Strategic group

| Strategic group |

|---|

| See also |

A strategic group is a concept in strategic management that refers to a group of companies in an industry that have similar characteristics and strategies. These companies are considered to be more similar to each other than they are to other companies in the same industry, and they may face similar competitive pressures and opportunities. Strategic groups can be identified by analyzing companies' market positions, product offerings, and competitive strategies. Understanding the dynamics of a strategic group can help a company identify potential competitors and inform its own strategic decision-making.

Michael E. Porter on the basis of observation of the competitive environment of enterprises put forward the idea that some firms in the same sector, are similar to each other, because of the chosen development strategy. Porter called these similar companies: strategic groups.

They are subsets of the sector, which consists of companies that have pursued a similar approach to the competitive struggle, offering comparable products (with similar quality and price), brought to the same customer segment, resulting in similar marketing policy, characterized by the same distribution network.

Types of strategic groups

There are several different ways to classify strategic groups, but some common types include:

- Industry-based strategic groups: These are groups of companies within the same industry that have similar characteristics and strategies. For example, a group of fast-food restaurants that all use a similar drive-thru model.

- Product-based strategic groups: These are groups of companies that produce similar products or services. For example, a group of car manufacturers that all produce luxury vehicles.

- Market-based strategic groups: These are groups of companies that serve similar customer segments or markets. For example, a group of retail stores that all specialize in outdoor gear.

- Geographic-based strategic groups: These are groups of companies that operate in the same geographical region or area. For example, a group of technology companies that all operate in Silicon Valley.

- Resource-based strategic groups: These are groups of companies that have similar resources and capabilities. For example, a group of airlines that all have a strong presence in the international market.

The classification of strategic groups can vary depending on the industry and the specific characteristics that are being analyzed. Understanding the dynamics of different strategic groups in an industry can help a company identify potential competitors and inform its own strategic decision-making.

Dimensions (criteria) used to separate strategic groups

There are several strategic dimensions that can be used to separate strategic groups within an industry. Some common examples include:

- Market position: This dimension looks at where a company's products or services fit within the market, such as luxury, budget, or mid-range.

- Product or service offerings: This dimension looks at the types of products or services a company offers, such as whether they are basic or specialized.

- Distribution channels: This dimension looks at how a company distributes its products or services, such as through retail stores, e-commerce, or direct sales.

- Customer segments: This dimension looks at the specific customer segments a company targets, such as businesses or consumers.

- Cost structure: This dimension looks at how a company's costs are structured, such as whether they are high or low.

- Technology: This dimension looks at the level of technology a company uses in its products or services and in its manufacturing process.

- Brand image: This dimension looks at the image of the company and the brand in the market.

These dimensions can be used to identify different strategic groups within an industry, and understanding the dynamics of these groups can inform a company's own strategic decision-making. Additionally, companies can use these dimensions to understand the competitive pressures and opportunities that they will face in the market.

The performance of a specific company, is estimated comparing it to the average for its industry or to the average for the entire strategic group for which the organization belongs. The concept of strategic groups rejects the theory that competition in the market is to compete with each company in each particular sector, but assumes that it takes place only between companies of the particular group. The analysis of strategic groups allows to understand and anticipate the forms of competitive fighting and areas of concentration of competition.

Rivals from different groups often come together wanting to strengthen barriers to entry into the sector, in order to impede imitation strategy used by potential new competitors, and to use the common market, allowing them to achieve benefits in the long run.

In sectors where companies are trying to restrict competition through differentiation strategies, the differences between the groups are the biggest.

Its worth noticing that barriers to entry into the sector strategic group and exit from it are called intra-industry mobility barriers, and their analysis provides an answer to the question why companies are finding it hard moving from one group to another.

Strategic group map with example

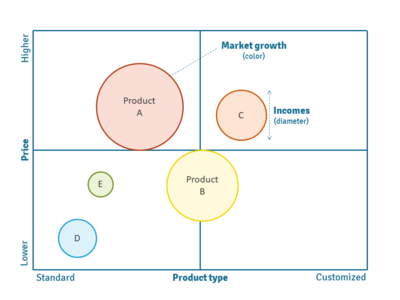

A strategic group map is a tool used in strategic management to visually display the different strategic groups within an industry. The map is created by plotting companies on a two-dimensional graph, with one axis representing one strategic dimension and the other axis representing another strategic dimension. The strategic dimensions that are chosen will depend on the specific industry and the characteristics that are being analyzed.

For example, a strategic group map for the fast-food industry might have one axis representing market position (budget or premium) and the other axis representing product offerings (burgers or sandwiches). Companies that are considered budget fast-food restaurants and primarily serve burgers would be plotted in one area of the map, while premium fast-food restaurants that primarily serve sandwiches would be plotted in another area.

A strategic group map can help a company understand the competitive dynamics of an industry and identify potential competitors. It can also be used to inform a company's own strategic decision-making, such as identifying potential market opportunities or determining where to position its own products or services.

It's important to note that a strategic group map is a static representation of a dynamic industry, and the position of the companies on the map may change over time as the industry evolves and the companies adapt to new competitive pressures and opportunities.

Steps of strategic groups analysis

There are several steps involved in conducting a strategic groups analysis:

- Identify the industry: The first step is to identify the industry or market that will be analyzed. This will typically involve researching the industry to gain a general understanding of its structure and dynamics.

- Determine strategic dimensions: Next, determine the strategic dimensions that will be used to separate the strategic groups within the industry. These dimensions should be chosen based on the specific characteristics of the industry and the companies that operate within it.

- Collect and analyze data: Collect and analyze data on the companies within the industry, with a focus on the strategic dimensions that have been identified. This data can be collected from a variety of sources, such as financial statements, industry reports, and company websites.

- Identify strategic groups: Use the data collected to identify the different strategic groups within the industry. These groups should be distinguished by their similarity on the strategic dimensions that have been chosen.

- Create a strategic group map: Create a strategic group map that visually displays the different strategic groups within the industry. This can be done by plotting the companies on a two-dimensional graph, with one axis representing one strategic dimension and the other axis representing another strategic dimension.

- Analyze the strategic groups: Analyze the dynamics of the strategic groups, including their size, market position, and competitive pressures. This will help to identify potential competitors and opportunities within the industry.

- Use the information: Use the information gained from the analysis to inform the company's own strategic decision-making. This could include identifying potential market opportunities, determining where to position its own products or services, and developing strategies to compete effectively within the industry.

It's important to note that the process of strategic groups analysis should be repeated periodically, as the industry and the companies within it may change over time.

Strategic group in Porter's competitive strategies

Michael Porter, a Harvard Business School professor, identified two types of competitive strategies that companies can use to achieve a competitive advantage in their respective industry:

- Cost Leadership: This strategy involves being the low-cost producer in an industry. A company that adopts this strategy aims to produce goods or services at a lower cost than its competitors, which allows it to sell them at a lower price and still make a profit. This strategy is often used by companies that have a large market share or economies of scale.

- Differentiation: This strategy involves offering a unique product or service that is valued by customers and not offered by competitors. A company that adopts this strategy aims to differentiate itself from its competitors by offering a unique value proposition, such as superior quality, innovative features, or exceptional customer service. This strategy is often used by companies that have a smaller market share or niche market.

Porter also suggests that companies can pursue a focused strategy, which combines elements of cost leadership and differentiation, targeting a specific market segment or niche.

References

- Dess, G. G., & Davis, P. S. (1984). Porter's (1980) generic strategies as determinants of strategic group membership and organizational performance. Academy of Management journal, 27(3), 467-488.

- Mascarenhas, B. (1989). Strategic group dynamics. Academy of Management Journal, 32(2), 333-352.

- Peteraf, M., & Shanley, M. (1997). Getting to know you: A theory of strategic group identity. Strategic Management Journal, 18(s 1), 165-186.

- Porter, M. E. (2008). Competitive strategy: Techniques for analyzing industries and competitors. Simon and Schuster.