Committed cost

| Committed cost |

|---|

| See also |

Committed cost is a kind of investment that a company or business organization has already made and couldn't recoup in any way. There are also obligations has made by the business, which cannot get back. According to sentence "Committed costs are fixed future streams of expenditures. Within this definition are leases and other contracts (with suppliers, customers and employees), warranties, mortgages, and capital amortizations. Such commitments can reduce uncertainties of supply, eliminate some search costs, increase demand, deny opportunities to competitors, and lock in lower costs over the life of the commitment."(F. Phillips and R. Srivastava, 1993, p.2) It is a fixed cost. '"Most costs are not inherently fixed or variable in nature. In management cuts the workforce because of a drop in demand, labor cost is variable; otherwise it is fixed." (R.L. Weil, M.W. Maher,2005, p. 183) Committed costs are difficult to change for many reasons:

- Strategy: This type of costs is an extension of business strategy. A strategic plan is very important, because contains strategic decisions, which are impossible (or almost impossible) to change.

- Long - term orientation: Companies must pay fixed amounts in contracts. Otherwise, if they do not keep the contract, they are required to pay punishments.

- Operations: It is other reasons why changing committed costs are difficult. It is connected with logistic decisions, often hard to change.

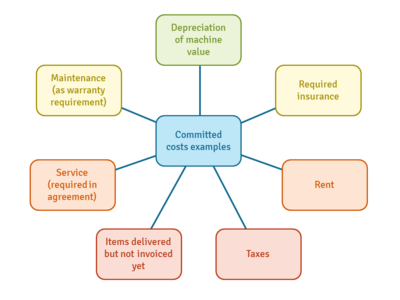

Examples of committed costs

Examples of Committed Costs include:

- Rent: A business will be obligated to pay rent for the space they are leasing, regardless of their level of production or sales.

- Insurance: Insurance is necessary to protect a business from potential liabilities, and is thus a fixed cost that the business must pay to remain operational.

- Salaries: Salaries are a committed cost as they represent the cost of employing staff.

- Debt Payments: Debt payments are a fixed cost that must be made in order to remain financially healthy.

'"The first category, committed costs (including leases etc.), are nonrecoverable if the project fails. The second category (materials etc.), although possibly recoverable, are irreducible if the project proceeds. The collection of both categories might be called determined costs. "(F. Phillips and R. Srivastava, 1993, p.3)

The committed cost is this type of costs which can't be excluded from net income (company's bottmline), frequently they are high-cost items (like a house or a car).

We can distinguish the following types of fixed committed costs: rental of office space, purchase of the machine needed for the properly operation of the company, long term investment in company plans or maintaining key personnel. There are also all additional fees that result from the original purchase. All of these outgoings are indispensable to run a business and fulfill the set goals. Generally, these costs can not be reduced in any way.

The cost of materials for the production of a product is an example of a committed cost. This cost is necessary for the production of the product, and must be paid regardless of the level of production or sales. In other words, the cost of materials is committed and is expected to be paid regardless of how successful the product is in the market. As such, it is a fixed cost that must be taken into account when pricing the product. In summary, the cost of materials for the production of a product is an example of a committed cost.

When to use Committed cost

Committed costs are used when a business is trying to determine the level of expenses it must incur in order to remain operational. They are also used to identify areas that can be cut in order to reduce expenses and improve profitability. For example, if a business is looking to reduce expenses, they may look at their committed costs and see if they can renegotiate rent, insurance, or debt payments in order to reduce expenses.

In summary, committed costs are used to determine the level of expenses necessary to remain operational, and can be used to identify areas that can be reduced in order to improve profitability.

Types of Committed cost

Committed costs can be divided into two main types: fixed costs and semi-fixed costs.

- Fixed Costs: Fixed costs are those that are expected and have an ongoing nature, meaning they will continue regardless of the level of production or sales. Examples of fixed costs include rent, insurance, and debt payments.

- Semi-Fixed Costs: Semi-fixed costs are those that have some level of flexibility, meaning they can change depending on the level of production or sales. Examples of semi-fixed costs include salaries and advertising costs.

In summary, committed costs can be divided into two types: fixed costs and semi-fixed costs, with examples of each being rent, insurance, debt payments, salaries, and advertising costs.

Steps of Committed cost

The process of calculating committed costs involves five steps.

- Identify the Cost: The first step is to identify the cost that is necessary for the business to maintain its operations. This includes rent, insurance, salaries, and debt payments.

- Calculate the Cost: The next step is to calculate the cost of these necessary items. This includes calculating the amount of rent, insurance payments, salaries, and debt payments that must be paid each period.

- Determine the Frequency: The third step is to determine the frequency of these payments. This includes whether rent is paid monthly, quarterly, or annually, as well as the frequency of insurance payments, salaries, and debt payments.

- Estimate the Variability: The fourth step is to estimate the variability of these costs. This includes considering potential changes in rent, insurance payments, salaries, and debt payments over time.

- Calculate the Total: The last step is to calculate the total cost of these items. This includes adding all of the rent, insurance payments, salaries, and debt payments to get the total cost for the period.

In summary, the process for calculating committed costs involves identifying the necessary costs, calculating the cost of each item, determining the frequency, estimating the variability, and calculating the total cost.

Difference between discretionary and committed costs

Discretionary fixed costs "are fixed costs that can be changed or avoided relatively easily at management discretion. For example, advertising is a discretionary fixed cost. It depends on the decision by management to purchase print, radio, or video advertising. This cost might depend on size of the ad or the number of times it runs, but it does not depend on the number of units produced and sold. Management can easily decide to increase or decrease money spent on advertising" (M. Mowen, D. Hansen, D. Heitger, 2009, p.84)

The difference between discretionary and committed costs depends on if can it be postponed and reduced in time or if the company is legally or otherwise associated with their recognition.

Limitations of Committed cost

Committed costs are necessary for a business to remain operational, however they can also limit a business’s ability to respond to changes in their environment. Once committed costs are fixed, they can be difficult to reduce or adjust in order to accommodate changes in production or sales. Additionally, committed costs do not take into account the varying levels of production or sales, meaning they can be difficult to scale up or down. This can limit a business’s ability to respond to changing market conditions.

Committed costs can be managed through the use of budgeting and cost control. Budgeting involves creating a plan for allocating resources to different activities in order to meet financial goals. Cost control involves monitoring and regulating costs in order to maximize efficiency and minimize expenses. Additionally, cost-benefit analysis can be used to determine the value of a project or activity, and whether it is worth the associated costs.

In summary, committed costs can be managed through the use of budgeting, cost control, and cost-benefit analysis to ensure that all expenses are justified and necessary.

References

- Ang J.S., (1991), Small Business Uniqueness and the Theory of Financial Management

- Baumol W.J, Willig R.D, (2009), Fixed Costs, Sunk Costs, Entry Barriers, and Sustainability on Monopoly,

- Mowen M., Hansen D.,Heitger D., (2009) Cornerstones of Managerial Accounting, South - Western Cengage Learning, Mason

- Phillips F.,Srivastava R.,(2019) Committed Costs vs. Uncertainty in New Product Development,

- Weil R.L., Maher M.W,(2005) Handbook of Cost Management, John Wiley & Sons, New Jersey,

- Westhead P., Howorth C., (2016), Ownership and Management Issues Associated With Family Firm Performance and Company Objectives,

Author: Edyta Krzyczman