Accounting Principles

Accounting principles are essential rules of accounting that ought to be followed in doing account planning and financial statements.

Contents

- 1 GAAP

- 2 The most important accounting principles

- 3 Examples of Accounting Principles

- 4 Advantages of Accounting Principles

- 5 Limitations of Accounting Principles

- 6 Other approaches related to Accounting Principles

- 7 References

GAAP

Accounting standards around the world have developed over centuries of business and capital market growth. During this process, accounting standards historically were planned to meet the needs of each nation's capital markets. Those principles which were found to work well in the legal, educational, political and economic context of each nation became the "generally accepted accounting principles," (GAAP), for that specific jurisdiction. Naturally, different regulations in different communities led to various accounting principles in each community. (Center for Audit Quality 2009)

GAAP are the currently accepted procedures, principles and standards that business use for financial accounting and reporting all over the world. These rules must be followed by businesses that sell shares to the public - and by any other businesses as well, during preparation of the financial statements . GAAP covers such issues as how to account for inventory, buildings, income taxes and capital stock; how to measure the results of a business’ operations; and how to account for the operations of businesses in specialized industries (for example banking industry or insurance industry). Thanks to GAAP, financial information is clarity for external users.

Accounting Standards are important to protect the interest of investors, managers and the general public by establishing acceptable accounting procedures and the content of financial reports. (B. Cunningham 2015, p. 22)

The most important accounting principles

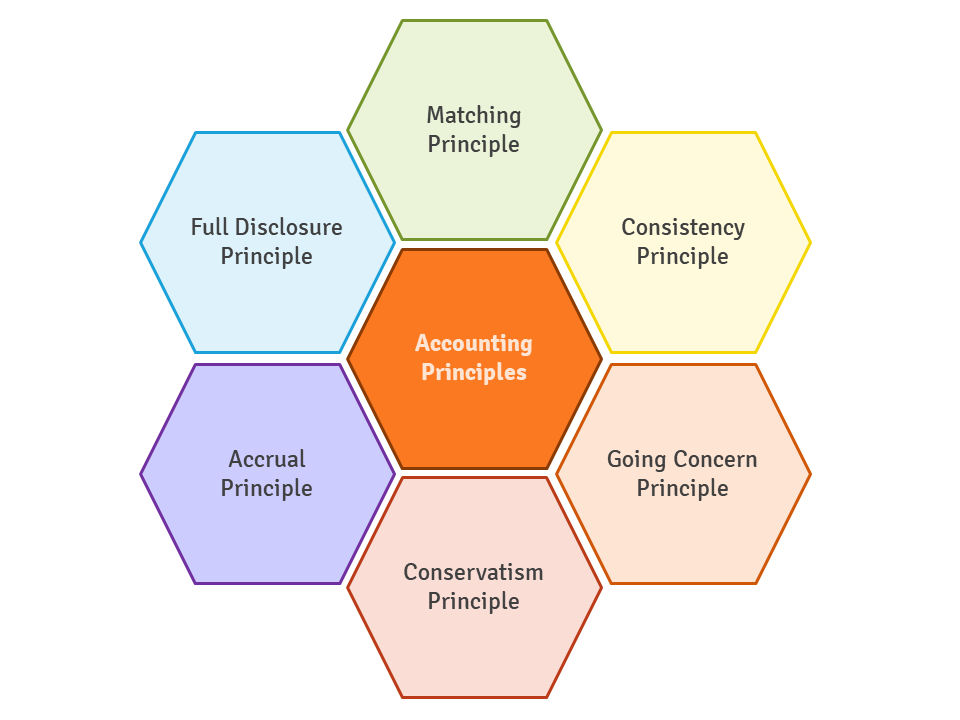

Fig.1. The accounting principles

The best-known of accounting principles are as follows:

- The separate entity or accounting entity or economic entity assumption - a company is an accounting unit isolated from its holders and their individual transactions.

- The continuity or going concern assumption - the conjecture that an enterprise will proceed indefinitely into the future so its assets are not for sale.

- The unit-of-measure assumption - all businesses must be consistently recorded using the same currency.

- Periodicity or the time-period assumption - a company should make reports of the results of its operations over a particular period of time.

- The historical cost principle - accounts record the original cost paid for assets.

- The revenue or realization principle - money is accepted as a revenue when the seller acquires the right to receive payment from the buyer. It happens at the time when goods are sold or when services are supplied.

- The matching principle - revenues and any related costs should be recognized together in the same period. The matching principle is one of the fundamental principles of accounting. This matching of expenses and earnings is crucial for the income statement to show authentic picture of the profitability of a business.

- The objectivity principle - to be reliable, all data recorded and accounting information must be verifiable and objective. It requires no subjective appraisal of replacement values (this means that accounting entries will be based not on individual opinion or beliefs, but on evidence and fact).

- The consistency principle - the same accounting methods or principles that are used in company must be followed from one accounting period to the next.

- The full-disclosure principle - financial reporting must disclose all significant and important information, this can be accomplished by adding significant amount of explanatory notes to the financial statements.

- Materiality principle - only things that would affect knowledgeable user's choice are important and need to be reported in an appropriate way, if an amount or transaction is negligible.

- The principle of conservatism - where two acceptable accounting methods are possible, conservatism directs the accountant to go for the alternative with the lower profit or lower asset amount.

(R. Hermason, J. Edwards, M. Maher (2010), p. 148,262,271; I. Mckenzie (2012), p. 18-19)

Examples of Accounting Principles

- The Revenue Recognition Principle: This principle states that revenue should be recognized when it is earned, not when it is received. An example of this is when a business provides a service and the invoice is sent before the customer pays. The revenue should be recorded when the invoice is sent, not when the payment is received.

- The Cost Principle: This principle states that assets purchased should be recorded at their historical cost. An example of this is when a company buys a new computer. The cost of the computer should be recorded at the amount that was paid for it rather than its current market value.

- The Matching Principle: This principle states that expenses should be matched with the related revenue. An example of this is when a company has costs associated with producing a product. The cost of the product should be matched with the revenue earned from selling it.

- The Full Disclosure Principle: This principle states that all material information should be disclosed in the financial statements. An example of this is when a company has a lawsuit pending. This should be disclosed in the financial statements so investors have an understanding of the potential risk of the company.

Advantages of Accounting Principles

Accounting principles provide a set of standards that help to ensure accuracy and consistency when recording and reporting financial information. Here are some key advantages of accounting principles:

- Accounting principles provide a framework for keeping financial records and reporting financial information. This helps to ensure accuracy and consistency in all financial transactions.

- Accounting principles help to ensure that financial statements are reliable and comparable across different companies. This allows investors and other stakeholders to compare financial performance between companies and make informed decisions.

- Accounting principles provide guidance to organizations in determining how to record and report financial information. This helps organizations to make sound financial decisions and minimize errors in the financial statements.

- Accounting principles also help to protect the interests of shareholders, creditors, and other stakeholders by ensuring that financial statements are accurate and reliable.

Limitations of Accounting Principles

Accounting principles are essential rules of accounting that ought to be followed in doing account planning and financial statements. However, there are several limitations associated with these principles. These include:

- Lack of standardization: Accounting principles, although standardized, are not uniform across different countries and industries, which can lead to confusion and inconsistency.

- Subjectivity: Accounting principles are based on the subjective interpretation of the data and facts presented, which can lead to errors and inconsistencies.

- Difficulty in changing: Accounting principles are difficult to amend or modify due to their complexity and the need for consensus among stakeholders.

- Vulnerability to manipulations: Accounting principles can be manipulated and abused by those with vested interests, leading to potential fraud and other unethical activities.

- Expense of implementation: It can be costly to implement and maintain accounting principles, making it difficult for some businesses to comply.

Other approaches related to Accounting Principles include:

- Cost Accounting: Cost Accounting is a type of accounting that focuses on the cost of producing and delivering a product or service. It involves tracking the costs associated with production and delivery, analyzing them, and making decisions.

- Auditing: Auditing is a way of assessing the accuracy of financial and accounting records. It involves examining financial documents, verifying transactions, and ensuring that they are in line with applicable laws and regulations.

- Financial Reporting: Financial reporting is the process of preparing and presenting financial statements to stakeholders. This includes preparing and presenting the balance sheet, income statement, cash flow statement, and statement of changes in equity.

- Tax Accounting: Tax Accounting is the practice of filing taxes, preparing tax returns, and maintaining records in accordance with applicable taxes. It involves analyzing current and prior-year tax laws, calculating taxes, and preparing tax returns.

- Accounting Information Systems: Accounting Information Systems are computer-based systems that collect, store, process, and report financial information. They are used for tasks such as financial reporting, budgeting, and data analysis.

In conclusion, Accounting Principles are the essential rules of accounting that should be followed in doing account planning and financial statements. Other approaches related to Accounting Principles include Cost Accounting, Auditing, Financial Reporting, Tax Accounting, and Accounting Information Systems.

| Accounting Principles — recommended articles |

| Periodicity concept — Micro Accounting — Accounting Convention — Accrual method — Time period concept — Creative accounting — Accounting documents — Cost principle — Objectivity concept — Decision matrix |

References

- Center for Audit Quality (2009), Guide to International Financial Reporting Standards, September 2009.

- Cunningham B. and others (2015), Accounting: Information for Business Decisions, Cengage Learning p. 22.

- Hermason R., Edwards J., Maher M. (2010), Accounting Principles: A Business Perspective, Financial Accounting. Chapters 1-8, Open College Textbook, p. 148, 262-272.

- Mckenzie I. (2012), Financial English with Financial Glossary, second edition Heinle, Cengage Learning, p. 18-19.

Author: Marta Mieszczak