McKinsey matrix: Difference between revisions

(The LinkTitles extension automatically added links to existing pages (<a target="_blank" rel="noreferrer noopener" class="external free" href="https://github.com/bovender/LinkTitles">https://github.com/bovender/LinkTitles</a>).) |

m (Infobox update) |

||

| Line 2: | Line 2: | ||

|list1= | |list1= | ||

<ul> | <ul> | ||

<li>[[ | <li>[[ADL matrix]]</li> | ||

<li>[[ | <li>[[Evaluation of sector's attractiveness]]</li> | ||

<li>[[Method of calculating the BCG matrix]]</li> | |||

<li>[[SPACE method]]</li> | <li>[[SPACE method]]</li> | ||

<li>[[Hofer matrix]]</li> | <li>[[Hofer matrix]]</li> | ||

<li>[[ | <li>[[BCG growth-share matrix]]</li> | ||

<li>[[ | <li>[[TOWS analysis]]</li> | ||

<li>[[ | <li>[[Ansoff strategy model]]</li> | ||

<li>[[ | <li>[[IFE matrix]]</li> | ||

</ul> | </ul> | ||

}} | }} | ||

Revision as of 23:30, 19 March 2023

| McKinsey matrix |

|---|

| See also |

McKinsey matrix (other names: matrix of product attractiveness, market attractiveness matrix, GE matrix) dates back to the seventies. Is used to determine the success factors of the company in the form of industry attractiveness and competitive position within the industry.

Assumptions used for creating McKinsey/GE matrix

The main assumptions of the McKinsey matrix structure:

- company should operate in the sector more attractive, while eliminating the products from the less attractive,

- company should invest in products with a strong competitive position, and withdraw from those in which its competitive position is weak.

The method is also called McKinsey nine-field analysis (9W analysis) of the company's production portfolio. This matrix consists of two variables:

- attractiveness of the industry,

- assessment of the competitive position and financial strength of the company.

Stages of evaluation of attractiveness of the industry

- Identification of criteria for the attractiveness of the industry and the market size.

- Weighing of ratings (sum of the weights of all criteria is 1).

- Evaluation of each industry on scale from 1 to 5 meaning: 1-unattractive, 5-industry very attractive.

- Interpretation of the final result of the attractiveness evaluation.

Stages of evaluation of competitive position

Assessment of the competitive position of the company has following stages:

- Identification of the factors of success of the company.

- Weighting of relative factor importance.

- Evaluation of competitiveness on scale from 1 to 5 meaning: 1-weak competitive position, 5-strong position.

- Interpretation of the estimated ratings.

Principles for GE/McKinsey matrix interpretation

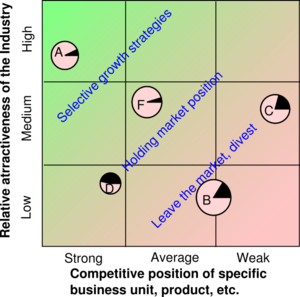

On the Y axis, which determines the level of attractiveness, we denote the attractiveness of each of the industries. X-axis mark strategic positions of the company. The intersection of the two dimensions determine the point, which is the centre of a circle, meaning the company position (fig. 1.).

Circle size is dependent on the size of the production. Inside the circle segments are drawn, which determine the size of the market share of the product. The distribution of products in the matrix informs us about the strategy that should be used.

Advantages and disadvantages of GE/McKinsey matrix

Advantages:

- flexibility in assessing the attractiveness of the industry,

- greater possibility of balancing a portfolio of production.

Disadvantages:

- subjective criteria for evaluation (assessment is more focused on the present and not the future competitive position of the company).

Examples of McKinsey matrix

- The first example of a McKinsey matrix is a nine-box grid, also known as a BCG matrix. This matrix consists of two main criteria, industry attractiveness and competitive position. The attractiveness is determined by factors such as industry size, growth prospects, competitive intensity, and profitability. The competitive position is based on market share, competitive advantage, and competitive intensity. This matrix is used to identify which businesses are best suited for growth and which should be divested.

- The second example of a McKinsey matrix is the Ansoff matrix. This matrix looks at four different strategies for growth: market penetration, product development, market development, and diversification. Each strategy is evaluated in terms of risk and reward to determine which approach is the most suitable for a particular company.

- The third example of a McKinsey matrix is the five forces model. This model looks at five different sources of competition in the marketplace: buyers, suppliers, substitute products, potential entrants, and the industry rivalry. The model is used to assess the competitive environment and the potential profitability of a particular business.

One-sentence introduction: Here is a list of other approaches related to McKinsey matrix:

- Boston Consulting Group (BCG) matrix - a popular portfolio management tool used for product portfolio planning and analysis, which classifies products into four categories based on their market growth rate and relative market share.

- Ansoff Matrix - a strategic planning tool used to analyze and plan for a company’s growth by focusing on existing and new products, existing and new markets.

- Porter's Five Forces Model - a framework used to analyze a company's competitive environment, which identifies five forces that affect the company's ability to compete in the market.

- SWOT Analysis - a tool used to identify an organization's strengths, weaknesses, opportunities and threats.

Summary: The approaches related to McKinsey matrix include Boston Consulting Group (BCG) matrix, Ansoff Matrix, Porter's Five Forces Model and SWOT Analysis, which are used to analyze a company's competitive environment, identify its strengths and weaknesses, and plan for its growth.

References

- Amatulli, Cesare, Tiziana Caputo, and Gianluigi Guido. Strategic analysis through the general electric/McKinsey Matrix: An application to the Italian fashion industry, International Journal of Business and Management 6.5 (2011): 61.

- Luthwig, M. (2015). A Multi-model tool for subsidiary management to measure market attractiveness, subsidiary strength, exploration, and exploitation.

- Proctor, R. A., & Kitchen, P. J. (1990). Strategic planning: An overview of product portfolio models. Marketing Intelligence & Planning, 8(7), 4-10.