Minimax criterion

| Minimax criterion |

|---|

| See also |

Min-max criterion - is a decision-making criterion presented in 1954 by Leonard Savage. This criterion minimizes the expected loss associated with making worse than optimal decision, for a given state of nature. In the decision-making process such strategy should be selected, for which the relative loss is the smallest.

Application

According to the criterion you must first find a matrix of relative loss (a matrix of grief). Loss is defined as the difference between the greatest win, for a particular state of nature, and winning that corresponds to the predicted results of current decision. The calculations are made in columns in each of them going to the largest value, and then typed in the array of grief, the difference between the highest value and the currently calculated. This process can be expressed in following equation:

The next step is, specifying maximum loss for each strategy, and at the end selection of the strategy for which the maximum loss, will be the largest. Model:

Example

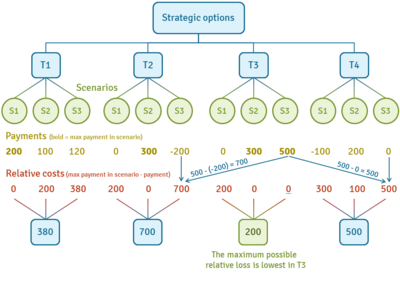

Example: we have an array of payments from the four possible decisions and three possible states:

| I | II | III | |

| T1 | 200 | 100 | 120 |

| T2 | 0 | 300 | −200 |

| T3 | 0 | 300 | 500 |

| T4 | −100 | 200 | 0 |

On this basis cost matrix of relative loss is calculated. Each value in column is subtracted from max values in scenario I/II/III:

| I | II | III | |

| T1 | 0 | 200 | 380 |

| T2 | 200 | 0 | 700 |

| T3 | 200 | 0 | 0 |

| T4 | 300 | 100 | 500 |

We are looking for the maximum losses for each strategy, and then select the smallest:

| Strategies | |

| T1 | 380 |

| T2 | 700 |

| T3 | 200 |

| T4 | 500 |

Summing up: According to the Min-max manager should choose a strategy T3.

References

- Bierwag, G. O., & Khang, C. (1979). An immunization strategy is a minimax strategy. The Journal of Finance, 34(2), 389-399.