Contra entry: Difference between revisions

mNo edit summary |

(The LinkTitles extension automatically added links to existing pages (<a target="_blank" rel="noreferrer noopener" class="external free" href="https://github.com/bovender/LinkTitles">https://github.com/bovender/LinkTitles</a>).) |

||

| Line 28: | Line 28: | ||

* Contra entries should be made as soon as possible after the error is discovered, to minimize the impact on financial statements and to maintain accurate records. | * Contra entries should be made as soon as possible after the error is discovered, to minimize the impact on financial statements and to maintain accurate records. | ||

* Contra entries should be clearly labeled and explained in the accounting records, such as in the "particulars" column of a double column cash book, so that anyone reviewing the records can understand the correction that was made. | * Contra entries should be clearly labeled and explained in the accounting records, such as in the "particulars" column of a double column cash book, so that anyone reviewing the records can understand the correction that was made. | ||

* Contra entries should be done with proper documentation and support, so that it can be tracked, who did it, when, and why. | * Contra entries should be done with proper [[documentation]] and support, so that it can be tracked, who did it, when, and why. | ||

* Contra entries should be done with the approval and authorization of authorized person in the organization. | * Contra entries should be done with the approval and authorization of [[authorized person]] in the [[organization]]. | ||

It's important to note that contra entries are not the only way to correct errors in accounting records, there are other ways to correct errors like adjusting entries, reversing entries etc. The best way to correct errors depends on the specific circumstances and the nature of the error. | It's important to note that contra entries are not the only way to correct errors in accounting records, there are other ways to correct errors like adjusting entries, reversing entries etc. The best way to correct errors depends on the specific circumstances and the nature of the error. | ||

Revision as of 11:12, 23 January 2023

| Contra entry |

|---|

| See also |

Contra entry It is the record which is entered in purpose of reversing or offsetting corresponding record placed on another side of the same account in Cash Book. Purpose of Contra Entry is to reduce the balance of an entry on the other side of account. It does not affect Net Cash Balance. Contra Entry is also known as “Against” or “Opposite” entries. For example- credit entry of $200 was made on the account (amount added), on the other side of the account (in debit) $200 entry (amount taken away) is the Contra Entry. Because of Contra Entry in the same amount as credit- account is balanced.

Letter “C” is used as a symbol of the Contra Entry in Ledger Folio Column (after ledger name). Contra Entry is essential part of both Double- Column as well as Three- Column Cash Books.

Rules referring to contra entries

There are a few rules related to contra entries in accounting:

- The accounts involved in a contra entry must have the same account type (e.g. both are asset accounts).

- The contra entry must be made in the same account as the original entry, with the opposite sign. For example, if the original entry was a debit, the contra entry must be a credit, and vice versa.

- The net effect of a contra entry should be zero, meaning that the debit and credit amounts should be equal.

- Contra entries should be made as soon as possible after the error is discovered, to minimize the impact on financial statements and to maintain accurate records.

- Contra entries should be clearly labeled and explained in the accounting records, such as in the "particulars" column of a double column cash book, so that anyone reviewing the records can understand the correction that was made.

- Contra entries should be done with proper documentation and support, so that it can be tracked, who did it, when, and why.

- Contra entries should be done with the approval and authorization of authorized person in the organization.

It's important to note that contra entries are not the only way to correct errors in accounting records, there are other ways to correct errors like adjusting entries, reversing entries etc. The best way to correct errors depends on the specific circumstances and the nature of the error.

Examples of Contra Entry transactions

Contra Entry is used when:

- Cash is deposited into bank:

Debit: Bank A, Credit: Cash

In this case Dt is made in Bank account, but the Ct Entry is made in Cash on the account.

- Cash is withdrawn from the bank,

Debit: Cash, Credit: Bank B

In this case Dt is made in Cash on the account, but the Ct Entry is made in Bank Account.

- Cash is transferred between two accounts,

Debit: Cash, Credit: Cash

In this case Dt is made in Cash on the account that transfer goes from, but the Ct Entry is made in Cash on the account transfer goes to.

- Fund is transferred between two banks (Bank B to Bank A):

Debit: Bank A, Credit: Bank B

In this case Dt is made in Bank account that transfer goes from, but the Ct Entry is made in Bank account transfer goes to.

Contra Entry in double column cash book

A double column cash book is a type of accounting document that is used to record all cash transactions, including both cash inflow (receipts) and cash outflow (payments). A contra entry in a double column cash book is used to correct errors or to cancel out a previous entry that was made in error.

To use a contra entry in a double column cash book, you would first identify the mistake in the original entry. Then, you would make a new entry in the same account, but with the opposite sign. For example, if the original entry was a $100 debit to the cash account, the contra entry would be a $100 credit to the cash account.

In a double column cash book, it is important to ensure that the debit and credit entries are made in the correct columns, as well as the correct accounts. You should also include a brief explanation of the contra entry in the "particulars" column of the double column cash book, to help explain the correction.

It is important to note that Contra Entry in double column cash book is a way of correcting errors that occur in the cash book. It is a very useful feature in accounting, as it helps to maintain the accuracy of the financial records and statements of an organization.

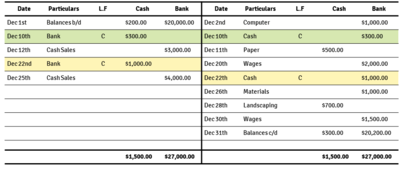

Below transactions are about to be entered into double- column cash book (balanced as at 31st Dec 2018):

| Date | Particulars | Amount |

|---|---|---|

| Dec 1st | Bank Balance b/d | $20,000.00 |

| Dec 1st | Balance of cash | $200.00 |

| Dec 2nd | Paid by check for Computer | $1,000.00 |

| Dec 10th | Withdrew from bank for office use | $300.00 |

| Dec 11th | Paid for paper- cash | $500.00 |

| Dec 12th | Banked cash sales | $3,000.00 |

| Dec 20th | Paid wages by transfer | $2,000.00 |

| Dec 22nd | Withdrew from bank for office use | $1,000.00 |

| Dec 25th | Banked cash sales | $4,000.00 |

| Dec 26th | Paid by check for materials | $1,000.00 |

| Dec 28th | Paid by cash for landscaping services | $700.00 |

| Dec 30th | Paid wages by transfer | $1,500.00 |

Double column cash book

| Date | Particulars | L.F | Cash | Bank | Date | Particulars | L.F | Cash | Bank |

|---|---|---|---|---|---|---|---|---|---|

| Dec 1st | Balances b/d | $200.00 | $20,000.00 | Dec 2nd | Computer | $1,000.00 | |||

| Dec 10th | Bank | C | $300.00 | Dec 10th | Cash | C | $300.00 | ||

| Dec 12th | Cash Sales | $3,000.00 | Dec 11th | Paper | $500.00 | ||||

| Dec 22nd | Bank | C | $1,000.00 | Dec 20th | Wages | $2,000.00 | |||

| Dec 25th | Cash Sales | $4,000.00 | Dec 22th | Cash | C | $1,000.00 | |||

| Dec 26th | Materials | $1,000.00 | |||||||

| Dec 28th | Landscaping | $700.00 | |||||||

| Dec 30th | Wages | $1,500.00 | |||||||

| Dec 31th | Balances c/d | $300.00 | $20,200.00 | ||||||

| $1,500.00 | $27,000.00 | $1,500.00 | $27,000.00 |

Contra entries are the transactions done on Dec 10th and Dec 22th (with "C" in L.F. Column).

References

- Banerjee, A. (2005). Financial Accounting a Managerial Emphasis. Second Edition.

- Erkes, H. (1921). The Teller's Brotter, "Bankers' Magazine (1896-1943); Cambridge Tom 102, No/edition 5, (May 1921): 760."

- Hoyle, K., & Whitehead, G. (1979). Business Statistics and Accounting Made Simple

- Kotas, R., & Conlan, M. (1997). Hospitality Accounting Fifth Edition

- Nhleko, Z. (2010). IFC’s contribution to the 57th ISI Session, Durban, 2009, "IFC Bulletin No 33."

- Sangster, A. (2016). The Genesis of Double Entry Bookkeeping, "The Accounting Review: January 2016, Vol. 91, No. 1, pp. 299-315"

- Tulisan, P. C. (2015). Tulisan's Quick Revision For Financial Accounting (For ICWA Intermediate: Paper 5)

Author: Patryk Wykręt