Economic feasibility: Difference between revisions

No edit summary |

m (Text cleaning) |

||

| (7 intermediate revisions by 3 users not shown) | |||

| Line 1: | Line 1: | ||

'''Economic feasibility''' refers to the ability of a project or business venture to generate enough revenue to cover its costs and provide a reasonable return on [[investment]]. It involves analyzing the costs and benefits of a project, including the costs of materials, labor, and equipment, as well as the projected revenue from sales or other sources of income. Economic feasibility is an important consideration when determining whether a project or venture should be undertaken, and it is often used in conjunction with other types of [[feasibility analysis]], such as technical feasibility and operational feasibility. | |||

==Example of economic feasibility== | |||

An example of an economic feasibility assessment would be a company considering launching a new product line. The company would conduct an analysis to determine the costs of developing and producing the new products, as well as the projected revenue from sales. They would also consider factors such as the size of the market for the new products, the level of [[competition]], and the target audience. | |||

The company would use this information to make a decision about whether to launch the new product line. They would evaluate the costs of the project and compare them to the projected revenue to determine whether the project is economically feasible. They would also consider other factors such as the potential risks and challenges, the overall [[market conditions]], and the company's ability to launch the new product line. | |||

'''Economic feasibility''' is a kind of [[cost]]-benefit analysis of the examined [[project]], which assesses whether it is possible to implement it. | If the company determines that the new product line is economically feasible, they would proceed with the launch. However, if the analysis indicates that the project is not economically feasible, the company would likely decide not to proceed with the launch. | ||

This term means the assessment and analysis of a project's potential to support the decision-making [[process]] by objectively and rationally identifying its strengths, weaknesses, opportunities and risks associated with it, the resources that will be needed to implement the project, and an assessment of its chances of success. | |||

This example is a simplified one, In real-world scenarios, it would involve more detailed analysis and considerations, but it illustrates the main concept of economic feasibility assessment, which is evaluating the costs and benefits of a project or venture to determine whether it is economically viable. | |||

==Elements of economic feasibility assessment== | |||

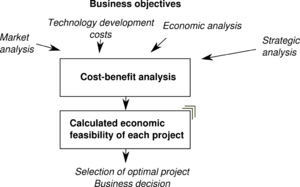

'''Economic feasibility''' is a kind of [[cost]]-benefit analysis of the examined [[project]], which assesses whether it is possible to implement it. This term means the assessment and analysis of a project's potential to support the decision-making [[process]] by objectively and rationally identifying its strengths, weaknesses, opportunities and risks associated with it, the resources that will be needed to implement the project, and an assessment of its chances of success. | |||

It consists of '''[[market]] analysis''', '''economic analysis''', '''technical and [[strategic analysis]]'''. | It consists of '''[[market]] analysis''', '''economic analysis''', '''technical and [[strategic analysis]]'''. | ||

==Market analysis== | ==Market analysis== | ||

'''Market analysis''' | '''Market analysis''' plays an important role in the [[evaluation]] of economic feasibility of a project or business venture. It involves gathering and analyzing data about the market in which the project or venture will operate, including information about the size and growth of the market, the current and projected demand for the product or [[service]], the competitive landscape, and the target audience. | ||

This information can be used to make more informed decisions about the project or venture, including decisions about pricing, marketing, and distribution. For example, a market analysis might reveal that there is high demand for a particular product or service, which would make it more economically feasible to launch the project or venture. Similarly, a market analysis might reveal that there is a large and growing market for a product or service, which would make it more likely that the project or venture would generate enough revenue to cover its costs and provide a reasonable [[return on investment]]. | |||

Market analysis also helps to identify potential risks and challenges that may impact the economic feasibility of a project or venture, such as intense competition, regulatory changes, or changes in consumer [[behavior]]. By identifying these risks and challenges early on, decision-makers can take steps to mitigate them, thereby increasing the chances of success for the project or venture. | |||

In summary, market analysis is an essential tool for evaluating the economic feasibility of a project or business venture as it provides a comprehensive understanding of the market behavior and trends, enabling to make rational decisions, and assessing potential risks and opportunities. | |||

==Economic analysis== | ==Economic analysis== | ||

| Line 27: | Line 27: | ||

'''Economic analysis''' is a [[method]] of studying economic processes, which consists in considering the relationships between the various elements of these processes. | '''Economic analysis''' is a [[method]] of studying economic processes, which consists in considering the relationships between the various elements of these processes. | ||

It can be used both to study economic phenomena and processes occurring on a scale of the whole economy ('''macroeconomic analysis'''), as well as phenomena and processes occurring within particular economic units and institutions ('''microeconomic analysis'''). Economic analysis makes it possible to make diagnoses, facilitates [[decision making]], as well as facilitates rationalization of economic processes, both on a macro- and microeconomic scale. In economic analysis, mathematical methods are widely applied (e.g. marginal calculus and [[linear programming]]). Analysis is a way of scientific procedure, ordering and dividing the whole into components. The aim of the analysis is to examine the structure of the whole, to get to know the mechanism of connections between the components. | It can be used both to study economic phenomena and processes occurring on a scale of the whole economy ('''macroeconomic analysis'''), as well as phenomena and processes occurring within particular economic units and institutions ('''microeconomic analysis'''). Economic analysis makes it possible to make diagnoses, facilitates [[decision making]], as well as facilitates rationalization of economic processes, both on a macro - and microeconomic scale. In economic analysis, mathematical methods are widely applied (e.g. marginal calculus and [[linear programming]]). Analysis is a way of scientific procedure, ordering and dividing the whole into components. The aim of the analysis is to examine the structure of the whole, to get to know the mechanism of connections between the components. | ||

Activities related to the assessment of the [[company]]'s activity are the subject of economic analysis. In the conditions of changing [[environment]], technological and scientific development, making decisions concerning [[enterprise]] [[management]] requires fast and reliable [[information]]. Therefore, economic analysis and the financial analysis included in it have become particularly important. The economic analysis covers all economic phenomena occurring within the company and in its surroundings. Investigating factors involves dividing economic phenomena and processes into constituent elements, determining the causal-impact relationship between the elements, and drawing conclusions from the assessment. | Activities related to the assessment of the [[company]]'s activity are the subject of economic analysis. In the conditions of changing [[environment]], technological and scientific development, making decisions concerning [[enterprise]] [[management]] requires fast and reliable [[information]]. Therefore, economic analysis and the financial analysis included in it have become particularly important. The economic analysis covers all economic phenomena occurring within the company and in its surroundings. Investigating factors involves dividing economic phenomena and processes into constituent elements, determining the causal-impact relationship between the elements, and drawing conclusions from the assessment. | ||

==Technical analysis== | ==Technical analysis== | ||

'''[[Technical analysis]]''' | '''[[Technical analysis]]''' can be used as a tool to evaluate the economic feasibility of a project or business venture, particularly in the context of financial markets. The techniques of technical analysis are based on the analysis of historical [[price]] data, and the goal is to use this information to predict future price movements and make investment decisions. Technical analysis can be used to evaluate the economic feasibility of a project or venture by assessing the potential return on investment and the [[level of risk]] associated with the investment. | ||

For example, if the technical analysis of a stock or commodity suggests that its price is likely to increase in the future, it may be considered economically feasible to invest in that stock or commodity. Conversely, if the technical analysis suggests that the price is likely to decrease, it may be considered less economically feasible to invest in that stock or commodity. | |||

In addition to evaluating the economic feasibility of a specific investment, technical analysis can also be used to evaluate the overall economic feasibility of a project or venture by assessing the current and projected market conditions for the [[industry]] or sector in which the project or venture will operate. For example, if technical analysis suggests that a specific industry or sector is likely to experience growth in the future, it may be considered more economically feasible to launch a project or venture in that industry or sector. | |||

It's worth mentioning that Technical analysis is just one of the methods used for [[forecasting]] future prices, it is not always accurate and should not be used in isolation to evaluate the economic feasibility of a project or business venture. It should be combined with other methods of analysis such as [[fundamental analysis]], market analysis and economic analysis to have a comprehensive evaluation<ref> J. Matson (2000),s. 4-7</ref>. | |||

==Strategic analysis== | ==Strategic analysis== | ||

| Line 41: | Line 47: | ||

The final stage of strategic analysis is to define and evaluate the [[strategic position]] of the company. Strategic analysis gives us an answer to the question: in what conditions the company will operate in the future and what possibilities it has to adapt to them. | The final stage of strategic analysis is to define and evaluate the [[strategic position]] of the company. Strategic analysis gives us an answer to the question: in what conditions the company will operate in the future and what possibilities it has to adapt to them. | ||

== | ==Benefits of economic feasibility assessment== | ||

The benefits of conducting an economic feasibility assessment include: | |||

* '''Identifying potential risks and challenges''': Economic feasibility assessment helps to identify potential risks and challenges that may impact the success of a project or venture, such as changes in the market, intense competition, or regulatory changes. By identifying these risks and challenges early on, decision-makers can take steps to mitigate them, thereby increasing the chances of success for the project or venture. | |||

* '''Making informed decisions''': Economic feasibility assessment provides decision-makers with the information they [[need]] to make informed decisions about a project or venture. By analyzing the costs and [[benefits of the project]] or venture, decision-makers can determine whether it is likely to be economically viable and whether it is worth investing in. | |||

* '''Optimizing resources''': Economic feasibility assessment helps to optimize the use of resources by identifying the most cost-effective way to implement a project or venture. By analyzing the costs and benefits of different [[options]], decision-makers can choose the one that is most likely to generate the greatest return on investment. | |||

* '''Enhancing [[stakeholder]]'s confidence''': Economic feasibility assessment provides [[stakeholders]] with the information they need to understand the potential return on investment, which can help to enhance their confidence in the project or venture. | |||

* '''Identifying opportunities for improvement''': Economic feasibility assessment can identify opportunities for improvement in the project or venture, such as reducing costs, increasing revenue, or finding new markets. | |||

In summary, economic feasibility assessment is an essential step in the decision-making process for any project or business venture, it helps to identify potential risks and challenges, make informed decisions, optimize resources, enhance stakeholders' confidence and identify opportunities for improvement. | |||

Marketing deals with the study of generated ideas about the [[needs]] of consumers, which are perceived in the first stage of the process of creating new concepts of services or alternative products. The promising concepts are subject to feasibility studies, which include several types of analyses, starting with market analysis<ref> M. Berrie (2008),s. 3-8</ref>. Most companies have a team of market analysts who create and evaluate [[consumer]] research, interviews, target groups, market tests. The market analysis assesses whether there is sufficient [[demand]] for the proposed [[product]] or whether to invest in further development <ref> M. Berrie (2008),s. 3-8</ref>. | Marketing deals with the study of generated ideas about the [[needs]] of consumers, which are perceived in the first stage of the process of creating new concepts of services or alternative products. The promising concepts are subject to feasibility studies, which include several types of analyses, starting with market analysis<ref> M. Berrie (2008),s. 3-8</ref>. Most companies have a team of market analysts who create and evaluate [[consumer]] research, interviews, target groups, market tests. The market analysis assesses whether there is sufficient [[demand]] for the proposed [[product]] or whether to invest in further development <ref> M. Berrie (2008),s. 3-8</ref>. | ||

==Methods== | ==Limitations of economic feasibility== | ||

If there is a potential demand, the next step is economic analysis, which estimates [[production]] and development costs, as well as compares them with the expected sales volume<ref> L. Bentley (2007),s. 417</ref>.The price range for a given product is compatible with the market segment (a separate group of people). Quantitative techniques such as cost/benefit analysis, decision theory, net present value, or internal rate of return are commonly used to assess the potential return on a project. The company estimates the [[risk]] of investing in a new product both whether it is able to bear the cost of the risk<ref> L. Bentley (2007),s. 417</ref>. | Economic feasibility assessment is a valuable tool for evaluating the economic viability of a project or business venture, but it has some limitations that should be taken into account. Some of the limitations of economic feasibility assessment include: | ||

* '''Uncertainty''': Economic feasibility assessment is based on a set of assumptions and projections about the future, and these assumptions may not always be accurate. Economic conditions, market trends, and other factors can change unexpectedly, which can impact the economic feasibility of a project or venture. | |||

* '''Limited data''': Economic feasibility assessment is based on the information that is available at the time of the assessment. If data is limited or incomplete, it can be difficult to make accurate projections about the future, which can lead to an incorrect assessment of the economic feasibility of a project or venture. | |||

* '''Subjectivity''': Economic feasibility assessment can be subjective, as it relies on the judgement and expertise of the individuals conducting the assessment. Different people may have different opinions about the economic feasibility of a project or venture, which can lead to conflicting recommendations. | |||

* '''Ignoring external factors''': Economic feasibility assessment is focused on the internal factors of the project or venture, such as costs and revenue, but it may not take into account external factors that can impact the [[success of the project]] or venture, such as social, [[environmental]], or political factors. | |||

* '''Lack of flexibility''': Economic feasibility assessment is a static analysis, It may not be flexible enough to adapt to changing circumstances or unexpected developments. | |||

In conclusion, economic feasibility assessment is a valuable tool for evaluating the economic viability of a project or business venture, but it has some limitations that should be taken into account. It is important to consider these limitations when interpreting the results of an economic feasibility assessment and to use other methods of analysis to make an overall decision. | |||

==Methods and techniques of economic feasibility assessment== | |||

There are several techniques that can be used to analyze the economic feasibility of a project or business venture. Some of the most commonly used include: | |||

* '''Benefit-cost analysis''': This technique involves comparing the projected benefits of a project to the projected costs. The ratio of benefits to costs is used to determine the overall economic feasibility of the project. | |||

* '''[[Payback period]]''': This technique calculates the amount of time it will take for a project's benefits to equal the costs. If the payback period is shorter than the expected life of the project, it is considered economically feasible. | |||

* '''[[Net present value (NPV)]]''': This technique calculates the present value of the expected cash flows from a project, taking into account the time value of [[money]]. A positive NPV indicates that a project is economically feasible. | |||

* '''Internal rate of return (IRR)''': This technique calculates the percentage return on an investment over the expected life of a project. A project is considered economically feasible if the IRR is higher than the [[required rate of return]]. | |||

* '''Break-even analysis''': This technique calculates the point at which a project's revenue will equal its costs. It helps to determine the minimum level of sales or output required to make a project economically feasible. | |||

* '''[[Sensitivity analysis]]''': This technique examines how changes in key variables such as revenue or costs will impact the overall economic feasibility of a project. | |||

All these techniques are using different methods and assumptions to help decision-makers to evaluate the economic feasibility of a project and to compare different projects. | |||

If there is a potential demand, the next step is economic analysis, which estimates [[production]] and development costs, as well as compares them with the expected sales volume<ref> L. Bentley (2007),s. 417</ref>. The price range for a given product is compatible with the market segment (a separate group of people). Quantitative techniques such as cost/benefit analysis, decision theory, net present value, or internal rate of return are commonly used to assess the potential return on a project. The company estimates the [[risk]] of investing in a new product both whether it is able to bear the cost of the risk<ref> L. Bentley (2007),s. 417</ref>. | |||

The performance list is written for the [[product concept]], after going through a [[feasibility study]], it contains a description of the product's function - what is how the product should satisfy the needs of consumers <ref> L. Bentley (2007),s. 417</ref>. | |||

{{infobox5|list1={{i5link|a=[[SPACE method]]}} — {{i5link|a=[[Impact of information on decision-making]]}} — {{i5link|a=[[ASTRA analysis]]}} — {{i5link|a=[[Decision point]]}} — {{i5link|a=[[Strategic analysis methods]]}} — {{i5link|a=[[Relevant information]]}} — {{i5link|a=[[Strategic planning tools]]}} — {{i5link|a=[[SWOT analysis]]}} — {{i5link|a=[[Measurement of innovation]]}} }} | |||

==References | ==References== | ||

* Berrie M. (2008), [https://pmhut.com/initiating-phase-feasibility-study-request-and-report Initiating Phase - Feasibility Study Request and Report], Queensland University of [[Technology]] | * Berrie M. (2008), [https://pmhut.com/initiating-phase-feasibility-study-request-and-report Initiating Phase - Feasibility Study Request and Report], Queensland University of [[Technology]] | ||

* Bentley L., Whitten J. (2006), [https://books.google.pl/books?id=6r78AAAACAAJ&dq=System+Analysis+%26+Design+for+the+Global+Enterprise&hl=pl&sa=X&ved=0ahUKEwiX5K3DlObeAhWl_CoKHZNrCQMQ6AEIKTAA System Analysis & Design for the Global Enterprise], McGraw-Hill | * Bentley L., Whitten J. (2006), [https://books.google.pl/books?id=6r78AAAACAAJ&dq=System+Analysis+%26+Design+for+the+Global+Enterprise&hl=pl&sa=X&ved=0ahUKEwiX5K3DlObeAhWl_CoKHZNrCQMQ6AEIKTAA System Analysis & Design for the Global Enterprise], McGraw-Hill | ||

Latest revision as of 20:36, 17 November 2023

Economic feasibility refers to the ability of a project or business venture to generate enough revenue to cover its costs and provide a reasonable return on investment. It involves analyzing the costs and benefits of a project, including the costs of materials, labor, and equipment, as well as the projected revenue from sales or other sources of income. Economic feasibility is an important consideration when determining whether a project or venture should be undertaken, and it is often used in conjunction with other types of feasibility analysis, such as technical feasibility and operational feasibility.

Example of economic feasibility

An example of an economic feasibility assessment would be a company considering launching a new product line. The company would conduct an analysis to determine the costs of developing and producing the new products, as well as the projected revenue from sales. They would also consider factors such as the size of the market for the new products, the level of competition, and the target audience.

The company would use this information to make a decision about whether to launch the new product line. They would evaluate the costs of the project and compare them to the projected revenue to determine whether the project is economically feasible. They would also consider other factors such as the potential risks and challenges, the overall market conditions, and the company's ability to launch the new product line.

If the company determines that the new product line is economically feasible, they would proceed with the launch. However, if the analysis indicates that the project is not economically feasible, the company would likely decide not to proceed with the launch.

This example is a simplified one, In real-world scenarios, it would involve more detailed analysis and considerations, but it illustrates the main concept of economic feasibility assessment, which is evaluating the costs and benefits of a project or venture to determine whether it is economically viable.

Elements of economic feasibility assessment

Economic feasibility is a kind of cost-benefit analysis of the examined project, which assesses whether it is possible to implement it. This term means the assessment and analysis of a project's potential to support the decision-making process by objectively and rationally identifying its strengths, weaknesses, opportunities and risks associated with it, the resources that will be needed to implement the project, and an assessment of its chances of success. It consists of market analysis, economic analysis, technical and strategic analysis.

Market analysis

Market analysis plays an important role in the evaluation of economic feasibility of a project or business venture. It involves gathering and analyzing data about the market in which the project or venture will operate, including information about the size and growth of the market, the current and projected demand for the product or service, the competitive landscape, and the target audience.

This information can be used to make more informed decisions about the project or venture, including decisions about pricing, marketing, and distribution. For example, a market analysis might reveal that there is high demand for a particular product or service, which would make it more economically feasible to launch the project or venture. Similarly, a market analysis might reveal that there is a large and growing market for a product or service, which would make it more likely that the project or venture would generate enough revenue to cover its costs and provide a reasonable return on investment.

Market analysis also helps to identify potential risks and challenges that may impact the economic feasibility of a project or venture, such as intense competition, regulatory changes, or changes in consumer behavior. By identifying these risks and challenges early on, decision-makers can take steps to mitigate them, thereby increasing the chances of success for the project or venture.

In summary, market analysis is an essential tool for evaluating the economic feasibility of a project or business venture as it provides a comprehensive understanding of the market behavior and trends, enabling to make rational decisions, and assessing potential risks and opportunities.

Economic analysis

Economic analysis is a method of studying economic processes, which consists in considering the relationships between the various elements of these processes.

It can be used both to study economic phenomena and processes occurring on a scale of the whole economy (macroeconomic analysis), as well as phenomena and processes occurring within particular economic units and institutions (microeconomic analysis). Economic analysis makes it possible to make diagnoses, facilitates decision making, as well as facilitates rationalization of economic processes, both on a macro - and microeconomic scale. In economic analysis, mathematical methods are widely applied (e.g. marginal calculus and linear programming). Analysis is a way of scientific procedure, ordering and dividing the whole into components. The aim of the analysis is to examine the structure of the whole, to get to know the mechanism of connections between the components.

Activities related to the assessment of the company's activity are the subject of economic analysis. In the conditions of changing environment, technological and scientific development, making decisions concerning enterprise management requires fast and reliable information. Therefore, economic analysis and the financial analysis included in it have become particularly important. The economic analysis covers all economic phenomena occurring within the company and in its surroundings. Investigating factors involves dividing economic phenomena and processes into constituent elements, determining the causal-impact relationship between the elements, and drawing conclusions from the assessment.

Technical analysis

Technical analysis can be used as a tool to evaluate the economic feasibility of a project or business venture, particularly in the context of financial markets. The techniques of technical analysis are based on the analysis of historical price data, and the goal is to use this information to predict future price movements and make investment decisions. Technical analysis can be used to evaluate the economic feasibility of a project or venture by assessing the potential return on investment and the level of risk associated with the investment.

For example, if the technical analysis of a stock or commodity suggests that its price is likely to increase in the future, it may be considered economically feasible to invest in that stock or commodity. Conversely, if the technical analysis suggests that the price is likely to decrease, it may be considered less economically feasible to invest in that stock or commodity.

In addition to evaluating the economic feasibility of a specific investment, technical analysis can also be used to evaluate the overall economic feasibility of a project or venture by assessing the current and projected market conditions for the industry or sector in which the project or venture will operate. For example, if technical analysis suggests that a specific industry or sector is likely to experience growth in the future, it may be considered more economically feasible to launch a project or venture in that industry or sector.

It's worth mentioning that Technical analysis is just one of the methods used for forecasting future prices, it is not always accurate and should not be used in isolation to evaluate the economic feasibility of a project or business venture. It should be combined with other methods of analysis such as fundamental analysis, market analysis and economic analysis to have a comprehensive evaluation[1].

Strategic analysis

Strategic analysis is a set of activities that diagnose and forecast the organisation and its surroundings in a way that results in the formulation of an appropriate strategy and the construction and implementation of a specific strategic plan.

Strategic analysis means the right way of strategic thinking by people and organisations. Such analysis must be comprehensive and use qualitative and quantitative methods in the fields of economics, finance, marketing, econometrics, statistics, psychology, international relations, security and defence.

The final stage of strategic analysis is to define and evaluate the strategic position of the company. Strategic analysis gives us an answer to the question: in what conditions the company will operate in the future and what possibilities it has to adapt to them.

Benefits of economic feasibility assessment

The benefits of conducting an economic feasibility assessment include:

- Identifying potential risks and challenges: Economic feasibility assessment helps to identify potential risks and challenges that may impact the success of a project or venture, such as changes in the market, intense competition, or regulatory changes. By identifying these risks and challenges early on, decision-makers can take steps to mitigate them, thereby increasing the chances of success for the project or venture.

- Making informed decisions: Economic feasibility assessment provides decision-makers with the information they need to make informed decisions about a project or venture. By analyzing the costs and benefits of the project or venture, decision-makers can determine whether it is likely to be economically viable and whether it is worth investing in.

- Optimizing resources: Economic feasibility assessment helps to optimize the use of resources by identifying the most cost-effective way to implement a project or venture. By analyzing the costs and benefits of different options, decision-makers can choose the one that is most likely to generate the greatest return on investment.

- Enhancing stakeholder's confidence: Economic feasibility assessment provides stakeholders with the information they need to understand the potential return on investment, which can help to enhance their confidence in the project or venture.

- Identifying opportunities for improvement: Economic feasibility assessment can identify opportunities for improvement in the project or venture, such as reducing costs, increasing revenue, or finding new markets.

In summary, economic feasibility assessment is an essential step in the decision-making process for any project or business venture, it helps to identify potential risks and challenges, make informed decisions, optimize resources, enhance stakeholders' confidence and identify opportunities for improvement.

Marketing deals with the study of generated ideas about the needs of consumers, which are perceived in the first stage of the process of creating new concepts of services or alternative products. The promising concepts are subject to feasibility studies, which include several types of analyses, starting with market analysis[2]. Most companies have a team of market analysts who create and evaluate consumer research, interviews, target groups, market tests. The market analysis assesses whether there is sufficient demand for the proposed product or whether to invest in further development [3].

Limitations of economic feasibility

Economic feasibility assessment is a valuable tool for evaluating the economic viability of a project or business venture, but it has some limitations that should be taken into account. Some of the limitations of economic feasibility assessment include:

- Uncertainty: Economic feasibility assessment is based on a set of assumptions and projections about the future, and these assumptions may not always be accurate. Economic conditions, market trends, and other factors can change unexpectedly, which can impact the economic feasibility of a project or venture.

- Limited data: Economic feasibility assessment is based on the information that is available at the time of the assessment. If data is limited or incomplete, it can be difficult to make accurate projections about the future, which can lead to an incorrect assessment of the economic feasibility of a project or venture.

- Subjectivity: Economic feasibility assessment can be subjective, as it relies on the judgement and expertise of the individuals conducting the assessment. Different people may have different opinions about the economic feasibility of a project or venture, which can lead to conflicting recommendations.

- Ignoring external factors: Economic feasibility assessment is focused on the internal factors of the project or venture, such as costs and revenue, but it may not take into account external factors that can impact the success of the project or venture, such as social, environmental, or political factors.

- Lack of flexibility: Economic feasibility assessment is a static analysis, It may not be flexible enough to adapt to changing circumstances or unexpected developments.

In conclusion, economic feasibility assessment is a valuable tool for evaluating the economic viability of a project or business venture, but it has some limitations that should be taken into account. It is important to consider these limitations when interpreting the results of an economic feasibility assessment and to use other methods of analysis to make an overall decision.

Methods and techniques of economic feasibility assessment

There are several techniques that can be used to analyze the economic feasibility of a project or business venture. Some of the most commonly used include:

- Benefit-cost analysis: This technique involves comparing the projected benefits of a project to the projected costs. The ratio of benefits to costs is used to determine the overall economic feasibility of the project.

- Payback period: This technique calculates the amount of time it will take for a project's benefits to equal the costs. If the payback period is shorter than the expected life of the project, it is considered economically feasible.

- Net present value (NPV): This technique calculates the present value of the expected cash flows from a project, taking into account the time value of money. A positive NPV indicates that a project is economically feasible.

- Internal rate of return (IRR): This technique calculates the percentage return on an investment over the expected life of a project. A project is considered economically feasible if the IRR is higher than the required rate of return.

- Break-even analysis: This technique calculates the point at which a project's revenue will equal its costs. It helps to determine the minimum level of sales or output required to make a project economically feasible.

- Sensitivity analysis: This technique examines how changes in key variables such as revenue or costs will impact the overall economic feasibility of a project.

All these techniques are using different methods and assumptions to help decision-makers to evaluate the economic feasibility of a project and to compare different projects.

If there is a potential demand, the next step is economic analysis, which estimates production and development costs, as well as compares them with the expected sales volume[4]. The price range for a given product is compatible with the market segment (a separate group of people). Quantitative techniques such as cost/benefit analysis, decision theory, net present value, or internal rate of return are commonly used to assess the potential return on a project. The company estimates the risk of investing in a new product both whether it is able to bear the cost of the risk[5].

The performance list is written for the product concept, after going through a feasibility study, it contains a description of the product's function - what is how the product should satisfy the needs of consumers [6].

| Economic feasibility — recommended articles |

| SPACE method — Impact of information on decision-making — ASTRA analysis — Decision point — Strategic analysis methods — Relevant information — Strategic planning tools — SWOT analysis — Measurement of innovation |

References

- Berrie M. (2008), Initiating Phase - Feasibility Study Request and Report, Queensland University of Technology

- Bentley L., Whitten J. (2006), System Analysis & Design for the Global Enterprise, McGraw-Hill

- Matson J. (2000), Cooperative Feasibility Study Guide, United States Department of Agriculture, Rural Business-Cooperative Service

- (2005), Feasibility studies as a tool for successful coperative business interprises, Cooperative Economic

Footnotes

Author: Nicoletta Krzewińska