ensure that all transactions are accurately recorded. This can help to avoid discrepancies that could lead to incorrect financial statements.

- Generating reports from the subsidiary ledger to show a more detailed view of the company’s finances. This can help to identify trends over time and can be used to make more informed decisions about the company’s financial strategies.

In summary, subsidiary accounts are a useful tool for managing and tracking financial transactions. They can be used to analyze and reconcile data, as well as to generate reports to gain insight into the company’s financial performance.

Footnotes

| Subsidiary account — recommended articles |

| Nominal ledger — Purchases ledger — Bank reference — Aged debt — Open item — Subsidiary ledger — Sales ledger — Nominal account — Account Analysis |

References

- Bragg S. M. (2005) , Inventory Accounting: A Comprehensive Guide, John Wiley & Sons, Inc.

- Epstein B. J., Jermakowicz E. K.(2010) Interpretation & Application of International Financial Reporting Standards, John Wiley & Sons, Inc.

- Lerner J. J. (2004) Schaum's Easy Outline Bookkeeping and Accounting, The McGraw-Hill Companiec

- Perri A. (2015) Innovation and the multinational firm: Perspectives on Foreign Subsidiaries and Host Locations, Palgrave Macmillan

Author: Kamil Piszczek