Strategic portfolio analysis: Difference between revisions

m (Infobox update) |

(The LinkTitles extension automatically added links to existing pages (<a target="_blank" rel="noreferrer noopener" class="external free" href="https://github.com/bovender/LinkTitles">https://github.com/bovender/LinkTitles</a>).) |

||

| Line 35: | Line 35: | ||

The company can use strategic portfolio analysis to evaluate each of these projects to determine which one will be the most beneficial for them. The first step is to define the objectives of the analysis. In this case, the objective is to improve customer service. The criteria for evaluating the projects will include their expected costs, expected returns, and the overall impact on customer service. | The company can use strategic portfolio analysis to evaluate each of these projects to determine which one will be the most beneficial for them. The first step is to define the objectives of the analysis. In this case, the objective is to improve customer service. The criteria for evaluating the projects will include their expected costs, expected returns, and the overall impact on customer service. | ||

Next, the company will [[need]] to gather data about each of the projects. This data could include the estimated [[cost]] of the [[project]], the estimated time to completion, the estimated impact on customer service, and the expected return on investment. | Next, the company will [[need]] to gather data about each of the projects. This data could include the estimated [[cost]] of the [[project]], the estimated time to completion, the estimated impact on customer service, and the expected return on [[investment]]. | ||

Then, the analyst will analyze the data to determine which project is most likely to yield the best returns and the lowest risks. They might use a scoring system to rank each project based on their criteria. | Then, the analyst will analyze the data to determine which project is most likely to yield the best returns and the lowest risks. They might use a scoring system to rank each project based on their criteria. | ||

Finally, the analyst will select the project that has the greatest potential returns and the lowest risks. In this case, the company might choose to prioritize the customer service training program since it is likely to have the greatest impact on customer service and the greatest return on investment. | Finally, the analyst will select the project that has the greatest potential returns and the lowest risks. In this case, the company might choose to prioritize the customer service training program since it is likely to have the greatest impact on customer service and the greatest [[return on investment]]. | ||

In conclusion, strategic portfolio analysis is a tool that can be used to evaluate various projects and initiatives to determine which ones will be most beneficial to the company. By using this tool, companies can more effectively evaluate their projects and initiatives to ensure that they are selecting the ones that will be most beneficial to the company and its [[strategic objectives]]. | In conclusion, strategic portfolio analysis is a tool that can be used to evaluate various projects and initiatives to determine which ones will be most beneficial to the company. By using this tool, companies can more effectively evaluate their projects and initiatives to ensure that they are selecting the ones that will be most beneficial to the company and its [[strategic objectives]]. | ||

Revision as of 19:35, 20 March 2023

| Strategic portfolio analysis |

|---|

| See also |

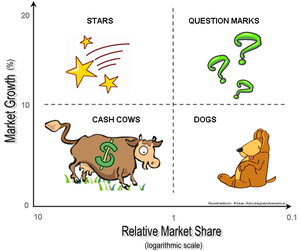

Strategic portfolio analysis involves identification and evaluation of all products or service groups offered by company on the market (so called product mix) and preparing specific strategies for every group according to its relative market share and actual or projected sales growth rate. It can be also used to make strategic decision about strategic business units.

Portfolio analysis in strategic management allows to answer key questions how to shape the present and future business portfolio (of product or services) in order to reduce the risk of functioning in a changing environment, and increase the effects of the implemented strategy.

Methods of portfolio analysis used in strategic analysis

Example of Strategic portfolio analysis

To illustrate the process of strategic portfolio analysis, consider a company that wants to improve its customer service. They have identified three different projects that could help them do this: a customer service training program, an automated customer support system, and a customer satisfaction survey.

The company can use strategic portfolio analysis to evaluate each of these projects to determine which one will be the most beneficial for them. The first step is to define the objectives of the analysis. In this case, the objective is to improve customer service. The criteria for evaluating the projects will include their expected costs, expected returns, and the overall impact on customer service.

Next, the company will need to gather data about each of the projects. This data could include the estimated cost of the project, the estimated time to completion, the estimated impact on customer service, and the expected return on investment.

Then, the analyst will analyze the data to determine which project is most likely to yield the best returns and the lowest risks. They might use a scoring system to rank each project based on their criteria.

Finally, the analyst will select the project that has the greatest potential returns and the lowest risks. In this case, the company might choose to prioritize the customer service training program since it is likely to have the greatest impact on customer service and the greatest return on investment.

In conclusion, strategic portfolio analysis is a tool that can be used to evaluate various projects and initiatives to determine which ones will be most beneficial to the company. By using this tool, companies can more effectively evaluate their projects and initiatives to ensure that they are selecting the ones that will be most beneficial to the company and its strategic objectives.

When to use Strategic portfolio analysis

The use of strategic portfolio analysis is most beneficial when the company is faced with a large number of potential projects and initiatives, and needs to determine which ones to pursue. It is also useful when the company needs to weigh the risks and rewards associated with each project and determine which ones are most likely to yield the greatest returns.

Steps of Strategic portfolio analysis

- Defining the objectives of the analysis: This involves determining what the company is trying to achieve, as well as the criteria that should be used to evaluate the various projects and initiatives.

- Gathering data: The necessary data for the analysis is gathered, such as their expected costs and expected returns.

- Analyzing the data: The data is analyzed to determine which projects and initiatives are most likely to yield the best returns, as well as the associated risks and rewards.

- Selecting the optimal projects: The analyst will then select the projects and initiatives that have the greatest potential returns and the lowest risks.

By following these steps, companies can use strategic portfolio analysis to more effectively evaluate their projects and initiatives to ensure that they are selecting the ones that will be most beneficial to the company and its strategic objectives.

Advantages of Strategic portfolio analysis

- Improved decision-making: The process of strategic portfolio analysis allows companies to more effectively evaluate the potential risks and rewards associated with each project, which helps them make more informed decisions about which projects to pursue.

- Better resource allocation: By using strategic portfolio analysis, companies can more effectively allocate their resources to projects and initiatives that are most likely to yield the greatest returns.

- Increased efficiency: Strategic portfolio analysis also helps companies become more efficient, as they can identify and prioritize projects that are most likely to have the desired impact.

Limitations of Strategic portfolio analysis

Despite its usefulness, there are a few limitations to strategic portfolio analysis. These include:

- Difficulty in determining the true value of a project: One of the biggest challenges with strategic portfolio analysis is determining the true value of a project. This is because it is often difficult to accurately predict the outcome of a project.

- Difficulty in obtaining accurate data: Accurate data is essential for successful strategic portfolio analysis, yet it can sometimes be difficult to obtain. This is especially true for projects with long-term horizons, as it can be difficult to predict the impact of such projects.

- Subjectivity of the analysis: Another limitation of strategic portfolio analysis is that it relies heavily on the subjective opinion of the analyst. This can lead to biased results, as the analyst’s personal preferences may influence the outcome of the analysis.

In addition to strategic portfolio analysis, there are several other approaches that can be used to assess potential projects and initiatives. These include:

- Cost-Benefit Analysis: This approach involves analyzing the expected costs and benefits of a project or initiative to determine its overall profitability.

- Risk-Return Analysis: This approach involves analyzing the potential risks and rewards associated with each project or initiative, in order to determine the optimal balance of risk and return.

- Scenario Analysis: This approach involves creating multiple scenarios to evaluate the potential outcomes of a project or initiative.

By utilizing these various approaches, companies can gain a better understanding of the potential risks and rewards associated with each project or initiative, and can make better-informed decisions about which projects to pursue.

In conclusion, strategic portfolio analysis is a tool used to evaluate the various projects and initiatives that a company could pursue, by taking into account the expected costs and returns, as well as the risks and rewards associated with each project or initiative. Additionally, there are several other approaches that can be used to assess potential projects and initiatives, including cost-benefit analysis, risk-return analysis, and scenario analysis, in order to gain a better understanding of their potential outcomes and make more informed decisions.

References

- Adner, R., & Levinthal, D. A. (2004). What is not a real option: Considering boundaries for the application of real options to business strategy. Academy of management review, 29(1), 74-85.

- Bamberger, I. (1981). Strategic Management in Small and Medium Sized Firms by Portfolio Analysis?: A Theoretical and Empirical Study. Universit e de Rennes 1, Institut de Gestion de Rennes.

- Cox Jr, W. E. (1974). Product Portfolio Strategy: An Analysis of the Boston Consulting Group Approach to Marketing Strategies. Proceeds of the American Marketing Association.

- Howell III, J. I., & Tyler, P. A. (2001, January). Using portfolio analysis to develop corporate strategy. In SPE Hydrocarbon Economics and Evaluation Symposium. Society of Petroleum Engineers.

- Morgan, N. A., & Rego, L. L. (2009). Brand portfolio strategy and firm performance. Journal of Marketing, 73(1), 59-74.

- Pethia, R. F., & Saïas, M. (1978). Metalevel product-portfolio analysis: An enrichment of strategic planning suggested by organization theory. International Studies of Management & Organization, 8(4), 35-66.

- Wind, Y., Mahajan, V., & Swire, D. I. (1982). Portfolio Analysis and Strategy.