Method of calculating the BCG matrix: Difference between revisions

(Infobox update) |

m (Text cleaning) |

||

| (5 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

Using '''[[method]] of calculating the BCG matrix''' manager can produce graphical representation of the [[company]] position in the [[market]] relative to its major [[competitor]]s. It was developed by Boston Counsulting Group in 1970. [[BCG growth-share matrix|Growth share matrix]] is one of the best known and most widely used methods of [[Strategic portfolio analysis|portfolio analysis]], which is a direct reflection of research participation and the [[competitiveness]] of companies in the [[market]]. | Using '''[[method]] of calculating the BCG matrix''' manager can produce graphical representation of the [[company]] position in the [[market]] relative to its major [[competitor]]s. It was developed by Boston Counsulting Group in 1970. [[BCG growth-share matrix|Growth share matrix]] is one of the best known and most widely used methods of [[Strategic portfolio analysis|portfolio analysis]], which is a direct reflection of research participation and the [[competitiveness]] of companies in the [[market]]. | ||

==Construction of BCG Matrix chart and computational methods == | ==Construction of BCG Matrix chart and computational methods== | ||

Horizontal axis on a logarithmic scale indicates share of the company and its largest [[competitor]]. Vertical axis indicates rate of sales growth. The next step is the division of the horizontal axis into two parts at the point equals the share of its nearest [[competitor]] with a vertical axis at the point equal to half the span of [[market dynamics]]. This creates four quadrants of the chart, called the "star", "question marks" (or "difficult children"), "cash cows" and "dogs". These names are equivalent to the [[product]] development phases. | Horizontal axis on a logarithmic scale indicates share of the company and its largest [[competitor]]. Vertical axis indicates rate of sales growth. The next step is the division of the horizontal axis into two parts at the point equals the share of its nearest [[competitor]] with a vertical axis at the point equal to half the span of [[market dynamics]]. This creates four quadrants of the chart, called the "star", "question marks" (or "difficult children"), "cash cows" and "dogs". These names are equivalent to the [[product]] development phases. | ||

| Line 38: | Line 21: | ||

# Drawing circles in the coordinate [[system]] and creating BCG map | # Drawing circles in the coordinate [[system]] and creating BCG map | ||

# Analysis of the phases of development of different products. | # Analysis of the phases of development of different products. | ||

==Examples of Method of calculating the BCG matrix== | |||

* The first example of the method of calculating the BCG matrix is the market share versus [[market growth]] analysis. This method is used to assess the [[market position]] of a company relative to its main competitors. The company's market share and market growth are plotted on a graph, with market growth on the x-axis and market share on the y-axis. Companies that have high market shares and high market growth are identified as "stars" and those with low market shares and low market growth are identified as "dogs", while companies with medium market shares and medium market growth are identified as "cash cows". | |||

* The second example of the method of calculating the BCG matrix is the [[relative market share]] analysis. This method is used to assess the [[competitive position]] of a company relative to its main competitors. The relative market share is calculated by dividing the company's market share by the market share of its main competitors. Companies with a relative market share of over one are identified as "stars" while those with a relative market share of less than one are identified as "dogs". | |||

* The third example of the method of calculating the BCG matrix is the revenue growth rate analysis. This method is used to assess the performance of a company's [[product portfolio]] relative to its competitors. The revenue growth rate is calculated by comparing the revenue growth of a company to the revenue growth of its main competitors. Companies with a revenue growth rate greater than the average revenue growth rate of its competitors are identified as "stars", while those with a revenue growth rate lower than the average revenue growth rate of its competitors are identified as "dogs". | |||

==Advantages of Method of calculating the BCG matrix== | |||

The method of calculating the BCG matrix offers several advantages for managers in assessing their company's competitive position. These advantages include: | |||

* Clear visual representation of the relative market positions of a company's different products, allowing managers to quickly identify strong and weak products. | |||

* Ability to assess the company's overall market position and compare it to its competitors. | |||

* Easy to understand and interpret the results, allowing managers to make decisions quickly. | |||

* Ability to identify potential opportunities for growth and [[diversification]]. | |||

* Ability to group products into categories and prioritize resources accordingly. | |||

* Helps to identify which products should be invested in and which should be discontinued. | |||

==Limitations of Method of calculating the BCG matrix== | |||

The method of calculating the BCG matrix is a useful tool for analyzing the competitive position of a company in the market, however, it has some limitations. These include: | |||

* '''Simplistic assumptions''': The BCG matrix is based on the assumption that market share is the primary driver of profitability, but this is often not the case in a dynamic and competitive market. | |||

* '''Lack of accurate market data''': The accuracy of the BCG matrix depends on the availability of accurate market data, which can be difficult to obtain. | |||

* '''Ignoring competitive forces''': The BCG matrix does not take into account competitive forces such as the [[threat of new entrants]], [[supplier]] power, buyer power, and substitutes. | |||

* '''Ignoring the lifecycle of a product''': The BCG matrix does not consider the [[product life cycle]], which can significantly affect the profitability of a product. | |||

* '''Ignoring [[innovation]]''': The BCG matrix does not take into account the potential impact of innovation on a product's profitability. | |||

* '''Reliance on assumptions''': The BCG matrix is based on a number of assumptions, which may not always be accurate. | |||

* '''Over-simplification''': The BCG matrix is a relatively simple tool, which can lead to an oversimplification of a company's position in the market. | |||

==Other approaches related to Method of calculating the BCG matrix== | |||

One of the most popular approaches related to the Method of calculating the BCG matrix is [[Strategic portfolio analysis]]. There are several other approaches which include: | |||

* [[Industry]] Attractiveness-Business Strength Matrix - This approach uses industry attractiveness and business strength scores to determine a company's competitive position in the market. | |||

* [[Strategic Group]] Mapping - This approach uses a two-dimensional grid to analyze the competitors within an industry. | |||

* Porter's Five Forces Model - This model looks at five factors that determine the level of [[competition]] within an industry, such as [[supplier power]], buyer power, and the threat of substitute products. | |||

* PIMS - [[Profit]] Impact of Market Strategy - This model looks at how different strategies can impact the profitability of a business. | |||

In conclusion, the Method of calculating the BCG matrix is a popular approach for strategic portfolio analysis, but there are several other approaches that can be used to gain insights into a company's competitive position in the market. | |||

{{infobox5|list1={{i5link|a=[[Potential market]]}} — {{i5link|a=[[Hofer matrix]]}} — {{i5link|a=[[Relative market share]]}} — {{i5link|a=[[McKinsey matrix]]}} — {{i5link|a=[[SPACE method]]}} — {{i5link|a=[[BCG growth-share matrix]]}} — {{i5link|a=[[Evaluation of sector's attractiveness]]}} — {{i5link|a=[[Market attractiveness]]}} — {{i5link|a=[[Economic profile of a sector]]}} }} | |||

==References== | ==References== | ||

* Calandro Jr, J., & Lane, S. (2007). ''[https://www.researchgate.net/profile/Scott_Lane2/publication/242339752_A_new_competitive_analysis_tool_the_relative_profitability_and_growth_matrix/links/00463533b02c5defaf000000.pdf A new competitive analysis tool: the relative profitability and growth matrix]''. [[Strategy]] & Leadership, 35(2), 30-38. | * Calandro Jr, J., & Lane, S. (2007). ''[https://www.researchgate.net/profile/Scott_Lane2/publication/242339752_A_new_competitive_analysis_tool_the_relative_profitability_and_growth_matrix/links/00463533b02c5defaf000000.pdf A new competitive analysis tool: the relative profitability and growth matrix]''. [[Strategy]] & Leadership, 35(2), 30-38. | ||

* Mutandwa, E., Kanuma, N. T., Rusatira, E., Kwiringirimana, T., Mugenzi, P., Govere, I., & Foti, R. (2009). ''[http://www.academicjournals.org/journal/AJBM/article-full-text-pdf/DFDE08816336 Analysis of coffee export marketing in Rwanda: Application of the Boston consulting group matrix]''. African Journal of Business [[Management]], 2(4), 210-219. | * Mutandwa, E., Kanuma, N. T., Rusatira, E., Kwiringirimana, T., Mugenzi, P., Govere, I., & Foti, R. (2009). ''[http://www.academicjournals.org/journal/AJBM/article-full-text-pdf/DFDE08816336 Analysis of coffee export marketing in Rwanda: Application of the Boston consulting group matrix]''. African Journal of Business [[Management]], 2(4), 210-219. | ||

* Smith, M. (2002). ''[http://www.researchgate.net/profile/Malcolm_Smith6/publication/24067403_Derrick's_Ice-Cream_Company_applying_the_BCG_matrix_in_customer_profitability_analysis/links/00b4953362799bdc26000000.pdf Derrick's | * Smith, M. (2002). ''[http://www.researchgate.net/profile/Malcolm_Smith6/publication/24067403_Derrick's_Ice-Cream_Company_applying_the_BCG_matrix_in_customer_profitability_analysis/links/00b4953362799bdc26000000.pdf Derrick's Ice-Cream Company: applying the BCG matrix in customer profitability analysis]]''. Accounting [[Education]], 11(4), 365-375. | ||

* [https://www.bcg.com/ BCG | * [https://www.bcg.com/ BCG - Global Management Consulting] website. | ||

[[Category:Strategic management methods]] | [[Category:Strategic management methods]] | ||

[[pl:Macierz BCG - metodyka obliczeniowa]] | [[pl:Macierz BCG - metodyka obliczeniowa]] | ||

Latest revision as of 01:48, 18 November 2023

Using method of calculating the BCG matrix manager can produce graphical representation of the company position in the market relative to its major competitors. It was developed by Boston Counsulting Group in 1970. Growth share matrix is one of the best known and most widely used methods of portfolio analysis, which is a direct reflection of research participation and the competitiveness of companies in the market.

Construction of BCG Matrix chart and computational methods

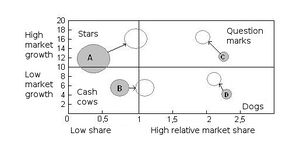

Horizontal axis on a logarithmic scale indicates share of the company and its largest competitor. Vertical axis indicates rate of sales growth. The next step is the division of the horizontal axis into two parts at the point equals the share of its nearest competitor with a vertical axis at the point equal to half the span of market dynamics. This creates four quadrants of the chart, called the "star", "question marks" (or "difficult children"), "cash cows" and "dogs". These names are equivalent to the product development phases.

In the literature we can find the usual interpretation of the descriptive method of calculating the BCG matrix, but its application in practice requires some analytical procedures leading to the preparation of BCG graph.

Figure 1 shows a classic Boston consulting group matrix graph. Circles shows sales of particular brands on the market, with current sales mean grey circles, while the clear - the predicted sale.

The surfaces of the wheels represent the size of sales, their radius is calculated by the following formula:

Coordinates of the center of the wheel are calculated as follows:

- ,

- .

Procedure for creating the BCG matrix chart

- Identification of the firm's position in the market for each product, taking into account sales (own and competitor's) and rate of growth (in%)

- Based on these data to calculate the appropriate wheel radius and the x, y coordinates

- Drawing circles in the coordinate system and creating BCG map

- Analysis of the phases of development of different products.

Examples of Method of calculating the BCG matrix

- The first example of the method of calculating the BCG matrix is the market share versus market growth analysis. This method is used to assess the market position of a company relative to its main competitors. The company's market share and market growth are plotted on a graph, with market growth on the x-axis and market share on the y-axis. Companies that have high market shares and high market growth are identified as "stars" and those with low market shares and low market growth are identified as "dogs", while companies with medium market shares and medium market growth are identified as "cash cows".

- The second example of the method of calculating the BCG matrix is the relative market share analysis. This method is used to assess the competitive position of a company relative to its main competitors. The relative market share is calculated by dividing the company's market share by the market share of its main competitors. Companies with a relative market share of over one are identified as "stars" while those with a relative market share of less than one are identified as "dogs".

- The third example of the method of calculating the BCG matrix is the revenue growth rate analysis. This method is used to assess the performance of a company's product portfolio relative to its competitors. The revenue growth rate is calculated by comparing the revenue growth of a company to the revenue growth of its main competitors. Companies with a revenue growth rate greater than the average revenue growth rate of its competitors are identified as "stars", while those with a revenue growth rate lower than the average revenue growth rate of its competitors are identified as "dogs".

Advantages of Method of calculating the BCG matrix

The method of calculating the BCG matrix offers several advantages for managers in assessing their company's competitive position. These advantages include:

- Clear visual representation of the relative market positions of a company's different products, allowing managers to quickly identify strong and weak products.

- Ability to assess the company's overall market position and compare it to its competitors.

- Easy to understand and interpret the results, allowing managers to make decisions quickly.

- Ability to identify potential opportunities for growth and diversification.

- Ability to group products into categories and prioritize resources accordingly.

- Helps to identify which products should be invested in and which should be discontinued.

Limitations of Method of calculating the BCG matrix

The method of calculating the BCG matrix is a useful tool for analyzing the competitive position of a company in the market, however, it has some limitations. These include:

- Simplistic assumptions: The BCG matrix is based on the assumption that market share is the primary driver of profitability, but this is often not the case in a dynamic and competitive market.

- Lack of accurate market data: The accuracy of the BCG matrix depends on the availability of accurate market data, which can be difficult to obtain.

- Ignoring competitive forces: The BCG matrix does not take into account competitive forces such as the threat of new entrants, supplier power, buyer power, and substitutes.

- Ignoring the lifecycle of a product: The BCG matrix does not consider the product life cycle, which can significantly affect the profitability of a product.

- Ignoring innovation: The BCG matrix does not take into account the potential impact of innovation on a product's profitability.

- Reliance on assumptions: The BCG matrix is based on a number of assumptions, which may not always be accurate.

- Over-simplification: The BCG matrix is a relatively simple tool, which can lead to an oversimplification of a company's position in the market.

One of the most popular approaches related to the Method of calculating the BCG matrix is Strategic portfolio analysis. There are several other approaches which include:

- Industry Attractiveness-Business Strength Matrix - This approach uses industry attractiveness and business strength scores to determine a company's competitive position in the market.

- Strategic Group Mapping - This approach uses a two-dimensional grid to analyze the competitors within an industry.

- Porter's Five Forces Model - This model looks at five factors that determine the level of competition within an industry, such as supplier power, buyer power, and the threat of substitute products.

- PIMS - Profit Impact of Market Strategy - This model looks at how different strategies can impact the profitability of a business.

In conclusion, the Method of calculating the BCG matrix is a popular approach for strategic portfolio analysis, but there are several other approaches that can be used to gain insights into a company's competitive position in the market.

| Method of calculating the BCG matrix — recommended articles |

| Potential market — Hofer matrix — Relative market share — McKinsey matrix — SPACE method — BCG growth-share matrix — Evaluation of sector's attractiveness — Market attractiveness — Economic profile of a sector |

References

- Calandro Jr, J., & Lane, S. (2007). A new competitive analysis tool: the relative profitability and growth matrix. Strategy & Leadership, 35(2), 30-38.

- Mutandwa, E., Kanuma, N. T., Rusatira, E., Kwiringirimana, T., Mugenzi, P., Govere, I., & Foti, R. (2009). Analysis of coffee export marketing in Rwanda: Application of the Boston consulting group matrix. African Journal of Business Management, 2(4), 210-219.

- Smith, M. (2002). Derrick's Ice-Cream Company: applying the BCG matrix in customer profitability analysis]. Accounting Education, 11(4), 365-375.

- BCG - Global Management Consulting website.