Lateral diversification strategy

Lateral diversification strategy involves the search for new opportunities through the introduction of new products into new markets. This kind of diversification strategy is one of the most risky and costly for company. It requires the effort associated with the process of manufacture of a new product (planning, purchase of technology, acquisition of machinery and equipment, licences etc.) and gain new markets (market segmentation, crowding out competition, intense distribution and promotional activities).

Contents

- 1 Types of diversification strategies

- 2 Lateral diversification strategy

- 3 Applications of lateral diversification strategy

- 4 Examples of Lateral diversification strategy

- 5 Advantages of Lateral diversification strategy

- 6 Limitations of Lateral diversification strategy

- 7 Other approaches related to Lateral diversification strategy

- 8 References

Types of diversification strategies

Based on the depth, diversification strategies can be divided into:

- centred diversification strategies,

- conglomerate diversification strategies.

In the framework of the centred diversification strategy there are 3 subtypes:

- horizontal diversification strategy,

- vertical diversification strategy,

- lateral diversification.

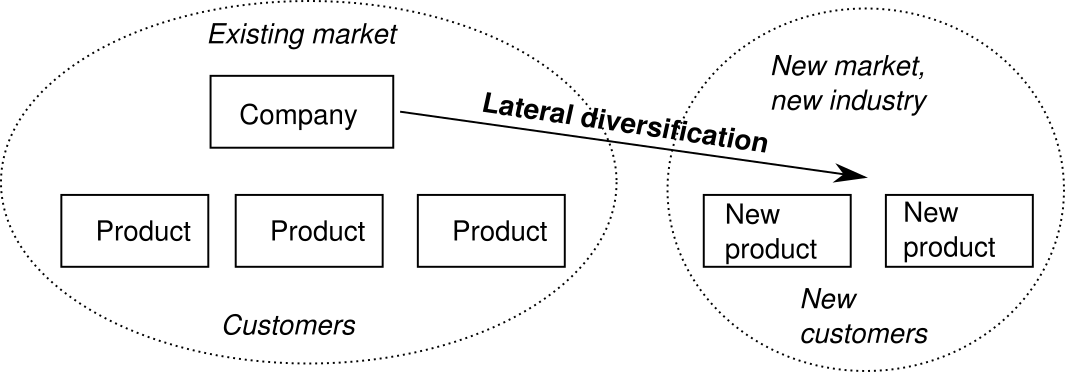

Fig. 1. Lateral diversification strategy

Lateral diversification strategy

It consists in the development of the side activities of the company. It is also linked to the introduction of a new product (s) not related to the current range of market and existing customer groups (usually without any synergies).

In the case of the production it involves an entirely different kind of products that changes the position on the market. Offered goods are extended with new products, which do not show a connection with a previous, it is the entry into the completely new territory.

Lateral diversification creates new chances and opportunities for development. The choice of such a strategy results in a so-called mergers, linking of not related industries, which often lead to the creation of conglomerates. The implementation of the lateral diversification strategy involves activities in different segments of the market, large variation in the environment. In comparison with other development strategies it is the most risky, but allows to spread of financial risk that is associated with a seasonality of sales fluctuations.

Applications of lateral diversification strategy

Compared with the horizontal and vertical diversification, it can be stated that the lateral diversification creates unlimited possibilities in the area of interest in the company, while the other two restrict it through the natural limits of diversity.

Lateral diversification strategy is mostly used in the electrical and chemical industry, thanks to the large amount of research activities and numerous merger opportunities. Lateral diversification is characteristic in industries with a high productivity rate, a large share of technical workers among the employed and of greater and faster pace of development.

In practice, companies generally do not use only one type of diversification strategy. Usually it is a combination of above mentioned three kinds, where lateral and horizontal diversification create greater opportunities to strengthen internal and external market position.

See also:

Examples of Lateral diversification strategy

- Apple Inc.’s introduction of the iPhone was a prime example of a lateral diversification strategy. The company took an existing, successful product, the iPod, and modified it to create a new product, the iPhone. This strategy allowed the company to enter a new market, the mobile phone market, while leveraging the existing success of their iPod product.

- Microsoft Corporation’s introduction of the Xbox was another example of a lateral diversification strategy. The company took their existing software and hardware products and applied them to the video game console market. This allowed them to enter a new market, while leveraging their existing knowledge and success in software and hardware.

- Another example of a lateral diversification strategy is Amazon’s introduction of the Kindle. The company took the existing technology of their online shopping platform and applied it to the e-reader market. This allowed the company to enter a new market, while leveraging their existing skills in online commerce.

Advantages of Lateral diversification strategy

Lateral diversification strategy is a type of diversification strategy which involves the search for new opportunities through the introduction of new products into new markets. This type of diversification can be beneficial for businesses seeking to expand and grow. The advantages of this strategy include:

- Lower risk compared to other forms of diversification as the business is entering a market it is familiar with.

- Increased market reach and potential for higher profits due to the fact that the business is targeting new markets.

- Improved competitive advantage due to the introduction of new products into the market.

- The potential for cost savings as the business is able to leverage existing resources and infrastructure to produce the new products.

- Increased flexibility as the business can quickly and easily adapt to changing market conditions.

- Improved employee morale as the introduction of new products can help to create a dynamic and innovative work environment.

Limitations of Lateral diversification strategy

- High fixed costs: The high costs associated with the production of a new product, as well as the costs associated with entering new markets, can quickly deplete a company’s finances.

- Unfamiliarity with the new market: A company may find it difficult to identify potential customers within the new markets, and may not have the resources to reach them effectively.

- Competition: Companies entering a new market may find it difficult to differentiate their products and services from those that are already present.

- Risk of failure: There is a risk that a company's product may not be accepted by the new market, and the resources invested in the new product may not be recouped.

- Time consuming process: The process of entering a new market can be time consuming, with extensive research and development needed to create a successful product.

- Mergers and Acquisitions: This approach involves combining two or more companies together to form a larger, more efficient and cost-effective entity.

- Licensing: This approach involves a company entering into an agreement with another company that owns a certain technology, trademark, or other intellectual property, allowing the licensee to use the property in exchange for a fee.

- Strategic Alliances: This approach involves companies entering into voluntary arrangements with other companies in order to share resources and reduce costs.

- Joint Ventures: This approach involves two or more parties combining resources to form a new company.

In summary, Lateral Diversification Strategy is a risky and costly approach that involves introducing new products into new markets. Other approaches related to this strategy involve Mergers and Acquisitions, Licensing, Strategic Alliances, and Joint Ventures.

| Lateral diversification strategy — recommended articles |

| Horizontal diversification strategy — Diversification in business — Lateral integration — Related diversification — Vertical diversification strategy — Tuck-In Acquisition — Incremental innovation — Conglomerate diversification — Global marketing strategy |

References

- Ansoff, H. I. (1957). Strategies for diversification. Harvard business review, 35(5), 113-124.

- Ansoff, H. I. (1958). A model for diversification. Management Science, 4(4), 392-414.

- Hitt, M. A., & Ireland, R. D. (1986). Relationships among corporate level distinctive competencies, diversification strategy, corporate structure and performance. Journal of Management Studies, 23(4), 401-416.

- Meyer, M. H., & Roberts, E. B. (1986). New product strategy in small technology-based firms: A pilot study. Management Science, 32(7), 806-821.

- Souza, G. C., Bayus, B. L., & Wagner, H. M. (2004). New-product strategy and industry clockspeed. Management Science, 50(4), 537-549.