Methods of restructuring: Difference between revisions

m (Text cleaning) |

|||

| (5 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

'''Restructuring''' means major changes made in the [[enterprise]] which goal is to improve [[organizational structure]] and [[operating effectiveness]]. | '''Restructuring''' means major changes made in the [[enterprise]] which goal is to improve [[organizational structure]] and [[operating effectiveness]]. | ||

| Line 22: | Line 5: | ||

* Operational restructuring - applies to changes in the [[technology]] and [[product]] assortment, | * Operational restructuring - applies to changes in the [[technology]] and [[product]] assortment, | ||

* Repairing restructuring - applies to businesses facing liquidation, mostly due to the bad situation of the [[company]]. Aims to improve the unfavourable economic conditions and the restoration of solvency. | * Repairing restructuring - applies to businesses facing liquidation, mostly due to the bad situation of the [[company]]. Aims to improve the unfavourable economic conditions and the restoration of solvency. | ||

* Development restructuring - based on strategic decisions taken by the [[management]], concerns the activities of an [[Innovation process|innovative development]]. It covers the period from 2 to 5 years. | * Development restructuring - based on [[strategic decisions]] taken by the [[management]], concerns the activities of an [[Innovation process|innovative development]]. It covers the period from 2 to 5 years. | ||

==Most common methods of restructuring== | ==Most common methods of restructuring== | ||

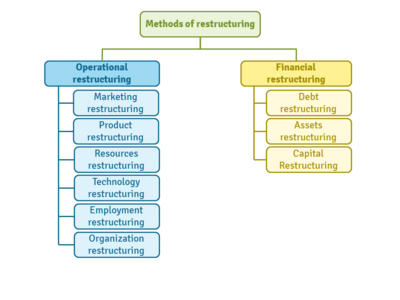

[[File:methods_of_restructuring.png|400px|right|thumb|Fig.1. Methods of restructuring]] | [[File:methods_of_restructuring.png|400px|right|thumb|Fig.1. Methods of restructuring]] | ||

1. '''Operational restructuring''' - includes changes in the core business operations. [[Profit]] or operating loss is reflected in changes in the level and structure of business assets: | 1. '''Operational restructuring''' - includes changes in the core business operations. [[Profit]] or [[operating loss]] is reflected in changes in the level and structure of business assets: | ||

* [[Marketing]] restructuring - involves changes leading to increased sales, strengthening position in the [[market]] by keeping [[flexible pricing]] policy, etc. | * [[Marketing]] restructuring - involves changes leading to increased sales, strengthening position in the [[market]] by keeping [[flexible pricing]] policy, etc. | ||

* Product restructuring - includes changes to the existing [[range of products]], | * Product restructuring - includes changes to the existing [[range of products]], | ||

| Line 36: | Line 19: | ||

2. '''Financial restructuring''' - includes activities in the [[financial management]] systems leading to greater financial gains or in case of loss of liquidity to restore the company solvency: | 2. '''Financial restructuring''' - includes activities in the [[financial management]] systems leading to greater financial gains or in case of loss of liquidity to restore the company solvency: | ||

* Restructuring of the debt (debt reduction) - the pursuit of a settlement between the creditor and debtor, | * Restructuring of the debt (debt reduction) - the pursuit of a settlement between the creditor and debtor, | ||

* Restructuring of assets - through the sale, lease, and through strategic alliances or continuous transfer of resources between partners, | * Restructuring of assets - through the sale, lease, and through [[strategic alliances]] or continuous transfer of resources between partners, | ||

* Restructuring of capital - increases the efficiency of invested capital. | * Restructuring of capital - increases the efficiency of invested capital. | ||

| Line 53: | Line 36: | ||

* [[Private equity investments]] | * [[Private equity investments]] | ||

* [[Strategic portfolio analysis]] | * [[Strategic portfolio analysis]] | ||

==Examples of Methods of restructuring== | |||

* '''Mergers and Acquisitions''': [[Mergers and acquisitions]] involve the combination of two or more companies into one entity. This can be done through a [[merger]] where both companies form a new company, or an acquisition where one company takes over the other. For example, the merger of Pfizer and Allergan in November 2015. | |||

* '''Spinoffs''': Spinoffs involve the breaking up of a company into two or more separate entities, either through the sale of a [[subsidiary]] or the division of the main company. For example, the [[spinoff]] of the healthcare business of Abbott Laboratories in 2013. | |||

* '''Divestitures''': Divestitures involve the sale of a company or its assets. For example, the divestiture of the data storage business of EMC Corporation in 2016. | |||

* '''Consolidations''': Consolidations involve the combining of two or more companies into one. For example, the consolidation of the airlines Delta and Northwest in 2008. | |||

* '''Restructuring''': Restructuring involves changes to the organizational structure and operating procedures of a company. This includes [[downsizing]], reorganizing, and changing management policies. For example, the restructuring of General Motors in 2009. | |||

==Advantages of Methods of restructuring== | |||

Restructuring can have many positive impacts on a company. Here are some of the advantages of restructuring: | |||

* It can help to streamline processes, reducing inefficiencies, duplication of effort, and wasted resources. | |||

* It can help to improve [[organizational effectiveness]] and create a more efficient and effective organizational structure. | |||

* It can create a more flexible and responsive organization, better able to react to changes in the [[environment]]. | |||

* It can help to strengthen the overall financial position of the company, allowing it to better compete in the marketplace. | |||

* It can help to improve morale, as employees can see that their efforts are contributing to the success of the company. | |||

* It can create a more unified and cohesive culture, as the restructuring [[process]] can help to clarify roles, responsibilities, and expectations. | |||

==Limitations of Methods of restructuring== | |||

Restructuring can be an effective way to improve organizational structure and operating effectiveness, however, there are some limitations to consider. These include: | |||

* '''The [[cost]] of restructuring''': Restructuring can involve substantial costs for [[training]], technological upgrades, and severance packages. | |||

* '''The disruption to existing operations''': Restructuring can cause significant disruption to existing operations as employees adjust to new roles and responsibilities. | |||

* '''The [[risk]] of alienating employees''': Restructuring can cause a sense of uncertainty and insecurity among employees, leading to alienation and reduced morale. | |||

* '''The risk of misalignment''': Without proper [[planning]] and [[communication]], restructuring can lead to misalignment between departments and divisions. | |||

* '''The risk of decreased effectiveness''': Without proper implementation, restructuring can lead to decreased effectiveness as employees struggle to adjust to their new roles and responsibilities. | |||

==Other approaches related to Methods of restructuring== | |||

Restructuring is a major change to the organizational structure of an enterprise, aimed to improve operating effectiveness. Other methods of restructuring include: | |||

* Mergers and Acquisitions - This involves combining two existing organizations into one, or one organization taking over another. This can allow for cost savings and increased efficiency, as well as greater market share. | |||

* Downsizing - This involves reducing the [[size of the organization]], either through a reduction in personnel or through the closure of offices and divisions. This can help to reduce costs and make the organization more efficient. | |||

* [[Outsourcing]] - This involves transferring some of the organization’s activities to external organizations. This can help to reduce costs and improve efficiency, as well as allowing the organization to focus on its core activities. | |||

* Reorganizing - This involves changing the structure of the organization, either by adding new [[levels of management]] or by changing the reporting relationships. This can help to make the organization more efficient and improve communication within the organization. | |||

In summary, restructuring can involve a variety of methods, such as mergers and acquisitions, downsizing, outsourcing, and reorganizing. These methods can help to improve the efficiency and cost-effectiveness of an organization, and can help to ensure that it remains competitive in the marketplace. | |||

{{infobox5|list1={{i5link|a=[[Functional strategy]]}} — {{i5link|a=[[Diversification strategy]]}} — {{i5link|a=[[Transformational outsourcing]]}} — {{i5link|a=[[Development by restructurization]]}} — {{i5link|a=[[Innovation management]]}} — {{i5link|a=[[Research and development definition]]}} — {{i5link|a=[[Organization life cycle]]}} — {{i5link|a=[[Spin-off]]}} — {{i5link|a=[[Experience curve]]}} }} | |||

==References== | ==References== | ||

| Line 59: | Line 77: | ||

* Mitchell, M. L., & Mulherin, J. H. (1996). ''[https://www.researchgate.net/profile/Mark_Mitchell8/publication/223086131_The_impact_of_industry_shocks_on_takeover_and_restructuring_activity/links/5562f68108ae8c0cab33450c.pdf The impact of industry shocks on takeover and restructuring activity]''. Journal of financial [[economics]], 41(2), 193-229. | * Mitchell, M. L., & Mulherin, J. H. (1996). ''[https://www.researchgate.net/profile/Mark_Mitchell8/publication/223086131_The_impact_of_industry_shocks_on_takeover_and_restructuring_activity/links/5562f68108ae8c0cab33450c.pdf The impact of industry shocks on takeover and restructuring activity]''. Journal of financial [[economics]], 41(2), 193-229. | ||

* Osterman, P. (2000). ''[http://web.mit.edu/osterman/www/Work-Reorg.pdf Work reorganization in an era of restructuring: Trends in diffusion and effects on employee welfare]''. Industrial & Labor Relations Review, 53(2), 179-196. | * Osterman, P. (2000). ''[http://web.mit.edu/osterman/www/Work-Reorg.pdf Work reorganization in an era of restructuring: Trends in diffusion and effects on employee welfare]''. Industrial & Labor Relations Review, 53(2), 179-196. | ||

[[Category:Strategic management]] | [[Category:Strategic management]] | ||

[[Category:Financial management]] | [[Category:Financial management]] | ||

[[pl:Rodzaje restrukturyzacji]] | [[pl:Rodzaje restrukturyzacji]] | ||

Latest revision as of 00:49, 18 November 2023

Restructuring means major changes made in the enterprise which goal is to improve organizational structure and operating effectiveness.

There can be distinguished following types of restructuring:

- Restructuring of equity - applies to legal and economic transformations,

- Operational restructuring - applies to changes in the technology and product assortment,

- Repairing restructuring - applies to businesses facing liquidation, mostly due to the bad situation of the company. Aims to improve the unfavourable economic conditions and the restoration of solvency.

- Development restructuring - based on strategic decisions taken by the management, concerns the activities of an innovative development. It covers the period from 2 to 5 years.

Most common methods of restructuring

1. Operational restructuring - includes changes in the core business operations. Profit or operating loss is reflected in changes in the level and structure of business assets:

- Marketing restructuring - involves changes leading to increased sales, strengthening position in the market by keeping flexible pricing policy, etc.

- Product restructuring - includes changes to the existing range of products,

- Restructuring of the company's resources - is aimed to increase the efficiency of real property and human resources to meet the success criteria prevailing in the market,

- Technological restructuring - merge changes to the product offer of the company and means to manufacture this products,

- Restructuring of employment - changes in the employment structure leading to lower costs and it's adaptation to the needs of the enterprise,

- Organisational restructuring and changes in enterprise management system - involves customizing of the internal structure of the company to comply with the implementation of the strategies adopted.

2. Financial restructuring - includes activities in the financial management systems leading to greater financial gains or in case of loss of liquidity to restore the company solvency:

- Restructuring of the debt (debt reduction) - the pursuit of a settlement between the creditor and debtor,

- Restructuring of assets - through the sale, lease, and through strategic alliances or continuous transfer of resources between partners,

- Restructuring of capital - increases the efficiency of invested capital.

Restructuring as a tool for organizational improvement

Development of the company through restructuring involves improvement in existing structures and systems. It has two varieties:

- restructuring as fixing problems,

- dynamic restructuring.

Restructuring as problem fixing tends to restore the original state of the company. In Polish conditions, a special case of this variety is restructuring of procedures to achieve a state of solvency.

Dynamic restructuring is aimed at diversification and modernization of the company. In this case main goal is to improve the organization and operation of such an extent that it reaches the economic performance compared to the original state. The dynamic restructuring involves looking for ways of development of such companies, which would lead to a higher results than satisfactory or good. This applies for example to improving the organizational structure, strengthening the economic and financial situation, improving product quality, expanding the profile of production and portfolio.

Other means than the development by restructuring is development by innovation. This includes creating new, original and effective theoretical concepts and specific practical solutions in various fields of activity. The results of the development through innovation are the designs that express a new level of quality. This new quality is determined by the discovery of the characteristic properties of the tested system and an indication of its strengths. It may also relate to the used management concept and research methods.

See also:

Examples of Methods of restructuring

- Mergers and Acquisitions: Mergers and acquisitions involve the combination of two or more companies into one entity. This can be done through a merger where both companies form a new company, or an acquisition where one company takes over the other. For example, the merger of Pfizer and Allergan in November 2015.

- Spinoffs: Spinoffs involve the breaking up of a company into two or more separate entities, either through the sale of a subsidiary or the division of the main company. For example, the spinoff of the healthcare business of Abbott Laboratories in 2013.

- Divestitures: Divestitures involve the sale of a company or its assets. For example, the divestiture of the data storage business of EMC Corporation in 2016.

- Consolidations: Consolidations involve the combining of two or more companies into one. For example, the consolidation of the airlines Delta and Northwest in 2008.

- Restructuring: Restructuring involves changes to the organizational structure and operating procedures of a company. This includes downsizing, reorganizing, and changing management policies. For example, the restructuring of General Motors in 2009.

Advantages of Methods of restructuring

Restructuring can have many positive impacts on a company. Here are some of the advantages of restructuring:

- It can help to streamline processes, reducing inefficiencies, duplication of effort, and wasted resources.

- It can help to improve organizational effectiveness and create a more efficient and effective organizational structure.

- It can create a more flexible and responsive organization, better able to react to changes in the environment.

- It can help to strengthen the overall financial position of the company, allowing it to better compete in the marketplace.

- It can help to improve morale, as employees can see that their efforts are contributing to the success of the company.

- It can create a more unified and cohesive culture, as the restructuring process can help to clarify roles, responsibilities, and expectations.

Limitations of Methods of restructuring

Restructuring can be an effective way to improve organizational structure and operating effectiveness, however, there are some limitations to consider. These include:

- The cost of restructuring: Restructuring can involve substantial costs for training, technological upgrades, and severance packages.

- The disruption to existing operations: Restructuring can cause significant disruption to existing operations as employees adjust to new roles and responsibilities.

- The risk of alienating employees: Restructuring can cause a sense of uncertainty and insecurity among employees, leading to alienation and reduced morale.

- The risk of misalignment: Without proper planning and communication, restructuring can lead to misalignment between departments and divisions.

- The risk of decreased effectiveness: Without proper implementation, restructuring can lead to decreased effectiveness as employees struggle to adjust to their new roles and responsibilities.

Restructuring is a major change to the organizational structure of an enterprise, aimed to improve operating effectiveness. Other methods of restructuring include:

- Mergers and Acquisitions - This involves combining two existing organizations into one, or one organization taking over another. This can allow for cost savings and increased efficiency, as well as greater market share.

- Downsizing - This involves reducing the size of the organization, either through a reduction in personnel or through the closure of offices and divisions. This can help to reduce costs and make the organization more efficient.

- Outsourcing - This involves transferring some of the organization’s activities to external organizations. This can help to reduce costs and improve efficiency, as well as allowing the organization to focus on its core activities.

- Reorganizing - This involves changing the structure of the organization, either by adding new levels of management or by changing the reporting relationships. This can help to make the organization more efficient and improve communication within the organization.

In summary, restructuring can involve a variety of methods, such as mergers and acquisitions, downsizing, outsourcing, and reorganizing. These methods can help to improve the efficiency and cost-effectiveness of an organization, and can help to ensure that it remains competitive in the marketplace.

| Methods of restructuring — recommended articles |

| Functional strategy — Diversification strategy — Transformational outsourcing — Development by restructurization — Innovation management — Research and development definition — Organization life cycle — Spin-off — Experience curve |

References

- Best, M. H. (1990). The new competition: institutions of industrial restructuring. Harvard University Press.

- Djankov, S., & Murrell, P. (2002). Enterprise restructuring in transition: A quantitative survey. Journal of economic literature, 40(3), 739-792.

- Mitchell, M. L., & Mulherin, J. H. (1996). The impact of industry shocks on takeover and restructuring activity. Journal of financial economics, 41(2), 193-229.

- Osterman, P. (2000). Work reorganization in an era of restructuring: Trends in diffusion and effects on employee welfare. Industrial & Labor Relations Review, 53(2), 179-196.