Short call option: Difference between revisions

(LinkTitles) |

m (Text cleaning) |

||

| (7 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

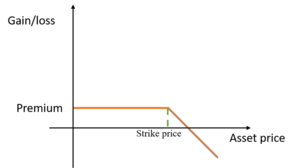

'''[[Short Call|Short call]] [[option]]''' is a type of option which is used when call seller predicts that underlying security i.e. asset [[price]] will drop down. Using other words investors sells [[Short Call|short call]] when i.e. asset price is relatively high, assuming that will be able to re-buy it for less [[money]] or simply wait until option call will expire. Maximum [[profit]] is equal to premium set by option seller. Potential lost in theory can be unlimited if i.e. price instead of going down will raise<ref>Danes S. J., (2014), p.5</ref>. | |||

'''[[Short Call|Short call]] option''' is a type of option which is used when call seller predicts that underlying security i.e. asset [[price]] will drop down. Using other words investors sells [[Short Call|short call]] when i.e. asset price is relatively high, assuming that will be able to re-buy it for less [[money]] or simply wait until option call will expire. Maximum [[profit]] is equal to premium set by option seller. Potential lost in theory can be unlimited if i.e. price instead of going down will raise<ref>Danes S. J., (2014), p.5</ref>. | |||

To find out more about [[options]] you can check out this [[Options|article]]. | To find out more about [[options]] you can check out this [[Options|article]]. | ||

==An example of short call option== | ==An example of short call option== | ||

[[Image:Wykres.png|300px|right|thumb|Fig. 1 Short call option]] | [[Image:Wykres.png|300px|right|thumb|Fig. 1 Short call option]] | ||

Investor predicts that there will be small price drop down of ABC [[company]] asset from $100 to $98. Knowing that Investor decide to release [[Short Call|short call]] option of 100 assets, premium [[cost]] is $100 (this will be his maximum profit). Assuming that investors prediction were correct he will have $100 of premium profit. If instead of price drop, asset ABC price will raise to $105 investor will loose $400<ref>Fabozzi F. J., (2004), p.34</ref>. Example formula | Investor predicts that there will be small price drop down of ABC [[company]] asset from $100 to $98. Knowing that Investor decide to release [[Short Call|short call]] option of 100 assets, premium [[cost]] is $100 (this will be his maximum profit). Assuming that investors prediction were correct he will have $100 of premium profit. If instead of price drop, asset ABC price will raise to $105 investor will loose $400<ref>Fabozzi F. J., (2004), p.34</ref>. Example formula will look as following: | ||

'''[($105-$100)*100as-100p]''' | '''[($105-$100)*100as-100p]''' | ||

| Line 28: | Line 12: | ||

* '''100p$''' - investors premium in dollars | * '''100p$''' - investors premium in dollars | ||

==Other types of options == | ==Other types of options== | ||

'''Long call option''' - this option is used to make profit when i.e. asset price raises. Main advantage of this type of option is that potential lost will be only limited to the premium price. If there will be big dropdown of the asset price investor will not exercise his right to buy. | '''Long call option''' - this option is used to make profit when i.e. asset price raises. Main advantage of this type of option is that potential lost will be only limited to the premium price. If there will be big dropdown of the asset price investor will not exercise his right to buy. | ||

'''[[Long put]] option''' - this option works in a similar way as long call. Main difference is that long put investor makes profit when i.e. asset price goes down. Similarly to long put potential lost is only limited to the premium price. | '''[[Long put]] option''' - this option works in a similar way as long call. Main difference is that long put investor makes profit when i.e. asset price goes down. Similarly to long put potential lost is only limited to the premium price. | ||

'''Short put option''' - using this option investor is selling sell option. Investor makes profit from premium when asset price is constant or when it slightly raises. Similarly to short call option profit is limited to premium but lost can be in theory unlimited<ref>Danes S. J., (2014), p.5</ref>. | '''Short put option''' - using this option investor is selling sell option. Investor makes profit from premium when asset price is constant or when it slightly raises. Similarly to [[Short Call|short call]] option profit is limited to premium but lost can be in theory unlimited<ref>Danes S. J., (2014), p.5</ref>. | ||

==Assumptions== | ==Assumptions== | ||

Short call options are used when investor predicts that price will not change or there will be small dropdown of underlying security i.e. asset price. From the issuer perspective potential lost can be unlimited therefore it is recommended to be used by experienced stock traders. | [[Short Call|Short call]] options are used when investor predicts that price will not change or there will be small dropdown of underlying security i.e. asset price. From the issuer perspective potential lost can be unlimited therefore it is recommended to be used by experienced stock traders. | ||

==Advantages of Short call option== | |||

Short call option is a [[strategy]] used when the investor believes that underlying asset's price will decline. It carries a number of advantages: | |||

* It allows for the possibility of earning the premium without having to purchase the underlying asset. | |||

* It limits the investor's [[risk]] to the premium price paid for the option. | |||

* It is relatively easy to execute and can be done in just a few clicks. | |||

* It is a flexible strategy, as it can be adjusted according to the investor's risk tolerance. | |||

* It can be used in combination with other strategies to maximize profits and diversify risk. | |||

==Limitations of Short call option== | |||

Short call option has some limitations which should be taken into consideration before deciding to sell it: | |||

* Unlimited risk - the risk of short call option is unlimited due to the fact that short call seller does not own the underlying asset, and the price of the asset can increase infinitely. | |||

* Time Decay - another limitation of short call option is the time decay, when the option approaches expiration, the option value decreases, which means that short call seller loses money. | |||

* Opportunity Cost - short call option has an opportunity cost, as the seller could invest the money received from selling the call option in other instruments and earn a higher return. | |||

==Other approaches related to Short call option== | |||

One possible approach related to Short call option is using synthetic short call which is combination of long put and short stock. The main objective of synthetic short call is to limit [[maximum potential]] loss. | |||

* Long Put - this is done to hedge against potential losses in case of unpredictable price movement. | |||

* Short Stock - this is to receive premium from the sale of stock. | |||

* Combination of the two - this is to ensure that the maximum potential loss is limited. | |||

In summary, synthetic short call is a way to minimize risk and limit potential loss in case of unexpected price movements. | |||

==Footnotes== | ==Footnotes== | ||

<references /> | <references /> | ||

{{infobox5|list1={{i5link|a=[[Selling Into Strength]]}} — {{i5link|a=[[Gamma hedging]]}} — {{i5link|a=[[Options]]}} — {{i5link|a=[[Long put]]}} — {{i5link|a=[[Long Hedge]]}} — {{i5link|a=[[Short Call]]}} — {{i5link|a=[[Bear spread]]}} — {{i5link|a=[[Short Straddle]]}} — {{i5link|a=[[Bunny Bond]]}} }} | |||

==References== | ==References== | ||

Latest revision as of 04:32, 18 November 2023

Short call option is a type of option which is used when call seller predicts that underlying security i.e. asset price will drop down. Using other words investors sells short call when i.e. asset price is relatively high, assuming that will be able to re-buy it for less money or simply wait until option call will expire. Maximum profit is equal to premium set by option seller. Potential lost in theory can be unlimited if i.e. price instead of going down will raise[1]. To find out more about options you can check out this article.

An example of short call option

Investor predicts that there will be small price drop down of ABC company asset from $100 to $98. Knowing that Investor decide to release short call option of 100 assets, premium cost is $100 (this will be his maximum profit). Assuming that investors prediction were correct he will have $100 of premium profit. If instead of price drop, asset ABC price will raise to $105 investor will loose $400[2]. Example formula will look as following:

[($105-$100)*100as-100p]

where:

- 100as - number of assets

- 100p$ - investors premium in dollars

Other types of options

Long call option - this option is used to make profit when i.e. asset price raises. Main advantage of this type of option is that potential lost will be only limited to the premium price. If there will be big dropdown of the asset price investor will not exercise his right to buy.

Long put option - this option works in a similar way as long call. Main difference is that long put investor makes profit when i.e. asset price goes down. Similarly to long put potential lost is only limited to the premium price.

Short put option - using this option investor is selling sell option. Investor makes profit from premium when asset price is constant or when it slightly raises. Similarly to short call option profit is limited to premium but lost can be in theory unlimited[3].

Assumptions

Short call options are used when investor predicts that price will not change or there will be small dropdown of underlying security i.e. asset price. From the issuer perspective potential lost can be unlimited therefore it is recommended to be used by experienced stock traders.

Advantages of Short call option

Short call option is a strategy used when the investor believes that underlying asset's price will decline. It carries a number of advantages:

- It allows for the possibility of earning the premium without having to purchase the underlying asset.

- It limits the investor's risk to the premium price paid for the option.

- It is relatively easy to execute and can be done in just a few clicks.

- It is a flexible strategy, as it can be adjusted according to the investor's risk tolerance.

- It can be used in combination with other strategies to maximize profits and diversify risk.

Limitations of Short call option

Short call option has some limitations which should be taken into consideration before deciding to sell it:

- Unlimited risk - the risk of short call option is unlimited due to the fact that short call seller does not own the underlying asset, and the price of the asset can increase infinitely.

- Time Decay - another limitation of short call option is the time decay, when the option approaches expiration, the option value decreases, which means that short call seller loses money.

- Opportunity Cost - short call option has an opportunity cost, as the seller could invest the money received from selling the call option in other instruments and earn a higher return.

One possible approach related to Short call option is using synthetic short call which is combination of long put and short stock. The main objective of synthetic short call is to limit maximum potential loss.

- Long Put - this is done to hedge against potential losses in case of unpredictable price movement.

- Short Stock - this is to receive premium from the sale of stock.

- Combination of the two - this is to ensure that the maximum potential loss is limited.

In summary, synthetic short call is a way to minimize risk and limit potential loss in case of unexpected price movements.

Footnotes

| Short call option — recommended articles |

| Selling Into Strength — Gamma hedging — Options — Long put — Long Hedge — Short Call — Bear spread — Short Straddle — Bunny Bond |

References

- Carter M. G., (2018) Options Trading: A Beginner's Guide to Make Money By Trading Options With Practical Strategies Ebook, 2018

- Danes S. J., (2014) Options Trading Stratgies: Complete Guide to Getting Started and Making Money with Stock Options Dylanna Publishing, 2014

- Duarte J., (2015) Trading Options For Dummies John Wiley & Sons, 2017

- Fabozzi F. J., (2004) Short Selling: Strategies, Risks, and Rewards John Wiley & Sons, 2004

- Kolb R. W., Overdahl J. A. (1997) Futures, options, and swaps Oxford-Blackwell, 1997

- Yates L., (2004) Performance Options Trading: Option Volatility and Pricing Strategies John Wiley & Sons, 2004

Author: Bartłomiej Olejniczak

.