Authorized Stock

| Authorized Stock |

|---|

| See also |

Authorized stock is the maximum number of shares that a company can offer to an investor to obtain cash to relate the organization's goals. The number of authorized shares is binding and specified in the company's statute. Can only be increased by shareholder voting. Authorized stock is the entire of issued and unissued stock. Because issuing shares is expensive, corporations can only issue a small portion of authorized shares to reduce expenses. The authorization of common stock does not result in a formal accounting entry. The reason is that the situation has no immexliate impact on corporate assets or stockholders' equity. Be that as it may, the organization must uncover within the stockholders value segment of the balance sheet the number of shares authorized[1][2].

Division of authorized stock

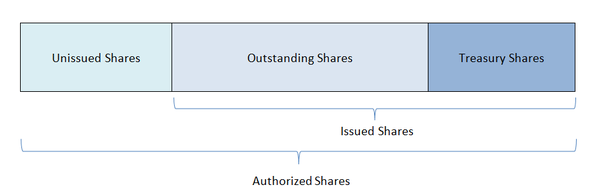

The issued stock is divided into[3]:

- Stock that is owned by investors - these are shares that have been issued and outstanding.

- Stock that is owned by the corporation - these is treasury stock that were sold and then repurchased as part of a stock buyback.

Demand for authorized stock

The full number of authorized shares, and the whole number of issued and out- standing shares, at the time of the company's arrangement is to a great extent self-assertive and, within the conclusion, not of high significance. In any case, clients ought to be empowered to authorize more shares than they at first expect issuing, so there's authorized stock accessible for future transaction (making it conceivable, in most cases, for the board of directors to enter into such transactions without the need of shareholder endorsement to alter the company's articles or certificate of incorporation). The want for parts of authorized stock may ought to be adjusted against the company's crave to maintain a strategic distance from superfluous fees in states like Delaware, where the number of authorized shares and the expressed standard esteem of such shares may be utilized to decide the company's yearly establishment assess expense within the state[4].

A lot of information about the company can be found in the section on shareholders' equity in the corporate balance sheet. This is in accordance with the full disclosure convention. As part of the contributed capital, types of inventories are recorded and the number of:

- authorized shares

- issued shares

- outstanding shares.

“Figure 1 shows the relationship of authorized shares to issued unissued, outstanding, and treasury shares. In this regard, Google is an interesting example The company has 9 billion authorized shares of stock and only about 309 million shares issued. With its excess of authorized shares, Google obviously has plenty of flexibility for future stock transactions” [5]

Footnotes

References

- Batman J. L. (2007), Advising the Small Business: Forms and Advice for the Legal Practitioner, American Bar Association, USA

- Groz M. M. (2009), Forbes Guide to the Markets: Becoming a Savvy Investor, John Wiley & Sons, Inc., Hoboken, New Jersey

- Kimmel P. D. , Weygandt J. J. , Kieso D. E. (2010), Accounting: Tools for Business Decision Makers, John Wiley & Sons, Inc.

- Needles B. E., Powers M., Crosson S. V. (2010), Principles of Accounting, Cengage Learning, South-Western

Author: Monika Wójcik