BCG growth-share matrix

| BCG growth-share matrix |

|---|

| See also |

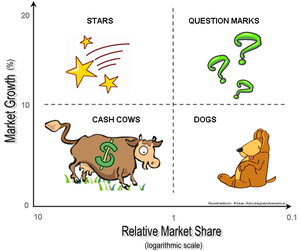

BCG Growth-Share Matrix (also known as BCG model, Boston matrix, BCG matrix, BCG analysis, or Boston Box) was developed by Bruce Henderson in the early 1970s for Boston Consulting Group, world known management consulting company. The Boston Consulting Group matrix presents different business units or major product lines based on their relative market share and the growth rate of the market. The model is useful in brand marketing, strategic management and production management and business portfolio analysis.

After using method of calculating the BCG matrix two main variables are placed along the axes (Fig. 1) describing bcg portfolio:

Market growth - Y axis

Market growth is represented by the vertical axis. The axis is divided into two segments: more and less than 10 percent growth per year. A market growth above 10 percent is considered high Therefore, this variable symbolizes the attractiveness of the market.

Relative market share is represented by the horizontal axis. It is company's market share divided by the share of its biggest competitor. Relative market share serves as a measure of the company's strength in the relevant market segment.

The limiting value is at 1: a value greater than 1 implies that a company has the largest relative market share and therefore is the market leader. A relative market share of 0.1 means that the company's sales volume is only 10 percent of the leader's sales volume; a relative share of 10 means that the company's strategic business unit (SBU) is the leader and has 10 times the sales of the next-strongest competitor in that market. The highest value typically is defined on the left, and the lowest on the right.

In portfolio matrix four types of products can be distinguished, depending on the placement of a product-market combination in one of the four quadrants:

Stars

These are products with a high market share in a strongly growing market. The cash resources used for and the cash resources required by these products are both high and therefore in principle are in balance. After some time all growth slows. This is the reason, why stars become finally Cash Cows if they keep their market share. If they will not be able to hold the market share, they will become Dogs.

Cash Cow

These are products with a high market share in a market that is not growing very much. As a result of the strong market position, they produce many cash resources, and they require few investments because of the limited market growth.

Question Marks

These products (also called Problem Children or Wild Cats) have a small market share in a rapidly growing market. As the name indicates, they have unsure and questionable situation and can create problems: they produce little but require a lot of cash resources. If they are able to strengthen their position, they can become stars and over time, when market growth decreases, cash cows.

Dogs

These are products with a low market share in a market that is growing very little. Therefore, they produce little but also require few investments. That means that the cash resources used for and the cash resources required by these products are both low and for that reason are in balance. Dogs are worthless cash traps, they do not bring sufficient profits for a company.

Strategic recommendations based on product portfolio matrix

Based on the BCG analysis and above described product market matrix, company has to decide what objective, strategy, and budget should be assigned to each SBU. Several general investment strategies may be recommended.

Growth (Build) - strategy

For some Question Marks a company may use a growth strategy financed by Cash Cows

The part of the Cash Cows' revenues would strengthen the positions of Question Marks that have the potential to become Stars. In that case, a company increases its market share substantially.

Maintain position (Hold) - strategy

The strong positions of the Stars and the Cash Cows should be maintained.

Also, if the Dogs have a sound size, they may be an important part of a company's activities. In that case, a maintenance strategy appears also to be promising.

Harvest or milk - strategy

The main aim of this strategy is to rise short-term cash flow despite the long-term consequences. Harvesting implies a decision of getting out of a business by executing a program of constant cost cutting. Companies use this strategy when they expect to reduce their cost at faster rate than potential fall in sales. This strategy is suitable for weak Cash Cows, Question Marks and Dogs. The recommendation for the Dogs is to milk them and remove them from the market.

Liquidation (Terminate, Divest) - strategy

If a company runs a weak business, it should consider weather to harvest or divest its business units. The decision of liquidation gives a company the opportunity to reinvest its resources in a more prosperous business. This strategy is appropriate for the Dogs and the rest of the Question Marks, which are not financed by the Cash Cows.

See also:

- The first example of the BCG growth-share matrix is the classic four-quadrant model. In this model, business units are divided into four categories - stars, cash cows, question marks, and dogs. Stars are business units that have a high market share in a fast-growing market, and these business units typically require large investments of resources. Cash cows are business units with a high market share in a low-growth market, and these business units generate a steady cash flow. Question marks are business units with a low market share in a fast-growing market, and these business units require large investments of resources in order to capture and maintain market share. Dogs are business units with low market share and low growth, and these business units typically do not require a large investment of resources.

- Another example of the BCG growth-share matrix is the three-dimensional model. In this model, business units are divided into three categories - stars, cash cows, and problem children. Stars are business units with a high market share in a fast-growing market, and they typically require large investments of resources. Cash cows are business units with a high market share in a low-growth market, and they generate a steady cash flow. Problem children are business units with a low market share in a slow-growing market, and these business units require large investments of resources in order to capture and maintain market share.

One of the advantages of BCG Growth-Share Matrix is that it provides a simple visual representation of a company's business portfolio. Specifically, it allows users to quickly identify the relative position of each business unit or product line in terms of both its market share and the market's growth rate. This can help with strategic decision-making, as it allows managers to easily prioritize the allocation of resources to the most attractive business opportunities. Additionally, the BCG Matrix is useful for comparing the performance of business units on two different dimensions. This can be a helpful tool for portfolio management, as it helps to identify which businesses should be invested in, divested from, or maintained. Furthermore, the BCG Matrix is relatively simple to interpret and has been in use for many years, so it is a familiar approach to most business leaders. Finally, the BCG Matrix can be used to identify areas of potential improvement and develop strategies for growth.

The BCG growth-share matrix has several limitations. These include:

- It does not account for the differences between products, services, and markets. It assumes that all products, services, and markets are the same, which is not necessarily true.

- It does not take into consideration the size of the organization or the resources available to it.

- It does not account for the financial and non-financial costs associated with each business unit.

- It assumes that each business unit has the same potential for growth and share in the market, which is not necessarily true.

- It does not take into consideration the competitive environment and other external factors such as government regulations.

- It does not consider the time frame involved in each business unit's growth or the effect of long-term changes in the market.

- It does not account for the quality of the products or services offered by each business unit.

- It does not account for the changing dynamics of the market, such as the emergence of new technologies and disruptive business models.

An introduction to the list:

The BCG growth-share matrix is one of several approaches related to business portfolio analysis. Here are some of the other approaches related to BCG growth-share matrix:

- The Ansoff Matrix: This matrix is used to determine the risk associated with a product or market growth strategy. It is based on four possible combinations of current and potential products and markets.

- The McKinsey 7S Framework: This framework looks at the ways in which seven elements of an organization interact in order to determine the most effective way to implement a change or strategy. The seven elements are strategy, structure, systems, skills, style, staff and shared values.

- The GE/McKinsey Matrix: This matrix is used to analyze a company’s business portfolio and helps to determine which businesses are most likely to be profitable. It looks at the industry attractiveness and the competitive strength of each business.

- The Balanced Scorecard: This is a performance management tool used to measure and monitor an organization’s progress towards its goals. It looks at both financial and non-financial measures.

In summary, the BCG growth-share matrix is one of several approaches related to business portfolio analysis. Other approaches include the Ansoff Matrix, the McKinsey 7S Framework, the GE/McKinsey Matrix and the Balanced Scorecard. Each approach has its own strengths and weaknesses and can be used to analyze different aspects of a company’s performance.

References

- Alsem K.J., (2007), Strategic Marketing: An Applied Perspective, New York, N.Y.: McGraw-Hill

- Allan, G. B., & Hammond, J. S. (1975). A note on the Boston Consulting Group concept of competitive analysis and corporate strategy. Harvard Business School Case Services.

- Calandro Jr, J., & Lane, S. (2007). A new competitive analysis tool: the relative profitability and growth matrix, Strategy & Leadership, 35(2), pp. 30-38

- Day, G. S. (1977). iagnosing the product portfolio. The Journal of Marketing, 29-38.

- Hambrick, D. C., MacMillan, I. C., & Day, D. L. (1982). Strategic Attributes and Performance in the BCG Matrix—A PIMS-Based Analysis of Industrial Product Businesses. Academy of Management Journal, 25(3), 510-531.

- Henderson, B. (1979), Henderson on Corporate Strategy, Abt Books

- Ioana, A., Mirea, V., & Bălescu, C. (2009), Analysis of service quality management in the materials industry using the bcg matrix method. Amfiteatru Economic Review, 11(26), pp. 270-276

- Kotler P., (2000), Marketing Management, Prentice Hall, Millennium Edition

- Koch, S., & Stix, V. (2008, July). Open Source Project Categorization Based on Growth Rate Analysis and Portfolio Planning Methods, In OSS, pp. 375-380

- Stern, C. W., & Deimler, M. S. (Eds.). (2012). The Boston consulting group on strategy: Classic concepts and new perspectives. John Wiley & Sons

- Stern, C.W. and Stalk, G. Jr (eds) (2006), Perspectives on Strategy: From the Boston Consulting Group, John Wiley & Sons, 1998; 2nd edn, Stern, C.W. and Deimler, M. (eds), The Boston Consulting Group on Strategy

- Boston Consulting Group website.

Author: Ewa Szczepankiewicz