Options

The option is a contract that conveys to its owner the right * not an obligation * to buy or sell an underlying asset at a specified price (strike/ exercise price) at some point in the future. We should differentiate European Option form American one. European Option can only be exercised at the end of its life while American can be exercised any time during its life.

In the option contract there is writer - person who creates an option, the originator, the seller.

And the buyer/holder - the party that holds option. The buyer pays a writer (or the seller) the premium, which is kept by the writer whether the option is exercised or not. In return the writer commits to deliver underlying asset when an option be exercised.

There are different types of options depending on underlying assets: equity options (index option, option on futures, currency option.

Classification

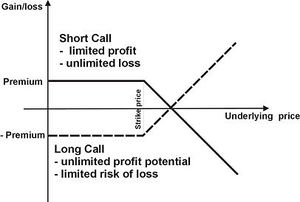

Call option * it an agreement that gives the holder of the option the right to buy (writer has an obligation to sell) an underlying asset at strike price. You can profit as a buyer on a call when the underlying asset increases in price, in other words when the price of an asset is above the strike price. Short position is seller position whereas long position is position of the buyer.

The call option is:

- in-the-money, when stock price > strike price

- at-the-money, when stock price = strike price

- out-of-money, when stock price < strike price

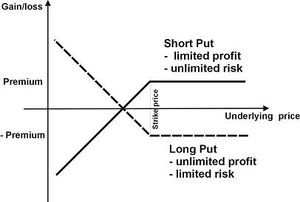

Put Option * the contract in which the holder has the right to sell (writer has an obligation to buy) an underlying asset at specified price on/within specific period of time. You will make a profit as holder when the price of underlying asset will be below strike price.

The put option is:

- in-the-money, when stock price < strike price

- at-the-money, when stock price = strike price

- out-of-money, when stock price > strike price

Investment strategies.

The holder of the option can act in three ways:

- Use option. Exercise call option * buy shares at fixed price or sell shares at a specified price in the case of put option.

- Leave the option to expire, when using would not be profitable

- Close position. Sell the option before its expiration date.

See also:

Examples of Options

- Stock Options: These are the most common type of option. A stock option gives the owner the right to buy or sell a certain number of shares of a company’s stock at a predetermined price (the strike price) at any time up until the expiration date.

- Index Options: These are options based on a stock index, such as the S&P 500. The owner of this type of option has the right to buy or sell the underlying index at a predetermined price (the strike price) on or before the expiration date.

- Currency Options: These are options based on the exchange rate of two different currencies. The owner of the option has the right to buy or sell the two currencies at a predetermined rate (the strike rate) at any time up until the expiration date.

- Commodity Options: These are options based on a commodity, such as gold, oil, or corn. The owner of this type of option has the right to buy or sell the underlying commodity at a predetermined price (the strike price) on or before the expiration date.

- Interest Rate Options: These are options based on a certain interest rate, such as the U.S. Treasury rate. The owner of this type of option has the right to buy or sell the underlying interest rate at a predetermined rate (the strike rate) at any time up until the expiration date.

Advantages of Options

One of the advantages of options trading is its potential to provide high leverage. Options can be used to generate income, hedge risk, and speculate on price movements. Below are some of the main benefits of buying and selling options:

- Leverage: Options allow investors to potentially generate more profits with less capital. A small investment in options can provide large returns if used correctly.

- Flexibility: Options provide the holder with flexibility in terms of the type of strategies they can use. There are many different strategies that can be used to generate income, hedge risk, or speculate on price movements.

- Low Cost: Options are generally less expensive than buying stocks or other securities. This allows traders to enter positions with a lower cost and less risk.

- Low Risk: Options trading can help to limit the risk of a position. By using options, traders can limit their downside risk while still maintaining the possibility of large profits.

- Tax Benefits: Options have the potential to generate tax benefits for certain investors. By taking advantage of the different tax treatments for options, traders can potentially increase their after-tax returns.

Limitations of Options

An option is a contract that conveys to its owner the right, not an obligation, to buy or sell an underlying asset at a specified price (strike/ exercise price) at some point in the future. However, options come with a number of limitations which include:

- Limited Expiration Date: Options come with a limited expiration date, meaning that they cannot be held in perpetuity. Once the expiration date has passed, the option loses its value and the buyer can no longer exercise it.

- Limited Potential Profit: The maximum potential profit for buying an option is limited to the premium paid for the option, while the maximum potential loss is unlimited.

- Limited Liquidity: Options tend to have lower liquidity than other financial products and underlying assets, which can make it difficult to buy or sell options at a good price.

- Risk of Early Exercise: If you are the seller of an American-style option, you could be subject to early exercise if the option is in-the-money. This could result in you having to fulfill the terms of the option sooner than expected.

- Time Decay: Options are subject to time decay, meaning that their value erodes over time. This can be especially problematic for buyers of options, who may find that their option position has lost value even if the price of the underlying asset has not moved.

One approach to options is the use of derivatives, which are financial instruments whose value is derived from an underlying asset such as a stock, index, or commodity. Some of the other approaches related to options include:

- Hedging – this is the use of options to offset potential losses in an investment portfolio. This is done by buying options that are inversely related to the investments in the portfolio.

- Speculation – this is the use of options to gamble on the direction of the underlying asset. Speculators may buy calls if they think the price of the underlying asset will increase or buy puts if they think the price of the underlying asset will decrease.

- Arbitrage – this is the simultaneous buying and selling of options to capitalize on price discrepancies in the market. Arbitrageurs use options to take advantage of market inefficiencies and make a profit.

In summary, there are many approaches related to options such as hedging, speculation, and arbitrage. These strategies can be used to offset risks, make bets on the direction of the underlying asset, or capitalize on market inefficiencies.

| Options — recommended articles |

| Long Hedge — Futures — Short Call — Bunny Bond — Interest Rate Collar — Short call option — Zero cost collar — Alternative futures — Bonds in finance |

References

- Kolb, R. W., & Overdahl, J. A. (1997). Futures, options, and swaps. Oxford: Blackwell.

Author: Katarzyna Wierzbinska