Sundry income: Difference between revisions

(Infobox update) |

mNo edit summary |

||

| Line 23: | Line 23: | ||

* foreign exchange gains, | * foreign exchange gains, | ||

* interest income. | * interest income. | ||

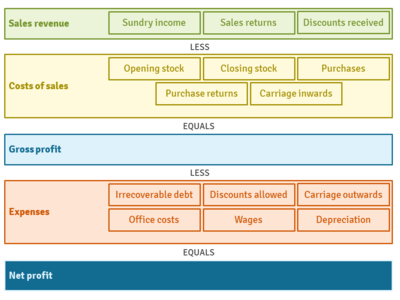

[[File:statement_of_profit_and_loss.png|400px|right|thumb|Fig.1. Place of sundry income in statement of profit and loss]] | |||

Generally sundry income has a small share in the company's entire income from operating activities. Amounts from sundry income do not have to be small. There is no limit as to the amount that can be qualified as sundry income, because it is an irregular source of income in the [[company]]. | Generally sundry income has a small share in the company's entire income from operating activities. Amounts from sundry income do not have to be small. There is no limit as to the amount that can be qualified as sundry income, because it is an irregular source of income in the [[company]]. | ||

Revision as of 09:25, 2 September 2020

| Sundry income |

|---|

| See also |

Sundry income is all the income not related to normal business operations, e.g. sales of products or services. Sundry income generates income from other sources than basic business operations. Usually sundry income is less predictable and much lower than usual incomes, because the associated activities are usually irregular and they are not seen as constant and guaranteed income sources over the long term (Aoyama, H., Souma, W., Nagahara, Y., Okazaki, M. P., Takayasu, H., & Takayasu, M., 2000).

Typical sources of sundry income are:

- late fees,

- profits on sales of assets,

- foreign exchange gains,

- interest income.

Generally sundry income has a small share in the company's entire income from operating activities. Amounts from sundry income do not have to be small. There is no limit as to the amount that can be qualified as sundry income, because it is an irregular source of income in the company. Sundry income must be shown in the balance sheet and financial statements, because it affect to the net value of the company. This is important information for current and future investors. Additionally, through sundry income the company incur tax consequences. All incomes must be reported to the Internal Revenue Service.

Sundry income is recorded on balance sheet and therefore has impact on financial results. It should be also reported to shareholders.

Sundry expenses are similar to sundry income. They are small in relation to other expenses and not too often. The companies often use general ledger account to record those amounts. If they begin to occur frequently, they should be moved to distinct account.

Sources of Sundry Income

Usually sundry income include income from various sources. Their character may change from one period to another. For example, profits on the sales minor assets may qualify as sundry income in one company, but the same profit may be main income in another company. It depends on the nature of the business involved.

Sundry income may include for example income from sources such as interest. It depends on whether the company has a significant on the interest received in a given period. In those case, interest income may be demonstrated as an entry separated from sundry income.

References

- Aoyama, H., Souma, W., Nagahara, Y., Okazaki, M. P., Takayasu, H., & Takayasu, M. (2000). Pareto's law for income of individuals and debt of bankrupt companies. Fractals, 8(03), 293-300.

- Bellandi, F. (2012). Dual reporting for equity and other comprehensive income under IFRSs and U.S. GAAP. John Wiley & Sons, p. 2-3.

- Fairfield, T. and Jorratt, M. (2014). Top Income Shares, Business Profits, and Effective Tax Rates in Contemporary Chile. Internationl Center for Tax and Development Working Paper, 17, p. 36-37.

- Sánchez, P and JE Ricart (2010). Business model innovation and sources of value creationin low-income markets. European Management Review, 7(3), 138–154.

Author: Iwona Tuleja