Money emission: Difference between revisions

m (Infobox5 upgrade) |

m (Text cleaning) |

||

| Line 1: | Line 1: | ||

Term '''emission of [[money]]''' (or '''money creation''' means introducing to circulation in economy cash- or non-cash money. It is mainly function of central banks in every country, but commercial banks also can indirectly '''create''' money. | Term '''emission of [[money]]''' (or '''money creation''' means introducing to circulation in economy cash - or non-cash money. It is mainly function of central banks in every country, but commercial banks also can indirectly '''create''' money. | ||

==Money emission by central bank== | ==Money emission by central bank== | ||

| Line 20: | Line 20: | ||

After the fall of the Bretton Woods [[system]] the only way of enlargement of the [[monetary base]] became the debts of remaining subjects in Central Bank. | After the fall of the Bretton Woods [[system]] the only way of enlargement of the [[monetary base]] became the debts of remaining subjects in Central Bank. | ||

==Money emission by commercial banks == | ==Money emission by commercial banks== | ||

Commercial banks have the possibility of emission of money mainly by giving credits to their customers. Therefore, enlarging debts in banks give a possibility to enlarge nominal value of non-cash money in circulation. The repayment of capital instalments means durable money recall. Interests are treated as the income and they come back to circulation as the expenses. | Commercial banks have the possibility of emission of money mainly by giving credits to their customers. Therefore, enlarging debts in banks give a possibility to enlarge nominal value of non-cash money in circulation. The repayment of capital instalments means durable money recall. Interests are treated as the income and they come back to circulation as the expenses. | ||

== The possible threats connected with emission of debt money == | ==The possible threats connected with emission of debt money== | ||

The lack of connections between the real [[demand]] on money and the total nominal value of money which is in circulation cause the problems of nature inflationary and deflationary. | The lack of connections between the real [[demand]] on money and the total nominal value of money which is in circulation cause the problems of nature inflationary and deflationary. | ||

| Line 33: | Line 33: | ||

The question of optimum quantity of money in literature appears in economy very often. In according with one of the ideas, the total nominal value of money in circulation should equal the total value of accessible goods on [[market]]. The systems described above do not guarantee this in average and long period. Alternative studies do not guarantee this either, but they deliver some pieces of advice. Here are some examples of alternative money theories: | The question of optimum quantity of money in literature appears in economy very often. In according with one of the ideas, the total nominal value of money in circulation should equal the total value of accessible goods on [[market]]. The systems described above do not guarantee this in average and long period. Alternative studies do not guarantee this either, but they deliver some pieces of advice. Here are some examples of alternative money theories: | ||

* '''[[Austrian theory of money]]''' - they propose introduction of gold [[standard]] or annulment of state [[monopoly]] on production of money, | * '''[[Austrian theory of money]]''' - they propose introduction of gold [[standard]] or annulment of state [[monopoly]] on production of money, | ||

* '''bank of time''' - means institution which is based on non- cash exchange of services between its members, | * '''bank of time''' - means institution which is based on non - cash exchange of services between its members, | ||

* '''social credit''' - the emission of money depends from subjects (not only banks), which are obligated to the realization of something useful, | * '''social credit''' - the emission of money depends from subjects (not only banks), which are obligated to the realization of something useful, | ||

* '''nominalistic theory of money''' - this idea weakens the legitimacy of metallic (ores) theory and affirms that only the noble metals can fulfil the [[functions of money]], | * '''nominalistic theory of money''' - this idea weakens the legitimacy of metallic (ores) theory and affirms that only the noble metals can fulfil the [[functions of money]], | ||

Latest revision as of 00:58, 18 November 2023

Term emission of money (or money creation means introducing to circulation in economy cash - or non-cash money. It is mainly function of central banks in every country, but commercial banks also can indirectly create money.

Money emission by central bank

Central bank emits bank notes and coins as well. The acceptance of notes as a lawful way of payments, which makes it possible to regulate the obligations (debts), can't be questioned, but there is a limiting sum, above which it is possible to refuse to regulate charges in coins.

Central bank emits also non-cash money and in this way it gives credits for commercial banks. In well-founded situations non-cash money can be exchanged on cash - Central Bank prints notes (non-cash money becomes an equivalent of cash money).

Emission of money in closed economy

In the past, central banks introduced to the circulation bank notes (printed, created money) throughout the purchase of noble metals (gold or silver - in stable parity) or by giving credit to commercial banks and government. Therefore, the total nominal value of cash consisted of the cash in circulation in figure of debts in central bank and the accumulated ores in treasure. Interests from debt were/are introduced to circulation again.

Open economy, fixed rate of monetary exchange

In the times of an increasing meaning of the international trade a new possibility for the emission of money appeared. Thanks to honouring the legal local means of payment by the central banks of particular countries, they gained the possibility of an enlargement of the quantity of cash in a way similar to the purchase of ores. Above of all, this possibility influenced particularly positively on importers and did not harm exporters.

However, the development of the international exchange lead to some kind of non-balanced situation, because some countries began to accumulate the foreign currencies, they sold more goods abroad than they bought, the reserves of foreign currencies were growing. And this situation could finish with an impact in a country in which the reserves would grow to such sizes that their exchange on ores could lead to a loss of fluency.

In relationship with above, this situation could create a short-time advantages for importers. But this benefits could become serious problems when transaction would be accounted in ores. It does not change the fact that an emission of a larger quantity of money in form of debt became possible, and developed countries cope with this problem throughout a change of the parity of exchange currencies.

Liquid monetary rate

After the fall of the Bretton Woods system the only way of enlargement of the monetary base became the debts of remaining subjects in Central Bank.

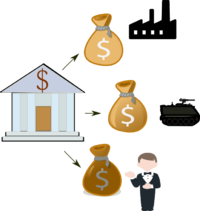

Money emission by commercial banks

Commercial banks have the possibility of emission of money mainly by giving credits to their customers. Therefore, enlarging debts in banks give a possibility to enlarge nominal value of non-cash money in circulation. The repayment of capital instalments means durable money recall. Interests are treated as the income and they come back to circulation as the expenses.

The possible threats connected with emission of debt money

The lack of connections between the real demand on money and the total nominal value of money which is in circulation cause the problems of nature inflationary and deflationary.

In the beginning, intensive credit action enlarges incomes, and in consequence the credit ability as well. However, in a certain point it is not possible any more to increase production, which can cause inflation, and if the creation of money does not satisfy the needs of real economy, we can have recession.

Obviously in the worst situation are those who are the most involved in debts, but a smaller and smaller supply of money in result of paying off the debts (the decrease of credit ability of system) hits in next branches of economy (in smaller or larger degree involved in debts and related one to another).

Alternative solutions to emission of money

The question of optimum quantity of money in literature appears in economy very often. In according with one of the ideas, the total nominal value of money in circulation should equal the total value of accessible goods on market. The systems described above do not guarantee this in average and long period. Alternative studies do not guarantee this either, but they deliver some pieces of advice. Here are some examples of alternative money theories:

- Austrian theory of money - they propose introduction of gold standard or annulment of state monopoly on production of money,

- bank of time - means institution which is based on non - cash exchange of services between its members,

- social credit - the emission of money depends from subjects (not only banks), which are obligated to the realization of something useful,

- nominalistic theory of money - this idea weakens the legitimacy of metallic (ores) theory and affirms that only the noble metals can fulfil the functions of money,

- money of labour - fundamental for this theory is work as the most significant aspect, it leads to record the amount of labour (work) which is spent on producing given goods (the bonds of labour would be exchanged on equivalent different goods).

See also:

Examples of Money emission

- Central Banks: Central banks are the main authority responsible for money emission. For example, the Federal Reserve in the United States is responsible for managing the money supply, controlling inflation and setting interest rates. They can increase the money supply by buying government bonds or other financial assets and introducing new money into circulation.

- Commercial Banks: Commercial banks can indirectly create money through the process of fractional reserve banking. When a bank makes a loan, it creates money by creating a new deposit in the borrower’s account. This new money is then circulated in the economy through the borrower’s spending.

- Government: Governments can also increase the money supply by printing new currency and introducing it into circulation. This is usually done to finance government spending or to stimulate the economy.

- Quantitative Easing (QE): Quantitative easing is a monetary policy tool used by central banks to increase the money supply. It involves the central bank buying financial assets from commercial banks, which increases the money supply and lowers interest rates.

Advantages of Money emission

One of the main advantages of money emission is that it supports economic growth. In particular, it helps increase the money supply in the economy, which in turn can lead to lower interest rates and more investment in businesses. Additionally, money emission can help alleviate liquidity problems, stimulate spending, and provide additional funds for governments to use for public goods and services. Moreover, money emission can help governments and central banks to maintain price stability and reduce the risk of deflation. Finally, money emission can also provide a source of revenue for the government, which can be used for public spending and to pay off existing debts.

Limitations of Money emission

Money emission has several limitations:

- Money supply should be balanced with demand for money in the economy. If the central bank increases money supply more than it is required, it may cause inflation.

- Money emission cannot substitute for fiscal policy. Money emission may only provide temporary support to the economy, but fiscal policy measures, such as government spending and taxation, are needed to make structural changes in the economy.

- Money emission is limited by the availability of financial instruments and economic conditions. For example, quantitative easing, which is an unconventional monetary policy, can be used to increase money supply, but only if there is sufficient liquidity in the financial markets.

- Money emission should be used responsibly. Too much money emission can lead to asset bubbles and economic instability. Therefore, central banks should use money emission with caution and in accordance with the economic situation.

Besides the direct money emission, there are several other approaches for money creation.

- Expansion of Central Bank’s Balance Sheet: expansion of the central bank's balance sheet increases the amount of money in circulation in the economy. This is done by the central bank buying securities or other assets from the public, and in exchange it provides them with money.

- Open Market Operations: This is a tool by which the central bank buys and sells government securities in the open market with an aim to control the money supply in the economy.

- Quantitative Easing: This is a tool of the central bank where it increases the money supply in the economy by buying assets from the public, such as government bonds, mortgages and other securities.

- Credit Creation by Banks: Banks also have the power to create money in the form of credit. When a bank lends money to a customer, it creates a deposit in the customer's account. This deposit is then available to be lent out again by the bank, resulting in the money supply increasing.

Money emission is mainly the function of central banks and commercial banks, but there are several other approaches that lead to money creation such as expansion of the central bank's balance sheet, open market operations, quantitative easing and credit creation by banks.

| Money emission — recommended articles |

| Creation of money — International liquidity — Fiduciary money — Interventionism — Expansionary monetary policy — Deposit rate — Austrian theory of money — Currency crisis — Currency Convertibility |

References

- Bayoumi, T. A., Eichengreen, B. J., & Eichengreen, B. J. (1994). One money or many?: Analyzing the prospects for monetary unification in various parts of the world (Vol. 76). Princeton: International Finance Section, Department of Economics, Princeton University.

- Davidson, P., & Weintraub, S. (1973). Money as cause and effect. The Economic Journal, 83(332), 1117-1132.

- Goodhart, C. A. E. (1995). The central bank and the financial system. MIT Press.

- Galbraith, J. K. (1975). Money, whence it came, where it went. Houghton Mifflin.

- Galbraith, J. K. (2008). The collapse of monetarism and the irrelevance of the new monetary consensus. Policy Note, The Levy institute of Bard College, 1.

- Davidson, P., & Weintraub, S. (1973). Money as cause and effect. The Economic Journal, 83(332), 1117-1132.

Author: Piotr Gawlewicz