Shareholder theory: Difference between revisions

(The LinkTitles extension automatically added links to existing pages (<a target="_blank" rel="noreferrer noopener" class="external free" href="https://github.com/bovender/LinkTitles">https://github.com/bovender/LinkTitles</a>).) |

mNo edit summary |

||

| Line 14: | Line 14: | ||

}} | }} | ||

'''Shareholder theory''' is a concept in corporate governance that holds that the primary goal of a corporation is to maximize returns to its shareholders. This theory posits that the interests of shareholders should take precedence over those of other stakeholders, such as employees, customers, and the community. Shareholder theory is often associated with the idea of "shareholder primacy," which holds that the interests of shareholders should be protected above all else. Critics of shareholder theory argue that it can lead to a focus on short-term profits at the expense of long-term sustainability and that it can neglect the interests of other stakeholders. | |||

[[Milton Friedman]] was a economist, statistician and a social philosopher, who was a strong advocate for the shareholder theory. He believed that the primary social responsibility of a corporation is to increase its profits and that any actions taken by a corporation to benefit other stakeholders, such as employees or the community, are ultimately a distraction from this goal. He also believed that the best way to ensure that a corporation acts in the best interests of its shareholders is to maximize the freedom of the marketplace. In a 1970 article in the New York Times Magazine, Friedman famously argued that "there is one and only one social responsibility of business - to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud." | |||

==Examples of using shareholder theory== | |||

Examples of using the shareholder theory in practice include: | |||

* Cost cutting measures: Companies may implement cost cutting measures, such as layoffs or outsourcing, in order to boost profits and increase shareholder value. | |||

* Mergers and acquisitions: Companies may engage in mergers and acquisitions in order to gain market share, reduce competition, and increase shareholder value. | |||

* Stock buybacks: Companies may use their profits to buy back their own stock, which can boost earnings per share and increase shareholder value. | |||

* Dividend payouts: Companies may distribute profits to shareholders in the form of dividends, which can provide a steady stream of income to shareholders and increase shareholder value. | |||

* Shareholder activism: Shareholders may engage in activism, such as pressuring management to make changes or influencing the outcome of proxy votes, in order to increase shareholder value. | |||

It is important to note that while these examples illustrate the focus on maximizing shareholder value, companies should also consider the impact of their decisions on other stakeholders and strive for a balance between financial performance and ethical conduct. It is also worth mentioning that the examples above may not always be the best practice for all companies, the circumstances and the company's vision, mission and values should be considered before making any decision. | |||

==Advantages of shareholder theory== | |||

The main advantage of the shareholder theory is that it can lead to efficient and effective management of a company. By prioritizing the financial interests of shareholders, companies may be more likely to make decisions that increase profits and boost the overall value of the company. This can lead to increased returns for shareholders and can attract additional investment, which can ultimately benefit all stakeholders. | |||

Another advantage of the shareholder theory is that it can provide a clear and measurable goal for management. By focusing on maximizing shareholder value, companies can have a clear objective that they can work towards, which can help to align the interests of management and shareholders. | |||

==The | Additionally, the shareholder theory can also provide a certain level of accountability for management. Shareholders are the owners of the company and have the ability to elect the board of directors and vote on important matters such as mergers and acquisitions. This can lead to a more accountable management who are more responsible to their shareholders. | ||

It is important to note that the shareholder theory is not the only perspective and different theories and perspectives can have different impacts on the behavior of a company. Companies should strive for a balance between financial performance and ethical conduct, and consider the interests of all stakeholders. | |||

==Critique of shareholder theory== | |||

The shareholder theory, also known as the shareholder primacy theory, has been the subject of much critique by scholars, policymakers and stakeholders. Some of the main criticisms are: | |||

* Neglect of other stakeholders: The shareholder theory's focus on maximizing shareholder value can lead to neglect of the interests of other stakeholders, such as employees, customers, suppliers, and the community. This can result in unethical business practices, such as cutting corners on employee safety or exploiting natural resources. | |||

* Short-term focus: The emphasis on short-term financial performance can lead to a neglect of long-term sustainability and stability of the company. Companies may engage in practices such as financial engineering or cutting research and development to boost short-term profits, which can ultimately harm the company in the long run. | |||

* Inequity: The focus on maximizing shareholder value can lead to a concentration of wealth among a small group of shareholders and can exacerbate inequality. Additionally, when companies prioritize short-term financial performance, they may overlook the impact of their decisions on marginalized communities. | |||

* Inefficiency: The shareholder theory assumes that the interests of shareholders and management are aligned, but this is not always the case. Managers may prioritize their own interests over those of shareholders, leading to inefficiencies and suboptimal outcomes. | |||

* Lack of Social responsibility: The shareholder theory focus on maximizing shareholder value can lead companies to neglect their social responsibilities, such as environmental protection, labour rights, and human rights. | |||

It is important to note that the shareholder theory is not the only perspective, and different theories and perspectives can have different impacts on the behavior of a company. Companies should strive for a balance between financial performance and ethical conduct and consider the interests of all stakeholders. | |||

==Impact on business ethics== | |||

The shareholder theory, also known as the shareholder primacy theory, holds that the primary goal of a company is to maximize shareholder value. This theory emphasizes the financial interests of shareholders and argues that they should be the primary consideration for management decisions. This can lead to a focus on short-term financial performance at the expense of other considerations, such as the well-being of employees, customers, and the environment. | |||

Critics of the shareholder theory argue that it can lead to a neglect of the interests of other stakeholders and can result in unethical business practices. For example, companies may prioritize cost cutting measures that harm employees or the environment in order to boost profits for shareholders. Additionally, the focus on short-term financial performance can lead to a neglect of long-term sustainability and stability of the company. | |||

However, proponents of the shareholder theory argue that it can lead to efficient and effective management of a company, which can ultimately benefit all stakeholders in the long run. | |||

Overall, business ethics is a complex topic, and different theories and perspectives can have different impacts on the ethical behavior of a company. It is important for companies to consider the interests of all stakeholders and strive for a balance between financial performance and ethical conduct.<ref>Carson, T. L. (2003)</ref>. | |||

==Shareholder vs. stakeholder theory== | |||

A '''shareholder''' is a person or entity that owns shares of stock in a company, and therefore has an ownership stake in the company. Shareholders are typically interested in the financial performance of the company and may receive dividends or capital gains based on the company's profitability. | |||

A '''stakeholder''' is any individual or group that has an interest or concern in something, especially a business. This can include shareholders, but also employees, customers, suppliers, and even the community in which the company operates. Stakeholders may have a variety of interests, such as ensuring the company's products or services meet certain standards, or that the company operates in an ethical and sustainable manner. | |||

===Stakeholder theory=== | |||

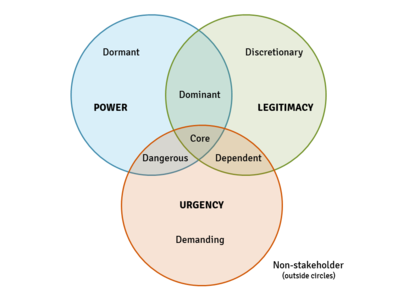

[[File:salience_model.png|400px|right|thumb|Fig.1. The Salience Model of Stakeholders]] | [[File:salience_model.png|400px|right|thumb|Fig.1. The Salience Model of Stakeholders]] | ||

[[Stakeholder]] theory is an alternative approach to understanding the purpose of a corporation. The theory claims that the corporations should serve the interests of all stakeholders rather than shareholders only. | [[Stakeholder]] theory is an alternative approach to understanding the purpose of a corporation. The theory claims that the corporations should serve the interests of all stakeholders rather than shareholders only. | ||

| Line 34: | Line 72: | ||

Preston and Baltimore's study determined that corporations do not make significant tradeoffs to meet objectives of all stakeholder groups. In fact, stakeholder management appears to be common among major U.S. corporations. The average stakeholder [[performance indicators]] are as favorable as shareholder performance indicators. Management typically do not make trade-offs to sacrifice the interests of other stakeholder groups. This may because the objectives of the four stakeholder groups are similar. Management's pursuit of good financial performance does not contradict the objectives of other stakeholder groups. Thus, corporations are capable of realizing objectives and interests of various stakeholder groups<ref>Preston, L. E., Sapienza H. J. (1990)</ref>. | Preston and Baltimore's study determined that corporations do not make significant tradeoffs to meet objectives of all stakeholder groups. In fact, stakeholder management appears to be common among major U.S. corporations. The average stakeholder [[performance indicators]] are as favorable as shareholder performance indicators. Management typically do not make trade-offs to sacrifice the interests of other stakeholder groups. This may because the objectives of the four stakeholder groups are similar. Management's pursuit of good financial performance does not contradict the objectives of other stakeholder groups. Thus, corporations are capable of realizing objectives and interests of various stakeholder groups<ref>Preston, L. E., Sapienza H. J. (1990)</ref>. | ||

== | ==Shareholder theory vs. corporate governance== | ||

Shareholder theory and corporate governance are related, but distinct concepts. | |||

'''Shareholder theory''' is a perspective that emphasizes the importance of maximizing shareholder value as the primary goal of a company. It is based on the idea that the interests of shareholders and management are aligned, and that management should prioritize the financial interests of shareholders when making decisions. | |||

'''Corporate governance''', on the other hand, refers to the systems and processes by which a company is directed and controlled. This includes the mechanisms by which a company's objectives are set and achieved, the rules and procedures for making decisions on behalf of the company, and the processes for monitoring and reporting on performance. Corporate governance also includes the roles and responsibilities of the board of directors, management, and shareholders, and the ways in which they interact and hold each other accountable. | |||

While shareholder theory focuses on the financial performance of the company and the interests of shareholders, corporate governance focuses on the overall management of the company and the interests of all stakeholders. Corporate governance is designed to ensure that a company is run in an ethical and responsible manner, and that the interests of all stakeholders are taken into account when making decisions. | |||

In practice, corporate governance can be used to balance the focus on shareholder value with consideration for the interests of other stakeholders. This can be done through mechanisms such as the appointment of independent directors, the use of codes of conduct, the implementation of risk management processes, and the establishment of an effective system of internal control. | |||

==References== | |||

* Carson, T. L. (2003). [https://www.jstor.org/stable/25075006?Search=yes&resultItemClick=true&searchText=shareholder&searchText=theory&searchUri=%2Faction%2FdoBasicSearch%3FQuery%3Dshareholder%2Btheory&refreqid=search%3A8b049eb18bb23ba94a8cae642cd06486&seq=1#page_scan_tab_contents Self-interest and business ethics: lessons of the recent corporate scandals.], Journal of [[Business Ethics]], Vol. 43, No. 4, p 389-394. Introduction, 389-390. | * Carson, T. L. (2003). [https://www.jstor.org/stable/25075006?Search=yes&resultItemClick=true&searchText=shareholder&searchText=theory&searchUri=%2Faction%2FdoBasicSearch%3FQuery%3Dshareholder%2Btheory&refreqid=search%3A8b049eb18bb23ba94a8cae642cd06486&seq=1#page_scan_tab_contents Self-interest and business ethics: lessons of the recent corporate scandals.], Journal of [[Business Ethics]], Vol. 43, No. 4, p 389-394. Introduction, 389-390. | ||

* Preston, L. E., Sapienza, H. J. (1990). [https://www.sciencedirect.com/science/article/pii/009057209090023Z Stakeholder Management and Corporate Performance.], Journal of Behavioral [[Economics]]. Vol. 19, Issue 4, Winter 1990, p. 361-375. Problems with the stakeholder concept, 362-366. | * Preston, L. E., Sapienza, H. J. (1990). [https://www.sciencedirect.com/science/article/pii/009057209090023Z Stakeholder Management and Corporate Performance.], Journal of Behavioral [[Economics]]. Vol. 19, Issue 4, Winter 1990, p. 361-375. Problems with the stakeholder concept, 362-366. | ||

* Smith, H. J. (2003). The shareholders vs. [[stakeholders]] debate. MIT Sloan [[Management]] Review, 44(4), 85-91. | * Smith, H. J. (2003). The shareholders vs. [[stakeholders]] debate. MIT Sloan [[Management]] Review, 44(4), 85-91. | ||

* Tse, T. (2011). [https://www.workbank247.com/sites/default/files/homeworkfiles/out(2)_1475744646.pdf Shareholder and stakeholder theory: after the financial crisis], Qualitative Research in Financial Markets, 3(1), 51-63. | * Tse, T. (2011). [https://www.workbank247.com/sites/default/files/homeworkfiles/out(2)_1475744646.pdf Shareholder and stakeholder theory: after the financial crisis], Qualitative Research in Financial Markets, 3(1), 51-63. | ||

==Footnotes== | ==Footnotes== | ||

<references/> | <references/> | ||

{{a| Daniel Gaura}} | {{a|Daniel Gaura}} | ||

[[Category:Strategic management]] | [[Category:Strategic management]] | ||

Revision as of 18:13, 24 January 2023

| Shareholder theory |

|---|

| See also |

Shareholder theory is a concept in corporate governance that holds that the primary goal of a corporation is to maximize returns to its shareholders. This theory posits that the interests of shareholders should take precedence over those of other stakeholders, such as employees, customers, and the community. Shareholder theory is often associated with the idea of "shareholder primacy," which holds that the interests of shareholders should be protected above all else. Critics of shareholder theory argue that it can lead to a focus on short-term profits at the expense of long-term sustainability and that it can neglect the interests of other stakeholders.

Milton Friedman was a economist, statistician and a social philosopher, who was a strong advocate for the shareholder theory. He believed that the primary social responsibility of a corporation is to increase its profits and that any actions taken by a corporation to benefit other stakeholders, such as employees or the community, are ultimately a distraction from this goal. He also believed that the best way to ensure that a corporation acts in the best interests of its shareholders is to maximize the freedom of the marketplace. In a 1970 article in the New York Times Magazine, Friedman famously argued that "there is one and only one social responsibility of business - to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud."

Examples of using the shareholder theory in practice include:

- Cost cutting measures: Companies may implement cost cutting measures, such as layoffs or outsourcing, in order to boost profits and increase shareholder value.

- Mergers and acquisitions: Companies may engage in mergers and acquisitions in order to gain market share, reduce competition, and increase shareholder value.

- Stock buybacks: Companies may use their profits to buy back their own stock, which can boost earnings per share and increase shareholder value.

- Dividend payouts: Companies may distribute profits to shareholders in the form of dividends, which can provide a steady stream of income to shareholders and increase shareholder value.

- Shareholder activism: Shareholders may engage in activism, such as pressuring management to make changes or influencing the outcome of proxy votes, in order to increase shareholder value.

It is important to note that while these examples illustrate the focus on maximizing shareholder value, companies should also consider the impact of their decisions on other stakeholders and strive for a balance between financial performance and ethical conduct. It is also worth mentioning that the examples above may not always be the best practice for all companies, the circumstances and the company's vision, mission and values should be considered before making any decision.

The main advantage of the shareholder theory is that it can lead to efficient and effective management of a company. By prioritizing the financial interests of shareholders, companies may be more likely to make decisions that increase profits and boost the overall value of the company. This can lead to increased returns for shareholders and can attract additional investment, which can ultimately benefit all stakeholders.

Another advantage of the shareholder theory is that it can provide a clear and measurable goal for management. By focusing on maximizing shareholder value, companies can have a clear objective that they can work towards, which can help to align the interests of management and shareholders.

Additionally, the shareholder theory can also provide a certain level of accountability for management. Shareholders are the owners of the company and have the ability to elect the board of directors and vote on important matters such as mergers and acquisitions. This can lead to a more accountable management who are more responsible to their shareholders.

It is important to note that the shareholder theory is not the only perspective and different theories and perspectives can have different impacts on the behavior of a company. Companies should strive for a balance between financial performance and ethical conduct, and consider the interests of all stakeholders.

The shareholder theory, also known as the shareholder primacy theory, has been the subject of much critique by scholars, policymakers and stakeholders. Some of the main criticisms are:

- Neglect of other stakeholders: The shareholder theory's focus on maximizing shareholder value can lead to neglect of the interests of other stakeholders, such as employees, customers, suppliers, and the community. This can result in unethical business practices, such as cutting corners on employee safety or exploiting natural resources.

- Short-term focus: The emphasis on short-term financial performance can lead to a neglect of long-term sustainability and stability of the company. Companies may engage in practices such as financial engineering or cutting research and development to boost short-term profits, which can ultimately harm the company in the long run.

- Inequity: The focus on maximizing shareholder value can lead to a concentration of wealth among a small group of shareholders and can exacerbate inequality. Additionally, when companies prioritize short-term financial performance, they may overlook the impact of their decisions on marginalized communities.

- Inefficiency: The shareholder theory assumes that the interests of shareholders and management are aligned, but this is not always the case. Managers may prioritize their own interests over those of shareholders, leading to inefficiencies and suboptimal outcomes.

- Lack of Social responsibility: The shareholder theory focus on maximizing shareholder value can lead companies to neglect their social responsibilities, such as environmental protection, labour rights, and human rights.

It is important to note that the shareholder theory is not the only perspective, and different theories and perspectives can have different impacts on the behavior of a company. Companies should strive for a balance between financial performance and ethical conduct and consider the interests of all stakeholders.

Impact on business ethics

The shareholder theory, also known as the shareholder primacy theory, holds that the primary goal of a company is to maximize shareholder value. This theory emphasizes the financial interests of shareholders and argues that they should be the primary consideration for management decisions. This can lead to a focus on short-term financial performance at the expense of other considerations, such as the well-being of employees, customers, and the environment.

Critics of the shareholder theory argue that it can lead to a neglect of the interests of other stakeholders and can result in unethical business practices. For example, companies may prioritize cost cutting measures that harm employees or the environment in order to boost profits for shareholders. Additionally, the focus on short-term financial performance can lead to a neglect of long-term sustainability and stability of the company.

However, proponents of the shareholder theory argue that it can lead to efficient and effective management of a company, which can ultimately benefit all stakeholders in the long run.

Overall, business ethics is a complex topic, and different theories and perspectives can have different impacts on the ethical behavior of a company. It is important for companies to consider the interests of all stakeholders and strive for a balance between financial performance and ethical conduct.[1].

A shareholder is a person or entity that owns shares of stock in a company, and therefore has an ownership stake in the company. Shareholders are typically interested in the financial performance of the company and may receive dividends or capital gains based on the company's profitability.

A stakeholder is any individual or group that has an interest or concern in something, especially a business. This can include shareholders, but also employees, customers, suppliers, and even the community in which the company operates. Stakeholders may have a variety of interests, such as ensuring the company's products or services meet certain standards, or that the company operates in an ethical and sustainable manner.

Stakeholder theory

Stakeholder theory is an alternative approach to understanding the purpose of a corporation. The theory claims that the corporations should serve the interests of all stakeholders rather than shareholders only.

In fact, studies reveal that corporations are capable of successfully serving the objectives of multiple stakeholders. The stakeholder theory raises several problematic issues:

- Definition of stakeholders is unclear - stakeholder identification may be problematic because multiple groups and subgroups may have direct or indirect interest in a corporation's activities. Preston and Baltimore identify four standard groups: shareholders, employees, customers, and the community.

- Manager's role as stewards of interests of all stakeholders may be problematic. Management actions are primarily driven by financial performance thus one may question their ability to pursue objectives of other stakeholders. This is known as an I&We paradigm, where individual utility (shareholder maximization/financial performance) competes with the social “We”, i.e. interests of multiple stakeholders.

- The ability of a corporation to successfully meet the objectives of all stakeholders may be in question. It may appear that different stakeholders may have different objectives.

Preston and Baltimore's study determined that corporations do not make significant tradeoffs to meet objectives of all stakeholder groups. In fact, stakeholder management appears to be common among major U.S. corporations. The average stakeholder performance indicators are as favorable as shareholder performance indicators. Management typically do not make trade-offs to sacrifice the interests of other stakeholder groups. This may because the objectives of the four stakeholder groups are similar. Management's pursuit of good financial performance does not contradict the objectives of other stakeholder groups. Thus, corporations are capable of realizing objectives and interests of various stakeholder groups[2].

Shareholder theory and corporate governance are related, but distinct concepts.

Shareholder theory is a perspective that emphasizes the importance of maximizing shareholder value as the primary goal of a company. It is based on the idea that the interests of shareholders and management are aligned, and that management should prioritize the financial interests of shareholders when making decisions.

Corporate governance, on the other hand, refers to the systems and processes by which a company is directed and controlled. This includes the mechanisms by which a company's objectives are set and achieved, the rules and procedures for making decisions on behalf of the company, and the processes for monitoring and reporting on performance. Corporate governance also includes the roles and responsibilities of the board of directors, management, and shareholders, and the ways in which they interact and hold each other accountable.

While shareholder theory focuses on the financial performance of the company and the interests of shareholders, corporate governance focuses on the overall management of the company and the interests of all stakeholders. Corporate governance is designed to ensure that a company is run in an ethical and responsible manner, and that the interests of all stakeholders are taken into account when making decisions.

In practice, corporate governance can be used to balance the focus on shareholder value with consideration for the interests of other stakeholders. This can be done through mechanisms such as the appointment of independent directors, the use of codes of conduct, the implementation of risk management processes, and the establishment of an effective system of internal control.

References

- Carson, T. L. (2003). Self-interest and business ethics: lessons of the recent corporate scandals., Journal of Business Ethics, Vol. 43, No. 4, p 389-394. Introduction, 389-390.

- Preston, L. E., Sapienza, H. J. (1990). Stakeholder Management and Corporate Performance., Journal of Behavioral Economics. Vol. 19, Issue 4, Winter 1990, p. 361-375. Problems with the stakeholder concept, 362-366.

- Smith, H. J. (2003). The shareholders vs. stakeholders debate. MIT Sloan Management Review, 44(4), 85-91.

- Tse, T. (2011). Shareholder and stakeholder theory: after the financial crisis, Qualitative Research in Financial Markets, 3(1), 51-63.

Footnotes

Author: Daniel Gaura