Differential costing: Difference between revisions

(The LinkTitles extension automatically added links to existing pages (<a target="_blank" rel="noreferrer noopener" class="external free" href="https://github.com/bovender/LinkTitles">https://github.com/bovender/LinkTitles</a>).) |

m (Text cleaning) |

||

| (6 intermediate revisions by 3 users not shown) | |||

| Line 1: | Line 1: | ||

'''Differential costing''' refers to the [[cost calculation]] [[method]], which shows the cost difference resulting from different levels of activity, such as the cost of producing one thousand or ten thousand additional product units. | '''Differential costing''' refers to the [[cost calculation]] [[method]], which shows the cost difference resulting from different levels of activity, such as the cost of producing one thousand or ten thousand additional product units. | ||

The [[differential cost]] is the difference between the cost of two alternative decisions or a change in [[production]] levels. The concept is used when there are many possible [[options]] to do, and the selection must be made to select one option and drop the others. This concept can be particularly useful in situations related to staged costs, where the production of one additional production unit may require significant additional costs. | The [[differential cost]] is the difference between the cost of two alternative decisions or a change in [[production]] levels. The concept is used when there are many possible [[options]] to do, and the selection must be made to select one [[option]] and drop the others. This concept can be particularly useful in situations related to staged costs, where the production of one additional production unit may require significant additional costs. | ||

The differential cost is the same as the incremental cost and [[marginal cost]]. The difference in revenue resulting from two decisions is called differential income (S.Bragg 2017). | The differential cost is the same as the incremental cost and [[marginal cost]]. The difference in revenue resulting from two decisions is called differential income (S.Bragg 2017). | ||

| Line 49: | Line 33: | ||

Costs may be extracted due to (S.Akinyemi 2013, p.49): | Costs may be extracted due to (S.Akinyemi 2013, p.49): | ||

* Place of costs | * Place of costs | ||

* Business activity | * [[Business activity]] | ||

* The sphere of activity | * The sphere of activity | ||

* How to refer the costs to products | * How to refer the costs to products | ||

* The method of costs reacting to changes in production volume | * The method of costs reacting to changes in production volume | ||

* Division due to the possibility of control by the centers of responsibility managers | * Division due to the possibility of control by the centers of responsibility managers | ||

* Classification due to the importance of costs when making economic decisions | * [[Classification]] due to the importance of costs when making economic decisions | ||

* Production costs | * Production costs | ||

* Direct costs | * Direct costs | ||

* Indirect costs | * Indirect costs | ||

==Advantages of Differential costing== | |||

Differential costing is a useful method for analyzing changes in cost due to changes in output levels. It can provide a clearer understanding of the cost drivers behind the changes in costs, which can help businesses make better decisions. The following are some of the advantages of differential costing: | |||

* It helps to identify [[fixed costs]] and variable costs, allowing firms to better understand their [[cost structure]] and make more informed decisions. | |||

* It can be used to analyze costs on a per unit basis, which can help firms to better understand their cost [[efficiency]]. | |||

* It can be used to identify the [[marginal cost of producing]] additional units and can be used to assess the cost effectiveness of different production techniques. | |||

* It can help to identify areas where costs can be reduced and help firms to become more cost-effective. | |||

* It can be used to compare costs between different production and business processes, allowing firms to make more informed decisions. | |||

==Limitations of Differential costing== | |||

Differential costing has a number of limitations that should be taken into consideration when deciding whether to use it or not. These include: | |||

* Differential costing does not take into account the costs that are fixed and cannot be changed, such as rent, utilities and [[insurance]] costs. | |||

* Differential costing does not consider the long-term costs associated with changes in production, such as the cost of purchasing new machinery or retraining staff. | |||

* Differential costing is not suitable for decision-making in the long-term, as it does not take into account future [[market]] conditions or other potential changes in the business [[environment]]. | |||

* Differential costing is often based on assumptions, which can lead to inaccurate cost calculations. | |||

* Differential costing can be time consuming and costly to implement. | |||

==Other approaches related to Differential costing== | |||

Differential costing is related to other cost calculation methods, such as: | |||

* '''Marginal Costing''': This approach focuses on calculating the cost of producing additional products, which is then compared to the cost of producing the base level of production. | |||

* '''Activity-based Costing (ABC)''': This approach looks at the cost of activities that [[need]] to be completed to produce a product. It is used to determine the cost of a product by allocating the cost of activities based on their usage. | |||

* '''[[Process]] Costing''': This method is used to calculate the total cost of producing a specific number of products. The cost is calculated by combining the costs of materials, labor, and overhead. | |||

* '''[[Standard]] Costing''': This method is used to compare the [[actual cost]] of producing a product with the standard cost of producing the product. It is used to identify cost variances and take [[corrective actions]]. | |||

In summary, Differential costing is a cost calculation method that shows the cost difference resulting from different levels of activity, and is related to other cost calculation methods such as marginal costing, activity-based costing, [[process costing]], and standard costing. | |||

{{infobox5|list1={{i5link|a=[[Step cost]]}} — {{i5link|a=[[Differential cost]]}} — {{i5link|a=[[Cost behavior]]}} — {{i5link|a=[[Step fixed cost]]}} — {{i5link|a=[[Allocated cost]]}} — {{i5link|a=[[Absorbed costs]]}} — {{i5link|a=[[Irrelevant cost]]}} — {{i5link|a=[[Cost per unit]]}} — {{i5link|a=[[Segment margin]]}} }} | |||

==References== | ==References== | ||

* Alchian A., Demsetz H., (1972), ''The American Economic Review'', "Production, [[Information]] Costs, and Economic [[Organization]] ", Vol. 62, No. 5, p. 777-795. | * Alchian A., Demsetz H., (1972), ''The American Economic Review'', "Production, [[Information]] Costs, and Economic [[Organization]] ", Vol. 62, No. 5, p. 777-795. | ||

* Akinyemi S., (2013), ''The [[economics]] of [[education]]'', | * Akinyemi S., (2013), ''The [[economics]] of [[education]]'', Strategic Book Publishing & Rights Agency, p. 2-76. | ||

* ''Bloomsbury Business Library - Business & Management Dictionary'', (2007), A & C Black Publishers, p. 2391-2391. | * ''Bloomsbury Business Library - Business & Management Dictionary'', (2007), A & C Black Publishers, p. 2391-2391. | ||

* Bragg S., (2017), ''Differential cost''. | * Bragg S., (2017), ''Differential cost''. | ||

* Jensen M., (1986), [https://www.jstor.org/stable/1818789?seq=1#page_scan_tab_contents , ''The american economic review''], | * Jensen M., (1986), [https://www.jstor.org/stable/1818789?seq=1#page_scan_tab_contents , ''The american economic review''], vol. 76, issue 2, p. 323-29. | ||

* Miyata E., (1979), [https://www.nrs.fs.fed.us/pubs/gtr/gtr_nc055.pdf , ''Derminating fixed and | * Miyata E., (1979), [https://www.nrs.fs.fed.us/pubs/gtr/gtr_nc055.pdf , ''Derminating fixed and operating costs of jogging equipment, general technical''], General Technical Report NC-55. St. Paul, p. 3-14. | ||

* Rajasekaran V, Lalitha R., (2011), ''Cost accounting'', Pearson Education. | * Rajasekaran V, Lalitha R., (2011), ''Cost accounting'', Pearson Education. | ||

* Russel D, Patel A, Wilkinson-Riddle G., (2002), ''Cost accounting an Essentials guide'' , Prentice Hall | * Russel D, Patel A, Wilkinson-Riddle G., (2002), ''Cost accounting an Essentials guide'' , Prentice Hall | ||

Latest revision as of 20:09, 17 November 2023

Differential costing refers to the cost calculation method, which shows the cost difference resulting from different levels of activity, such as the cost of producing one thousand or ten thousand additional product units.

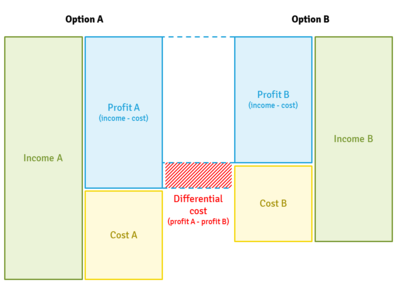

The differential cost is the difference between the cost of two alternative decisions or a change in production levels. The concept is used when there are many possible options to do, and the selection must be made to select one option and drop the others. This concept can be particularly useful in situations related to staged costs, where the production of one additional production unit may require significant additional costs.

The differential cost is the same as the incremental cost and marginal cost. The difference in revenue resulting from two decisions is called differential income (S.Bragg 2017).

Cost - this is a concept understood as an economic category and the value of work which was expressed in the money and resources of the enterprises consumed, at a certain time in order to produce a product (A.Alchian, H.Demsetz 1972, p.777).

Differential cost examples

Here are two examples of main cases of differential costing (S.Bragg 2017):

- An example of alternative decisions:

If you decide to run a fully automated operation that produces 100,000 widgets annually at a cost of $ 1,200,000, or using direct manpower to manually produce the same number of widgets for $ 1,400,000, the differential cost between the two alternatives is US$200,000.

- An example of changing the output:

The work center can produce 10,000 widgets for $ 29,000 or 15,000 widgets for $ 40,000. The differential cost of an additional 5,000 widgets is $ 11,000.

Treatment of Differential cost

The differential cost can be a fixed cost, variable cost or a combination of both. The company's management uses a variety of costs to choose between options to make real decisions that have a positive impact on the company. Therefore, an accounting entry for this cost is not required because it is not an actual transaction. In addition, there are no accounting standards that define the treatment of differential costs (What is Differential Cost?, 2015).

Differential cost applications

Managers use the differential cost as follows (What is Differential Cost?, 2015):

- Define the most profitable level of price and production.

- Offer a quotation at a lower sale price to increase throughput.

Differential cost vs. Incremental cost

These terms can be used interchangeably. The terms mean the same: the cost difference between the two alternatives.

For example, if a company determines that the annual labor cost of US$80,000 machine hours was US$4,000,000, while the annual labor cost of US$70,000 machine hours was US$3,800,000. Then the differential cost or additional cost of an additional US$10,000 machine hours amounted to US$200,000.

The term marginal cost refers to the cost of operation for one additional hour of the machine (What is Differential Cost?, 2015).

Cost type

Costs may be extracted due to (S.Akinyemi 2013, p.49):

- Place of costs

- Business activity

- The sphere of activity

- How to refer the costs to products

- The method of costs reacting to changes in production volume

- Division due to the possibility of control by the centers of responsibility managers

- Classification due to the importance of costs when making economic decisions

- Production costs

- Direct costs

- Indirect costs

Advantages of Differential costing

Differential costing is a useful method for analyzing changes in cost due to changes in output levels. It can provide a clearer understanding of the cost drivers behind the changes in costs, which can help businesses make better decisions. The following are some of the advantages of differential costing:

- It helps to identify fixed costs and variable costs, allowing firms to better understand their cost structure and make more informed decisions.

- It can be used to analyze costs on a per unit basis, which can help firms to better understand their cost efficiency.

- It can be used to identify the marginal cost of producing additional units and can be used to assess the cost effectiveness of different production techniques.

- It can help to identify areas where costs can be reduced and help firms to become more cost-effective.

- It can be used to compare costs between different production and business processes, allowing firms to make more informed decisions.

Limitations of Differential costing

Differential costing has a number of limitations that should be taken into consideration when deciding whether to use it or not. These include:

- Differential costing does not take into account the costs that are fixed and cannot be changed, such as rent, utilities and insurance costs.

- Differential costing does not consider the long-term costs associated with changes in production, such as the cost of purchasing new machinery or retraining staff.

- Differential costing is not suitable for decision-making in the long-term, as it does not take into account future market conditions or other potential changes in the business environment.

- Differential costing is often based on assumptions, which can lead to inaccurate cost calculations.

- Differential costing can be time consuming and costly to implement.

Differential costing is related to other cost calculation methods, such as:

- Marginal Costing: This approach focuses on calculating the cost of producing additional products, which is then compared to the cost of producing the base level of production.

- Activity-based Costing (ABC): This approach looks at the cost of activities that need to be completed to produce a product. It is used to determine the cost of a product by allocating the cost of activities based on their usage.

- Process Costing: This method is used to calculate the total cost of producing a specific number of products. The cost is calculated by combining the costs of materials, labor, and overhead.

- Standard Costing: This method is used to compare the actual cost of producing a product with the standard cost of producing the product. It is used to identify cost variances and take corrective actions.

In summary, Differential costing is a cost calculation method that shows the cost difference resulting from different levels of activity, and is related to other cost calculation methods such as marginal costing, activity-based costing, process costing, and standard costing.

| Differential costing — recommended articles |

| Step cost — Differential cost — Cost behavior — Step fixed cost — Allocated cost — Absorbed costs — Irrelevant cost — Cost per unit — Segment margin |

References

- Alchian A., Demsetz H., (1972), The American Economic Review, "Production, Information Costs, and Economic Organization ", Vol. 62, No. 5, p. 777-795.

- Akinyemi S., (2013), The economics of education, Strategic Book Publishing & Rights Agency, p. 2-76.

- Bloomsbury Business Library - Business & Management Dictionary, (2007), A & C Black Publishers, p. 2391-2391.

- Bragg S., (2017), Differential cost.

- Jensen M., (1986), , The american economic review, vol. 76, issue 2, p. 323-29.

- Miyata E., (1979), , Derminating fixed and operating costs of jogging equipment, general technical, General Technical Report NC-55. St. Paul, p. 3-14.

- Rajasekaran V, Lalitha R., (2011), Cost accounting, Pearson Education.

- Russel D, Patel A, Wilkinson-Riddle G., (2002), Cost accounting an Essentials guide , Prentice Hall

- Sen A. (2018), , The political economy of targeting, "Theory and method", p. 2-14.

- What is Differential Cost?, (2015), "Financial Modeling and Valuation Analyst".

Author: Joanna Krygowska

.