Project evaluation methods: Difference between revisions

No edit summary |

(The LinkTitles extension automatically added links to existing pages (<a target="_blank" rel="noreferrer noopener" class="external free" href="https://github.com/bovender/LinkTitles">https://github.com/bovender/LinkTitles</a>).) |

||

| Line 35: | Line 35: | ||

The most frequently mentioned and described static methods of investment projects evaluation include: | The most frequently mentioned and described static methods of investment projects evaluation include: | ||

* The payback period | * The [[payback period]] | ||

* Account of comparative costs | * Account of comparative costs | ||

* Account of comparative [[profit]] | * Account of comparative [[profit]] | ||

| Line 62: | Line 62: | ||

* MIRR - Modified Internal Rate of Return | * MIRR - Modified Internal Rate of Return | ||

* Annuity method | * Annuity method | ||

* The profitability index | * The [[profitability index]] | ||

* NPVR - Indicator revised of net present value | * [[NPVR]] - Indicator revised of net present value | ||

'''See also:''' | '''See also:''' | ||

Revision as of 00:52, 21 January 2023

| Project evaluation methods |

|---|

| See also |

Evaluation of the project involves a comprehensive assessment of the given project, policy, program or investments, taking into account all its stages: planning, implementation, and monitoring of results. It provides information used in the decision-making process.

Evaluations can be divided from the point of view of the project goals (evaluation of action in relation to the objectives, national or community) and operational aspects (monitoring of project activities).

There is also the separation due to the moment of performing evaluation: evaluation ex ante (before implementation), current evaluation (during implementation) and ex post evaluation (after implementation).

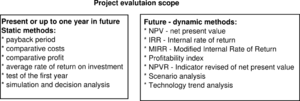

To achieve goal of cost-effective allocation of capital, investors use different methods to assess the rationality of investment. From the point of view of the time factor, techniques profitability of investment projects are divided into: static methods, (also known as simple) and dynamic methods (so called the discount methods).

Static methods of project evaluation

A characteristic feature of static methods in assessing the effectiveness of investment projects by defining the relationship of annual (medium or target) proceeds from investments and the total nominal expenditure required for its implementation.

These methods do not take into account the effect of the time, which means that the individual values are not differentiated in the following years, and the calculation involves the sum of the expected costs and benefits, or average values selected from a specified period. These methods only approximate capture the project life cycle and the level of commitment of capital expenditures.

It is proposed that simple method should be used only:

- In the initial stages of the process of preparation of projects, when there is not enough detailed and extensive information about the investment project,

- In the case of projects with relatively short economic life cycle, in which the different timing of inputs and the effects do not affect in a decisive way calculation of the profitability of the project,

- In the case of projects of small scale, when both the inputs and the effects are minor and do not affect the market position and the financial situation of the company implementing the investment project.

The most frequently mentioned and described static methods of investment projects evaluation include:

- The payback period

- Account of comparative costs

- Account of comparative profit

- Account of comparative profitability

- The average rate of return on investment

- Test of the first year

Advantages and disadvantages of static methods of project appraisal

Their advantages include:

- Simplicity.

- Ease of communication,

- accessibility for every manager,

- clear mathematical formula,

- ease of interpretation of the results.

Criticism of these methods include:

- Not taking into account the distribution of payments over time,

- Uncertainty as to obtain future revenues (they are only expected values).

- The cost of unused opportunities associated with generating future revenue,

- Not taking into account inflation, which reduce real incomes.

Dynamic methods of project appraisal

For evaluation of investment projects, more common is the tendency to use the dynamic methods.

- NPV - net present value

- IRR - Internal rate of return

- MIRR - Modified Internal Rate of Return

- Annuity method

- The profitability index

- NPVR - Indicator revised of net present value

See also:

References

- Copeland, T. E., Weston, J. F., & Shastri, K. (1983). Financial theory and corporate policy (Vol. 3). Reading, MA: Addison-Wesley.

- Dasgupta, P., Sen, A., & Marglin, S. (1972). Guidelines for project evaluation. In UNIDO. Project Formulation and Evaluation (Vol. 2). United Nations. UNIDO.

- Devarajan, S., Squire, L., & Suthiwart-Narueput, S. (1997). Beyond rate of return: reorienting project appraisal. The World Bank Research Observer, 12(1), 35-46.

- Frechtling, J. (2002). The 2002 User-Friendly Handbook for Project Evaluation.