Fiduciary money

Fiduciary money (fiat money) is a type of currency that does not have coverage in material properties (to which we can include noble gold, among them gold, among others). The value of fiat money has its source mostly in the legally-decreed monopoly of state power. This allows the use of this currency as a legal tender in a given region. The functioning of fiat money is based on trust (Latin fides - faith). In other words, it is a medium of exchange that is not a commodity of any commercial value, nor belongs to production or consumption goods.

There is a widespread belief that the definition of fiat money is the same as the concept of paper money (banknote), unlike in the case of ore coins. However, due to the fact that money based on ores can be represented by paper banknotes (certificates giving the right to collect ore from the treasury), while fiat money can be distributed in the form of precious metal coins minted, this conviction is not correct.

Currently, fiat money is issued as part of monetary policy conducted by central banks. The key instruments regulating the amount of money in circulation include the interest rate on loans granted by central banks. Its amount is subject to changes, which is aimed at ensuring the stability of the market economy.

Examples of fiduciary money

Fiduciary money is money that is backed by a government or other central authority, such as a central bank, rather than by a physical commodity like gold or silver. Examples of fiduciary money include paper currency, like US dollars, and digital currency, like the ones held in bank accounts. These types of money are not backed by a physical commodity, but by the trust and confidence people have in the government or central authority that issues it. Here are a few more examples of fiduciary money:

- Euro: The currency used in the European Union, which is issued and backed by the European Central Bank.

- Japanese Yen: The currency used in Japan, which is issued and backed by the Bank of Japan.

- British Pound: The currency used in the United Kingdom, which is issued and backed by the Bank of England.

- Canadian Dollar: The currency used in Canada, which is issued and backed by the Bank of Canada.

- Australian Dollar: The currency used in Australia, which is issued and backed by the Reserve Bank of Australia.

- In fact probably every currency used in the world today.

- Digital currency, like Bitcoin, Ethereum and others, even though they are not issued by any government or central bank, they are still considered fiduciary money as they are not backed by any physical commodity and their value is determined by the trust and confidence people have in the system.

Money vs. currency

Money and currency are related but distinct concepts. Money refers to any medium of exchange, unit of account, and store of value that is widely accepted in transactions for goods and services. Currency, on the other hand, specifically refers to the physical or digital forms of money that are issued by a government or central bank, such as paper notes and coins or digital currency. Here is a comparison table:

| Characteristic of Money | Characteristic of Currency |

|---|---|

| Used as a medium of exchange | Used as a medium of exchange |

| Used to store value | Can be used to store value |

| Universal | Not universal |

| Limited in supply | Unlimited in supply |

| Durable | Not durable |

| Divisible | Divisible |

| Portable | Portable |

| Reusable | Not reusable |

| Accepted as payment | Accepted as payment |

In summary, money is a broader concept that includes all forms of medium of exchange, unit of account, and store of value, while currency specifically refers to the physical or digital forms of money that are issued by a government or central bank.

The evolution of the form of money

The evolution of the form in which contemporary money can occur is undoubtedly influenced by the payment system that has developed over time. The initiation of money is related to the monetization of precious metals. At that time, the primary means of payment were precious metals, for example gold, silver or copper. Subsequently, paper assets such as banknotes and checks entered the payment system. The disclosure of defects associated with money in the form of coins and banknotes, and therefore frequent cases of theft or difficulty in transporting very large amounts of heavy metal coins and rapid development of banking, have enabled the introduction of a payment system based on checks. Checks allowed to carry out cash transactions without the need to physically carry large amounts of money. In addition, the introduction of checks led to the reduction of transport costs related to the functioning of the payment system and contributed to the improvement of the efficiency of the economy. The next step possible to implement thanks to the development of advanced telecommunications technology and computers was the emergence of electronic means of payment. The advent of electronic money constituted the global evolution of payment systems. Such money can occur, among others in the form of debit cards, stored-value cards, electronic cash or electronic checks.

The Austrian economist Ludwig von Mises devoted much attention to the issue of fiat money. The money typology according to Mises is based on the division of money in a broad sense into money in the narrow sense and on money sybstytuty, to which the Austrian scholar included fiduciary media.

Kinds of money

Ludwig von Mises distinguished the following types of money in a narrow sense:

- commodity money (raw material) - it is money made of valuable materials or precious metals. According to von Mises, the key is the fact that the raw material is money, and money is simply a commodity. In this way, the scholar showed the difference between the commodity money created in a natural way from the market exchange and the fiat money. In the case of raw material money, the original value is a derivative of the technological value of the commodity, whereas empty money is established by virtue of a legal act of the state authority,

- loan money - it is a claim against a legal or natural person, made in the future and used as a medium of exchange. In von Mises's view, an example of a credit money is, for example, a promissory note. The value of this exchange medium may be subject to valuation depending on the institution or person issuing it,

- empty money - money that arises under a state decree. In this case the seal is the decisive element and it is money. It is a symbol of giving value to the state through the act of power,

Ludwig von Mises also distinguished money substitutes. Unlike credit money, the value of which depends on the credibility of a given person, substitutes are paid on demand and fully secured claims to money (raw material). They can take the form of a vista or banknote deposit. Money substitutes are divided into cash certificates and fiduciary media.

- cash certificates - these are money substitutes for which a 100% reserve of commodity money (in the narrower sense) is maintained to cover them;

- fiduciary means of payment - this part of substitutes, which does not have 100% coverage.

Fiduciary media, on the other hand, are divided into uncovered deposits and banknotes as well as short money in this respect, in which their value exceeds the value of the metal from which they were made.

According to the Austrian economist, changes in the amount of monetary certificates do not change the money supply. In turn, the issuance of fiat money results in the fact that the bank's loan funds outweigh its own funds and those entrusted by clients. In this process, von Mises sees the reasons for credit expansion.

Advantages and disadvantages of fiduciary (fiat) money

The advantages of fiduciary money are numerous and include the following:

- It provides a medium for exchange that is universally accepted and used.

- It is easily transportable and divisible, meaning it can be divided into smaller denominations for smaller transactions.

- It provides an easy way to store value, as it is durable and can be used in the future to purchase goods and services.

- It is also easier to use and count than bartering or other forms of payment.

- It is backed by a government, providing a measure of security and stability to its value.

In conclusion, fiduciary money provides a convenient, secure, and stable medium for exchange, making it invaluable in modern economies.

The disadvantages of fiduciary money are also worth noting.

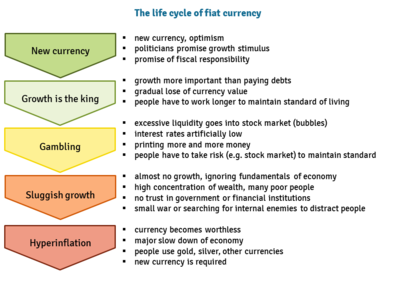

- It can be subject to inflation, meaning its value can fluctuate due to the supply and demand of money.

- It can be subject to manipulation and abuse by those in power, leading to economic instability.

- It can be counterfeited, leading to losses in value.

- It can be difficult to regulate, leading to mismanagement of money supply and potentially causing financial crises.

Overall, fiduciary money is a necessary tool for modern economies, but it can also be subject to manipulation and instability, making it a double-edged sword.

| Fiduciary money — recommended articles |

| Money emission — Repatriable — Money — Functions of money — Monetary system — Creation of money — Capital turnover — Capital flow — Cash Ratio |

References

- Friedman, M., & Schwartz, A. J. (1986). Has government any role in money?. journal of Monetary Economics, 17(1), 37-62.

- Wennerlind, C. (2001). The Link between David Hume's A Treatise of Human Nature and His Fiduciary Theory of Money. History of Political Economy, 33(1), 139-160.

- Aglietta, M. (2002). Whence and whither money?. The future of money, 31-72.