Short call option: Difference between revisions

(LinkTitles) |

(LinkTitles) |

||

| Line 33: | Line 33: | ||

'''[[Long put]] option''' - this option works in a similar way as long call. Main difference is that long put investor makes profit when i.e. asset price goes down. Similarly to long put potential lost is only limited to the premium price. | '''[[Long put]] option''' - this option works in a similar way as long call. Main difference is that long put investor makes profit when i.e. asset price goes down. Similarly to long put potential lost is only limited to the premium price. | ||

'''Short put option''' - using this option investor is selling sell option. Investor makes profit from premium when asset price is constant or when it slightly raises. Similarly to short call option profit is limited to premium but lost can be in theory unlimited<ref>Danes S. J., (2014), p.5</ref>. | '''Short put option''' - using this option investor is selling sell option. Investor makes profit from premium when asset price is constant or when it slightly raises. Similarly to [[Short Call|short call]] option profit is limited to premium but lost can be in theory unlimited<ref>Danes S. J., (2014), p.5</ref>. | ||

==Assumptions== | ==Assumptions== | ||

Revision as of 08:56, 23 May 2020

| Short call option |

|---|

| See also |

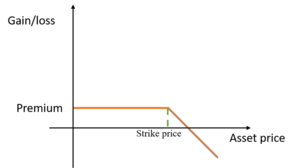

Short call option is a type of option which is used when call seller predicts that underlying security i.e. asset price will drop down. Using other words investors sells short call when i.e. asset price is relatively high, assuming that will be able to re-buy it for less money or simply wait until option call will expire. Maximum profit is equal to premium set by option seller. Potential lost in theory can be unlimited if i.e. price instead of going down will raise[1].

To find out more about options you can check out this article.

An example of short call option

Investor predicts that there will be small price drop down of ABC company asset from $100 to $98. Knowing that Investor decide to release short call option of 100 assets, premium cost is $100 (this will be his maximum profit). Assuming that investors prediction were correct he will have $100 of premium profit. If instead of price drop, asset ABC price will raise to $105 investor will loose $400[2]. Example formula will look as following:

[($105-$100)*100as-100p]

where:

- 100as - number of assets

- 100p$ - investors premium in dollars

Other types of options

Long call option - this option is used to make profit when i.e. asset price raises. Main advantage of this type of option is that potential lost will be only limited to the premium price. If there will be big dropdown of the asset price investor will not exercise his right to buy.

Long put option - this option works in a similar way as long call. Main difference is that long put investor makes profit when i.e. asset price goes down. Similarly to long put potential lost is only limited to the premium price.

Short put option - using this option investor is selling sell option. Investor makes profit from premium when asset price is constant or when it slightly raises. Similarly to short call option profit is limited to premium but lost can be in theory unlimited[3].

Assumptions

Short call options are used when investor predicts that price will not change or there will be small dropdown of underlying security i.e. asset price. From the issuer perspective potential lost can be unlimited therefore it is recommended to be used by experienced stock traders.

Footnotes

References

- Carter M. G., (2018) Options Trading: A Beginner's Guide to Make Money By Trading Options With Practical Strategies Ebook, 2018

- Danes S. J., (2014) Options Trading Stratgies: Complete Guide to Getting Started and Making Money with Stock Options Dylanna Publishing, 2014

- Duarte J., (2015) Trading Options For Dummies John Wiley & Sons, 2017

- Fabozzi F. J., (2004) Short Selling: Strategies, Risks, and Rewards John Wiley & Sons, 2004

- Kolb R. W., Overdahl J. A. (1997) Futures, options, and swaps Oxford-Blackwell, 1997

- Yates L., (2004) Performance Options Trading: Option Volatility and Pricing Strategies John Wiley & Sons, 2004

Author: Bartłomiej Olejniczak

.