Shareholder value added

| Shareholder value added |

|---|

| See also |

Shareholder Value Added (SVA) is a value based management performance measure of a company's worth to shareholders compared to the weighted average cost of capital invested (WACC). It started to become popular in the 1980s mainly thanks to Jack Welch, former CEO of General Electric, and Alfred Rappaport.

In its essence, the idea is that shareholders' money should give a higher return than could be earned by investing in other assets at the same level of risk. In other words, value is added when the overall net economic cash flow of the business exceeds the economic cost of all the capital employed to produce the operating profit. Value creation is virtually guaranteed when a company's return on capital exceeds its cost of capital. In sharp contrast, accounting profitability does not necessarily lead to value creation. In fact, in many cases, profitable projects actually destroy the value of the company.

The Shareholder Value Added method has rooted from experiences connected with using the discounted cash flow model (DCF). The mathematical model behind it is based on the thought that the value of the company is comparable with the belief of its future generation of cash or dividends and not historical earnings. To put it in a simple thinking framework for example, if a US$100 investment in an enterprise is made, that has a 20 percent risk factor, the expected average return could be US$20.

If the investment provided more than US$20, it had positive value added - the result was more than the money invested. If it yielded less than US$20, it proved to have negative value added. Even if there would be a return, but less than US$20 the value added would be negative if it was less than the expected return based on the amount of investment and the risk factor (or cost of capital).

SVA = Net Operating Profit After Taxes (NOPAT) - (Capital x WACC)

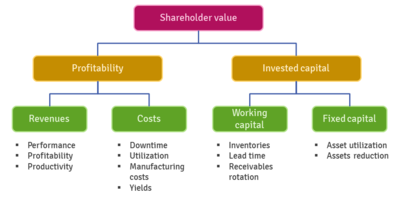

Traditionally accounting measures focus on sore profits after tax equivalents measured as a percentage of the total asset base, the value based management approach, like SVA, concentrates mainly on the operating performance of the firm by adjusting net operating revenue (NOPAT) by the allocation of a capital charge along with the economic operations of the business. SVA itself takes into consideration one hugely important variable that most traditional accounting measures do not - how much capital is being employed in the business. SVA combines income statement and balance sheet data to determine the excess returns available to all capital holders.

The sole concentration on shareholder value has been widely criticized. While shareholder value benefits the owners of a corporation financially, it does not provide a clear measure of corporate social responsibility and environmental issues like employment, ethical business practices. A management decision can maximize shareholder value while lowering the welfare of the local communities, the workers employed and the environment.

Additionally, short term focus on shareholder value can be harmful to long term shareholder value; the expense of tricks that briefly boost a stocks value can have negative impacts on its long term value.

Even one of its earliest users, mentioned before, Jack Welch, has widely criticized the SVA model - "On the face of it, shareholder value is the dumbest idea in the world," he said. "Shareholder value is a result, not a strategy. Your main constituencies are your employees, your customers and your products.".

See also:

- Common consolidated corporate tax base

- Anglo-Saxon model of corporate governance

- Continental model of corporate governance

References

- Guerrera F., Welch condemns share price focus, "Financial Times", 12 March 2009

- Hillman, A. J., & Keim, G. D. (2001). Shareholder value, stakeholder management, and social issues: what's the bottom line?. Strategic management journal, 22(2), 125-139.

- Holliday C., Sustainable Growth, the DuPont Way, "Harvard Business Review", September 2001, p. 134

- Froud J., Haslam C., Johal S. Williams K., Shareholder value and financialization: consultancy promises, management moves, "Economy and Society" Volume 29 Number 1, February 2000, p. 80, 110

- Prahalad C.K., Corporate governance or corporate value added?: Rethinking the primacy of shareholder value, The second Mitsumi Life symposium on global financial markets, 11 May 1993

- Pradnya J., New tool to run a tight company, "Milwaukee Journal Sentinel" 2 September 1996, p. 27

- Rappaport A., Creating shareholder value: The new standard for business performance, New York Free Press, 1986

- Tischer, S., & Hildebrandt, L. (2014). Linking corporate reputation and shareholder value using the publication of reputation rankings. "Journal of Business Research", 67(5), 1007-1017.

Author: Łukasz Skarka